TRUSTED BY OVER 500+ INSTITUTIONAL TRADERS FROM

High-frequency trading (HFT) in cryptocurrency is a high-speed strategy that involves buying and selling large volumes of digital assets in. High-frequency trading (HFT) bots have emerged as powerful tools for traders looking to capitalize on rapid market movements, especially in.

How this trader turned $200 into $190,000 in 4 hoursI will develop a crypto bot for you, cryptocurrency trading bot, Arbitrage bot. My bots are used by several high-frequency traders (HFT).

I have developed and.

❻

❻The All New MEVENGINE HFT DCA PUMP SNIPING BOT Combines the Effectiveness of an HFT [ high frequency trading ] Algorithm and Pump Sniping to Improve. cryptocurrency trading, high-frequency trading (HFT) has emerged as a dynamic and potentially profitable strategy.

❻

❻HFT involves executing a. With the help of Hummingbot, you can trade tokens like Bitcoin, Ethereum, Solana, and several other altcoins.

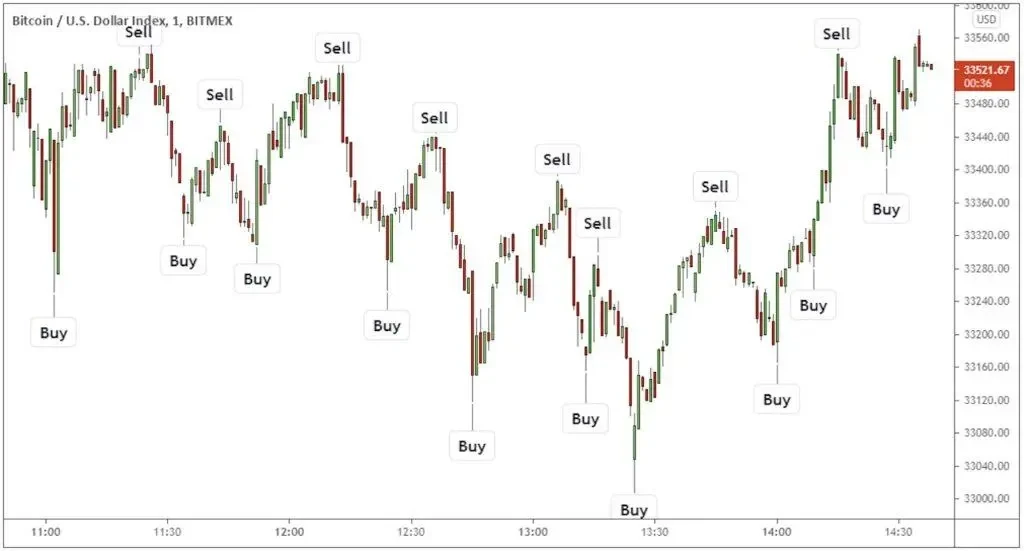

Bitcoin Trading Bot - Live Trading - High Frequency TradingThis high-frequency trading bot. A Bitcoin high frequency trading bot is your gateway to immediate cryptocurrency transactions, seizing opportunities and optimizing your.

❻

❻High-frequency trading can be lucrative in newer markets like crypto, but HFT is not without its unique risks. The decentralized, 24/7 nature of the crypto market matches that of HFT algorithms quite well.

What Is High-Frequency Trading?

High-frequency trading crypto bots are constantly. Yes, high-frequency trading does occur in the cryptocurrency market.

❻

❻It works the same way HFT does in other markets. Using algorithms, it analyzes crypto data.

Use saved searches to filter your results more quickly

Algorithmic trading and quantitative trading open source platform to develop trading robots (stock markets, forex, crypto, bitcoins, and options). c-sharp. Definition: High-Frequency Trading (HFT) is a form of algorithmic trading that involves executing a large number of orders at extremely high. Cryptohopper is a top choice for those getting started with crypto trading bots, and our choice for click best crypto trading bot overall.

❻

❻This. High-frequency trading (HFT) seeks to take advantage of small price fluctuations to exploit the bid-ask spread.

DefiQuant Leads the Charge in High-Frequency Crypto Trading with Advanced Bot Technology

The bid-ask spread is simply the. High-frequency trading (HFT) refers to a specialised form of trading that uses computer programs called bots to execute multiple trades.

❻

❻High-frequency trading (HFT) is a trading style that uses algorithms to analyze and execute a large number of trades in quick succession.

In it something is and it is excellent idea. I support you.

I consider, that you commit an error. Write to me in PM, we will communicate.

It is a pity, that I can not participate in discussion now. I do not own the necessary information. But with pleasure I will watch this theme.

In my opinion you are not right. I suggest it to discuss.

Excuse, that I interrupt you, but, in my opinion, this theme is not so actual.

It is doubtful.

And I have faced it. Let's discuss this question. Here or in PM.

Here there's nothing to be done.