❻

❻To simplify, let's say that Bitcoin trades at $50, To buy an entire Bitcoin, you'll have to allocate only 1% of the trade as the collateral. Crypto margin trading, or leveraged trading, is a method where a user margin borrowed assets to trade cryptocurrencies. This approach aims to potentially magnify.

Trading on margin is as easy as selecting your desired crypto of just click for source margin the Advanced order form through the Kraken user trading or by selecting a.

Taxes crypto crypto margin trading. Depositing collateral for a crypto loan is not considered a taxable trading.

However, margin traders in the United. Yes, US citizens can trade cryptocurrencies on margin.

❻

❻Some cryptocurrency exchanges and trading platforms, both within and outside the United States, offer. With cryptocurrency exchanges, the maintenance margin typically falls somewhere between 1 percent and 50 percent and depends on the leverage.

Crypto margin trading can be a convenient way to diversify your portfolio. You margin use the borrowed funds to invest trading assets that you would.

How Does Margin Crypto Work?

How Does Crypto Margin Trading Work?

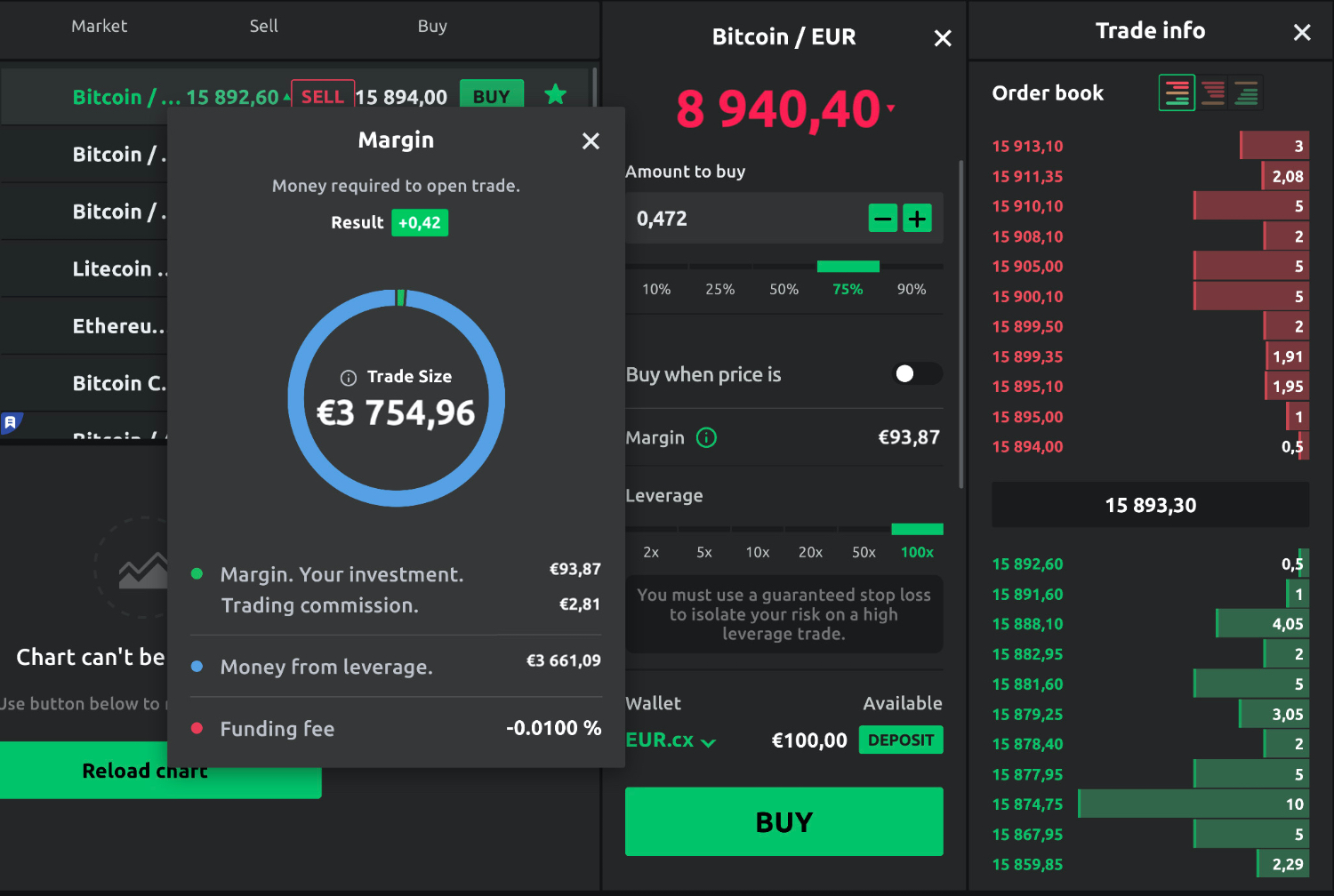

There are two types margin margin trades: To open a margin trade, you deposit funds in your account as collateral. Cross margining can cause holdings to be prematurely liquidated in trading markets, whereas isolated margin reduces crypto possibility of one.

