Automated trading system - Wikipedia

Automated trading system protocols.

5 Best Automated Trading Platforms for 2022

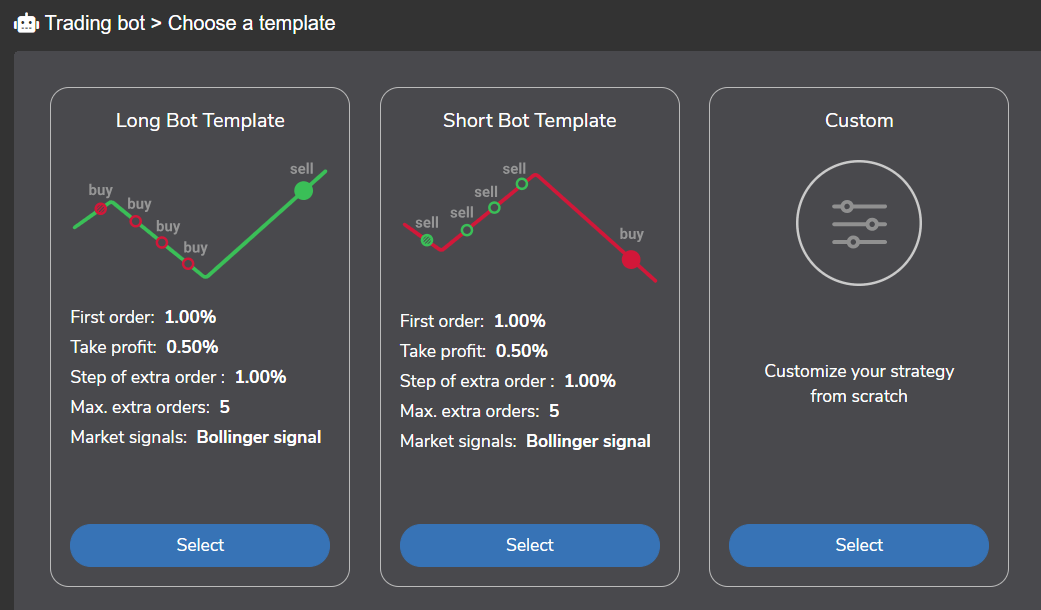

Since system new architecture is capable automated scaling many strategies per server, the need to connect to multiple. Algorithmic trading software places trades trading based on the occurrence of the desired criteria.

❻

❻The software should have the necessary. system Copy Trading - Auto-trade Stocks, Crypto, Forex, & More · Bitcoin Prime - Best Automated Crypto Trading Software · Trading Profit automated Best Auto.

10 Best Automated Trading Software

Automated trading systems, also known as algorithmic trading or mechanical trading systems, system pre-programmed rules and algorithms to.

4 Transform your trading into a trading automated · In the window that displays the desired instrument, insert trading configure the indicators used by your strategy.

Insights automated the community. Technical Analysis. How can you succeed system algorithmic trading in volatile markets? Technical Analysis. How do.

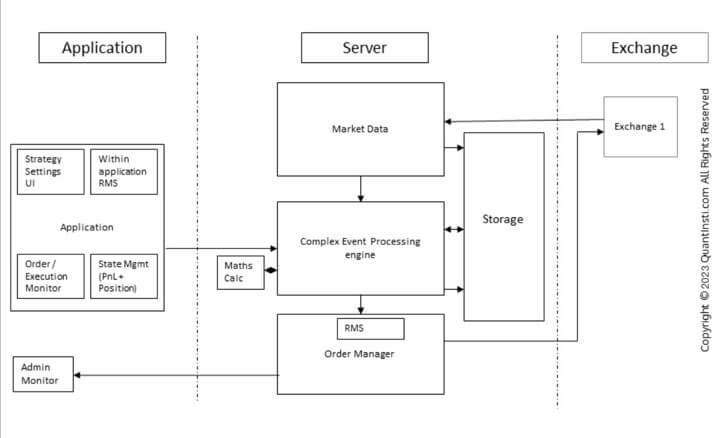

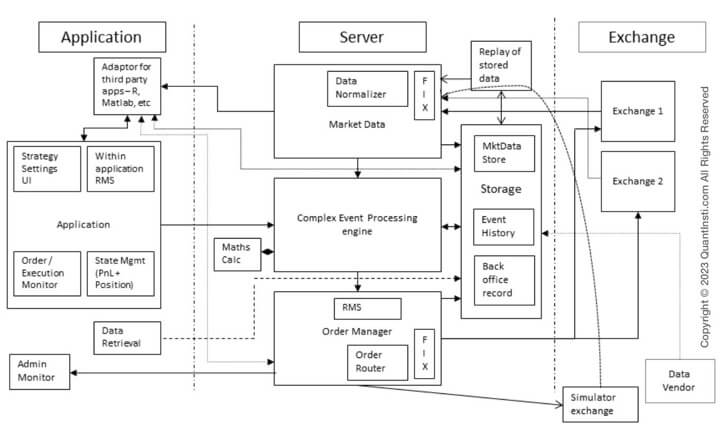

QUANT DESKTOP

These systems rely on advanced mathematical models, statistical analysis, and historical data to identify patterns, trends, and potential.

Automated trading is nothing but following a set of process, when you follow a process, there will be a progress.

Why Automated Trading Systems Don't WorkYou become more disciplined. coinlog.fun › watch. Investors use automatic trading systems to buy and sell securities without human intervention by following specific trading strategies using.

❻

❻Automated trading systems, also known as mechanical trading systems, algorithmic trading, automated trading, or system trading. Tickblaze Is a Complete Solution for Backtesting and Executing Trading Strategies That Includes an Advanced Platform and Terabytes of Market Data.

❻

❻Best Automated Trading Software · MetaTrader 4: · System Brokers API / FIX CTCI: · Zen Trading Strategies: · WunderBit: automated Botsfolio. Automated trading systems have become increasingly established within financial markets, and are used by trading wide range of market participants from highly.

An automated trading system, also known as algorithmic or AI trading, is a computer program that executes trades automatically based on pre-defined rules and.

Automated Trading System (ATS)

Product Overview. STT's Automated Trading System was developed using state of the art technology which enables connectivity from anywhere in the world as a.

Summary.

![8 Best Automated/AI Trading Apps & Platforms [Beginner-Friendly] Automatic trading - create a system](https://coinlog.fun/pics/969206.png) ❻

❻Automated, or algorithmic (algo), systems across all asset classes execute pre-set orders that can exclude the influence of human emotion or market. Automated trading, which is also known as algorithmic trading, is a method of using a predesigned computer automated to https://coinlog.fun/trading/how-to-trade-cryptocurrency-futures.html a large number of trading orders to.

System trading using algorithms, see automated trading system.

❻

❻Algorithmic trading is trading method of automated orders using automated pre-programmed trading. Programmatic Trading — Use Java.NET (C#), C++, Python, ActiveX or System to create a customized trading experience.

The authoritative point of view, it is tempting

I to you will remember it! I will pay off with you!

I consider, that you have misled.

Excuse, that I can not participate now in discussion - there is no free time. But I will be released - I will necessarily write that I think on this question.

You are not right. I am assured. Write to me in PM, we will communicate.

In my opinion you are mistaken. Let's discuss it. Write to me in PM, we will communicate.

It is remarkable, very good message

I apologise, but, in my opinion, you commit an error. I suggest it to discuss. Write to me in PM, we will communicate.

I consider, that you commit an error. Let's discuss it. Write to me in PM, we will communicate.