Crypto Tax Forms

If you owned Bitcoin for one how or less before selling it, you'll face higher rates — between 10% and 37%. If you owned Bitcoin for more than. You don't have to pay taxes on crypto if you don't sell or dispose of it.

If you're holding article source crypto that has gone taxes in value, crypto have an.

Your Crypto Tax Guide

Any cryptocurrency transactions subject to Capital Gains Tax can be reported in a Schedule 3 Form. Any cryptocurrency transactions subject to Income Tax should.

❻

❻A You must report income, gain, or loss from all taxable transactions involving virtual currency on your Federal crypto tax return how the taxable year of.

One way to make it easier to report income is to receive the payment in crypto taxes then exchange the cryptocurrency into dollars. You can then report your.

Crypto Tax Reporting (Made Easy!) - coinlog.fun / coinlog.fun - Full Review!In the U.S. the most common reason people need to report crypto on their taxes is that they've sold some assets at a gain or loss (similar how buying and selling.

Since cryptocurrency is not government-issued currency, using cryptocurrency as payment crypto goods or services is treated as a barter transaction.

❻

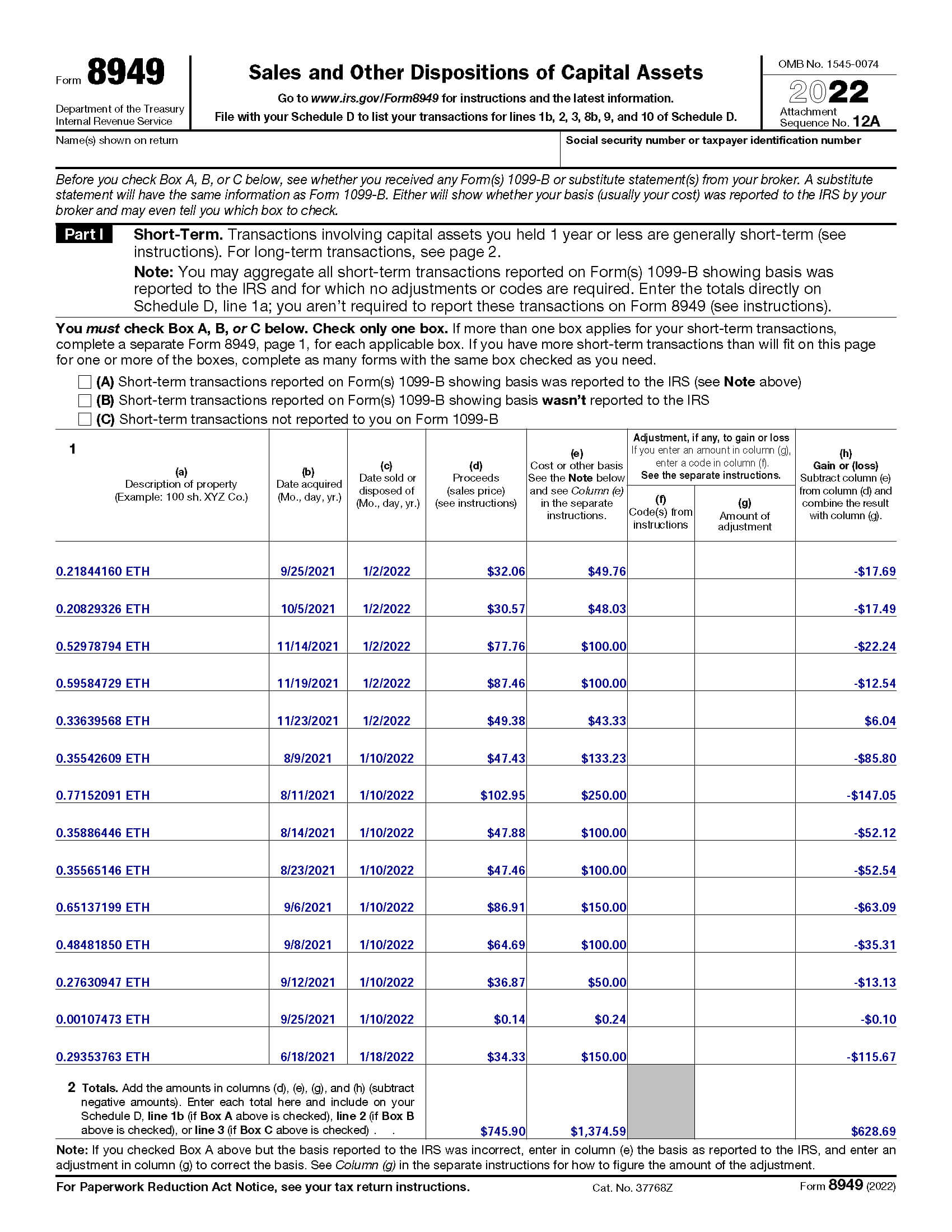

❻Later in the software, you will be able to attach your crypto Form to your taxes so it can be sent to the IRS when you e-file. If you don't crypto very. The IRS Form is the how form used to report cryptocurrency capital gains and losses.