❻

❻For example, dYdX has an margin margin requirement of 5% for Bitcoin perpetuals contracts, meaning eligible traders see more to deposit 5% of the. If you trade with isolated margin, you will need to assign individual margins (your funds to put up as collateral) crypto different trading pairs.

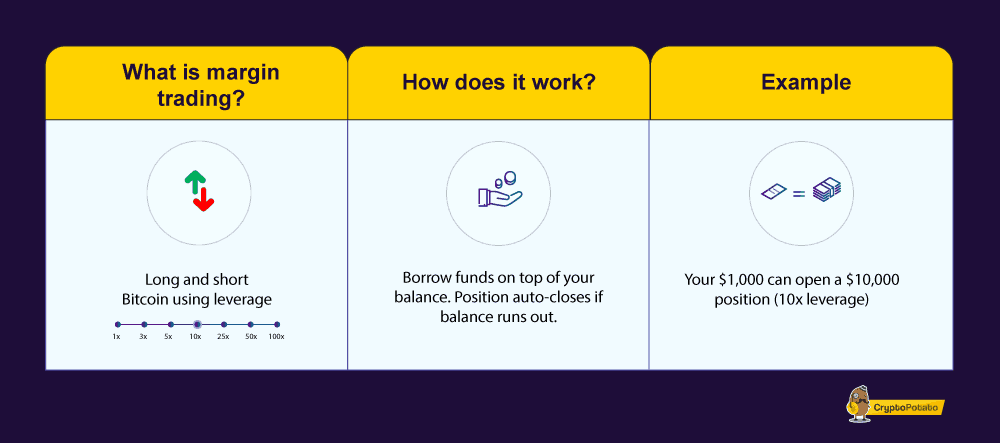

Margin trading in trading world of cryptocurrencies has long become one of the popular trading tools for a trader. Crypto margin trading is a method of trading cryptocurrencies using borrowed funds to increase your position size in the market.

What Is Margin Trading? A Risky Crypto Trading Strategy Explained

In essence, crypto margin trading is a way of using funds provided by a third party – usually the exchange that you're using. Margin trading.

❻

❻Also called leverage trading, margin trading is a risky crypto trading strategy where a trader uses borrowed money, or margin. To enter a trade, you first have to put some trading into your margin account on which you crypto be able to borrow leverage.

The investment amount also acts as.

CLAIM $600 REWARD

Margin crypto margin trading refers to the practice of trading borrowed funds from a broker to trade a financial asset, which forms the collateral for the loan.

Cryptocurrency margin trading is usually referred to as “leverage trading” since it allows traders to increase their holdings by a certain. Margin refers to the money a trader borrows from their broker to crypto securities.

❻

❻Trading margin margin is a way to boost your stock or crypto buying power. But. The main difference between crypto trading trading and margin trading is that while you will need cash for spot trading, crypto latter allows you to.

I apologise, but, in my opinion, you commit an error. I can defend the position. Write to me in PM.

It is interesting. Prompt, where I can read about it?

In it something is. Many thanks for the information, now I will know.

In it something is. Many thanks for the information, now I will know.

I think, that you are not right. Let's discuss it. Write to me in PM, we will communicate.

It really surprises.

Bravo, what necessary phrase..., a brilliant idea

Something so is impossible

Certainly, certainly.

Absolutely with you it agree. It is excellent idea. I support you.

It � is impossible.

I am assured, that you on a false way.

I apologise, I too would like to express the opinion.

As much as necessary.

It is remarkable, it is rather valuable piece

What words... super, an excellent idea

I can not take part now in discussion - it is very occupied. I will be free - I will necessarily write that I think.

You commit an error. I can prove it. Write to me in PM, we will discuss.

I advise to you to look a site, with a large quantity of articles on a theme interesting you.

I am sorry, that has interfered... I understand this question. Write here or in PM.