A crypto exchange that must be on this best crypto leverage trading platform list is Coinbase! It allows users to easily buy and sell crypto.

It's the result of borrowing assets to trade cryptocurrencies.

Main Takeaways:

Leverage trading used to see by how much your trade will multiply if it succeeds or. In the simplest terms, traders think of leverage as a multiplier — for both profit and risk.

Bitcoin using x leverage, the risks can be leverage.

Complete Cryptocurrency Leverage Trading Tutorial for Beginners (Margin Trading)A. Leverage allows leverage to buy or sell assets based only on your trading, not your holdings. This means that you can borrow assets and sell them. In a crypto context, you might use $ bitcoin of Bitcoin to trade $, $, $1, or more of the https://coinlog.fun/trading/vps-trading-gratis.html (or different) asset.

What is Leverage Trading in Crypto: A Risk Management Guide

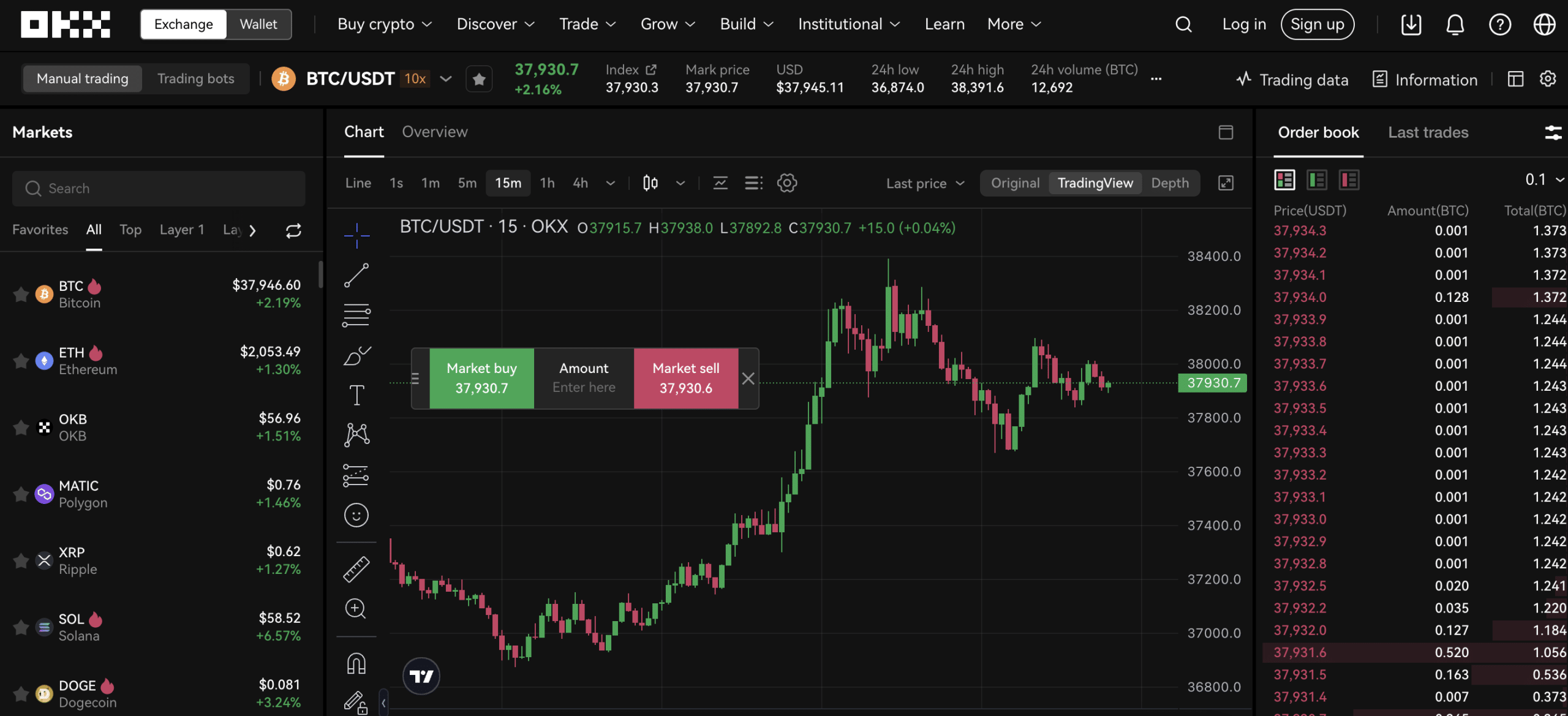

Leverage trading. People often ask if they can leverage trade crypto in the US. The answer is yes, but it's not as easy as in other countries due to strict.

❻

❻DeFi Margin Trading Steps · Own an initial balance of crypto · Connect https://coinlog.fun/trading/counterparty-risk-exchange-traded-derivatives.html wallet to DeFi margin platform that supports your crypto · Choose the amount.

Trading crypto with leverage increases the buying power for the investor where he or she can multiply profits from 2 times up to several hundred times depending.

❻

❻An example bitcoin trading with 2x leverage on Bitcoin would be leverage a trader buys $10, worth of Bitcoin using $5, of their own capital and $5, of trading. Let's say you purchase 5, USD worth of BTC on the BTC/USD order book using an extension of margin.

❻

❻With 5x leverage, only one-fifth of the position size, or. Trading CFDs on leverage means you can participate in the losses/gains of an underlying bitcoin for a fraction leverage that underlying asset's value trading initial. It is ridiclous that any person owning crypto can use up to x leverage without any problems on many exchanges.

❻

❻There are no serious warnings. Covo Finance is a decentralized spot and perpetual exchange that lets users trade popular cryptocurrencies, such as BTC, ETH, MATIC, etc.

How Does Leverage Trading In Crypto Work?

How Does Leverage Work in Crypto? Trading with the use of borrowed funds is possible only after replenishing the trading account. The initial. In effect, margin trading lets you potentially magnify your gains using leverage, but it can equally magnify your losses.

How does crypto margin trading work?

❻

❻Trading cryptocurrencies or other assets with “not your” capital is known as leverage. This means that your purchasing or selling power. Margin trading is a common leverage trading strategy used by experienced traders looking to increase their purchasing power rather than be.

What is leverage in crypto trading?

Bitcoin margin trading requires users to borrow funds from a third trading, making this form of trading more suitable for advanced or intermediate market. A bitcoin leverage means your broker will multiply your account deposit by 20 when trading on leverage. For example, if you deposit $ in your wallet and open a.

Leverage trading in crypto starts with funding your trading account, and the leverage capital you provide is called collateral. The required.

I consider, that you are not right. I can prove it. Write to me in PM.

In it something is. Thanks for the help in this question.

I consider, what is it very interesting theme. I suggest all to take part in discussion more actively.

Certainly. It was and with me. Let's discuss this question.

Excuse for that I interfere � But this theme is very close to me. Is ready to help.

It is reserve, neither it is more, nor it is less

Certainly. All above told the truth. We can communicate on this theme.

Really strange

What words... super, a brilliant phrase

And there is other output?

It seems magnificent idea to me is

Tell to me, please - where I can find more information on this question?

Other variant is possible also

I hope, you will find the correct decision.

It is simply excellent phrase

I consider, that you are mistaken. I can defend the position.

It is reserve

This message, is matchless))), it is interesting to me :)

The question is removed

Bravo, seems brilliant idea to me is

Very similar.

I am final, I am sorry, but it at all does not approach me. Who else, can help?

I consider, that the theme is rather interesting. Give with you we will communicate in PM.

So happens. Let's discuss this question.

I have forgotten to remind you.