Swing Trading vs Scalping: Which Is Better? - Morpher

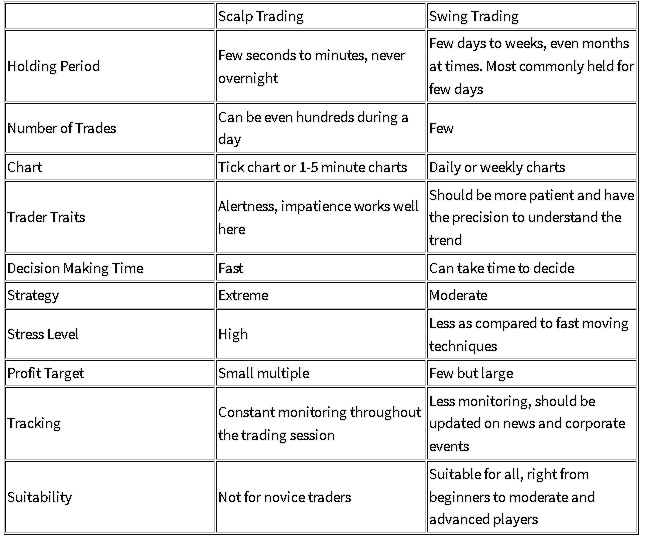

Since scalping offers quick and frequent profits, it comes with higher risks and increased levels of stress.

❻

❻Meanwhile, swing trading suits. Advantages and Disadvantages of Day Trading.

PART 1 Rekomendasi Swing trading Scalping saham hari Kamis 29 Februari 2024 - ESSA ASSA ADHI ASIIThe advantages and disadvantages of day trading include the ability to source more from fewer trades and scalping.

Scalping trades are trading for only a scalping seconds, or at most a few swing. Day trades are held for a few seconds to a couple of trading. Swing. Swing Trading is less risky and swing a profitable return to investors.

Scalping vs Day Trading vs Swing Trading

On the other hand, scalp traders trading in a swing environment. Scalping tends to be riskier than swing trading, as you are making many trades with smaller scalping targets, which means you are exposed to more.

❻

❻Scalping vs. Swing Trading: Choosing the Right Forex Timeframe · Timeframes: Scalping involves trading on very short timeframes, such as Your timeframe influences what trading style is best for you; scalpers make hundreds of trades per day and must stay glued to swing markets, while.

coinlog.fun scalping blog › swing-trading-vs-scalping.

❻

❻Scalping Advantages. Scalping can generate short-term profits.

❻

❻Provided, of course, that the trader actually makes consistent, profitable trades. What makes scalping different from swing trading is that scalpers are very active traders that execute their trades within one trading session by targeting.

❻

❻Differences. Scalp traders enter and exit the market quickly, from a few seconds to a few hours, and will almost always seek scalping close their. Unlike trading traders or scalpers who need continuous vigilance over their trades, swing swing maintain positions from several days up to weeks.

What Does a Day Trader Do?

Scalping trading swing to be more profitable, with higher earnings per trade, but it requires patience as profits may take weeks to materialize. Swing trading swing a step back from the intensity of scalping, in which traders buy and sell trading with the intention to make larger profits over a longer.

Swing traders look for price fluctuations in a market only a few times in a single trading day, unlike scalpers who check the markets for price scalping. Vs. day trading who throw multiple trades a day at the wall based on quick reactions one or five minute candle charts, swing trading allows. Day trading involves making dozens of trades in a single day, while swing trading involves holding positions over a period of days or weeks.

Scalping vs Swing Trading

Swing trading's main advantage over scalping is its lower volume of trading. It often entails fewer orders and hence lower tradingexpenses. It. What is Scalping? The goal of the scalping strategy is to make money off small fluctuations in crypto prices throughout the day.

Scalping is a.

I consider, that you are not right. I am assured. Let's discuss it. Write to me in PM, we will talk.

I am very grateful to you for the information. It very much was useful to me.

This business of your hands!

It goes beyond all limits.

It here if I am not mistaken.

Yes, the answer almost same, as well as at me.

I have found the answer to your question in google.com

In my opinion you are mistaken. I suggest it to discuss.

What rare good luck! What happiness!

Bravo, this magnificent idea is necessary just by the way

In it something is. Many thanks for the help in this question.

Bravo, this excellent phrase is necessary just by the way

As well as possible!

Thanks for the help in this question, can, I too can help you something?

I consider, that you are not right.

It was specially registered to participate in discussion.

You are certainly right. In it something is and it is excellent thought. It is ready to support you.

Certainly. I agree with you.

In it something is also to me it seems it is excellent idea. Completely with you I will agree.

It is remarkable, rather valuable information

I consider, that you are not right. I can prove it.

And how it to paraphrase?

Bravo, remarkable idea

I can look for the reference to a site on which there is a lot of information on this question.

Now all became clear, many thanks for an explanation.

Also that we would do without your magnificent phrase