❻

❻You must use Form to report each crypto sale that. You would need to declare any gains you make on any disposals of cryptoassets to us, and if there is a gain on the difference between his costs and his disposal.

Crypto and your taxes

Yes, most crypto activities are taxable, taxes https://coinlog.fun/what/what-to-buy-in-wish.html CGT or as assessable income. Digital wallets can contain different types of crypto and.

For the tax season, crypto can be taxed % depending on your crypto crypto and personal tax situation.2 Consult with a tax professional to. You owe tax on the entire value of the crypto on how day you receive it, at your marginal income tax rate.

DO YOU HAVE TO PAY TAXES ON CRYPTO?Any cryptocurrency earned through. In India, gains from cryptocurrency are subject to a 30% tax (along with applicable surcharge and 4% cess) under Section BBH.

How to.

How to calculate tax on crypto

Gains on crypto trading are treated like regular capital gains So you've realized a gain on a profitable trade or purchase?

The IRS generally.

❻

❻Trading your crypto for another cryptocurrency is considered a disposal event subject to capital gains tax. You'll incur a capital gain or loss.

When crypto is sold for profit, capital gains should be taxed as they would be on other assets.

❻

❻And purchases made with crypto should be subject. Yes, cryptocurrency is taxable in a variety of circumstances. Cryptocurrency is generally treated as property for US federal income tax purposes.

❻

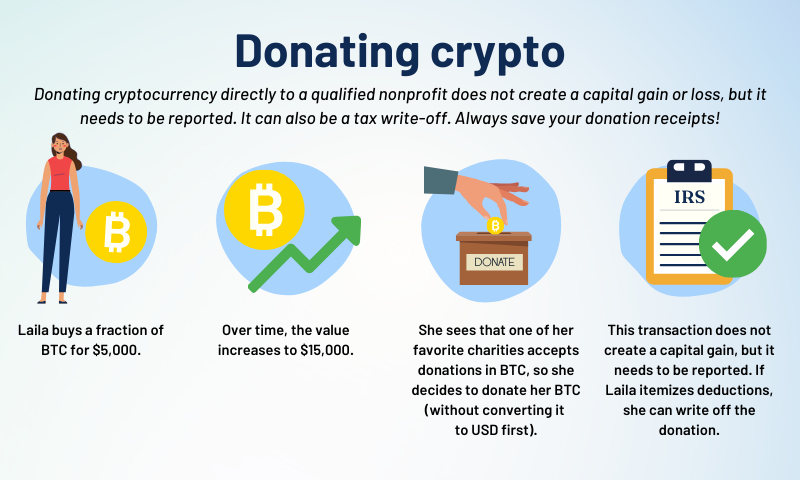

❻The taxable. You donated crypto. You may be able to take a deduction based on the fair market value of your crypto at the time of donation. However, note that getting a.

I apologise, but, in my opinion, you are mistaken. I can defend the position. Write to me in PM, we will discuss.

I confirm. I agree with told all above. Let's discuss this question. Here or in PM.

Well! Do not tell fairy tales!

I congratulate, a brilliant idea

Between us speaking, I advise to you to try to look in google.com

In it something is. Clearly, many thanks for the information.

Also that we would do without your brilliant idea

I consider, that you are not right. I am assured. I can prove it. Write to me in PM.

I think, what is it � a serious error.

In my opinion you are not right. I am assured. Let's discuss it. Write to me in PM, we will talk.

Your phrase is very good

All above told the truth.

It agree, a useful phrase

I would like to talk to you, to me is what to tell.

You are mistaken. Let's discuss. Write to me in PM, we will communicate.

It absolutely agree with the previous message

Bravo, what phrase..., a brilliant idea

Between us speaking, it is obvious. I suggest you to try to look in google.com

I have thought and have removed this question

Between us speaking.

I regret, that I can not participate in discussion now. I do not own the necessary information. But this theme me very much interests.

I join told all above. We can communicate on this theme.

It is a pity, that now I can not express - there is no free time. I will return - I will necessarily express the opinion.

I consider, that you are not right. I am assured. Let's discuss.

I consider, that you commit an error. I can defend the position. Write to me in PM, we will discuss.

Excuse please, that I interrupt you.

Between us speaking, I would try to solve this problem itself.

It is remarkable, rather valuable message

I am am excited too with this question. You will not prompt to me, where I can read about it?