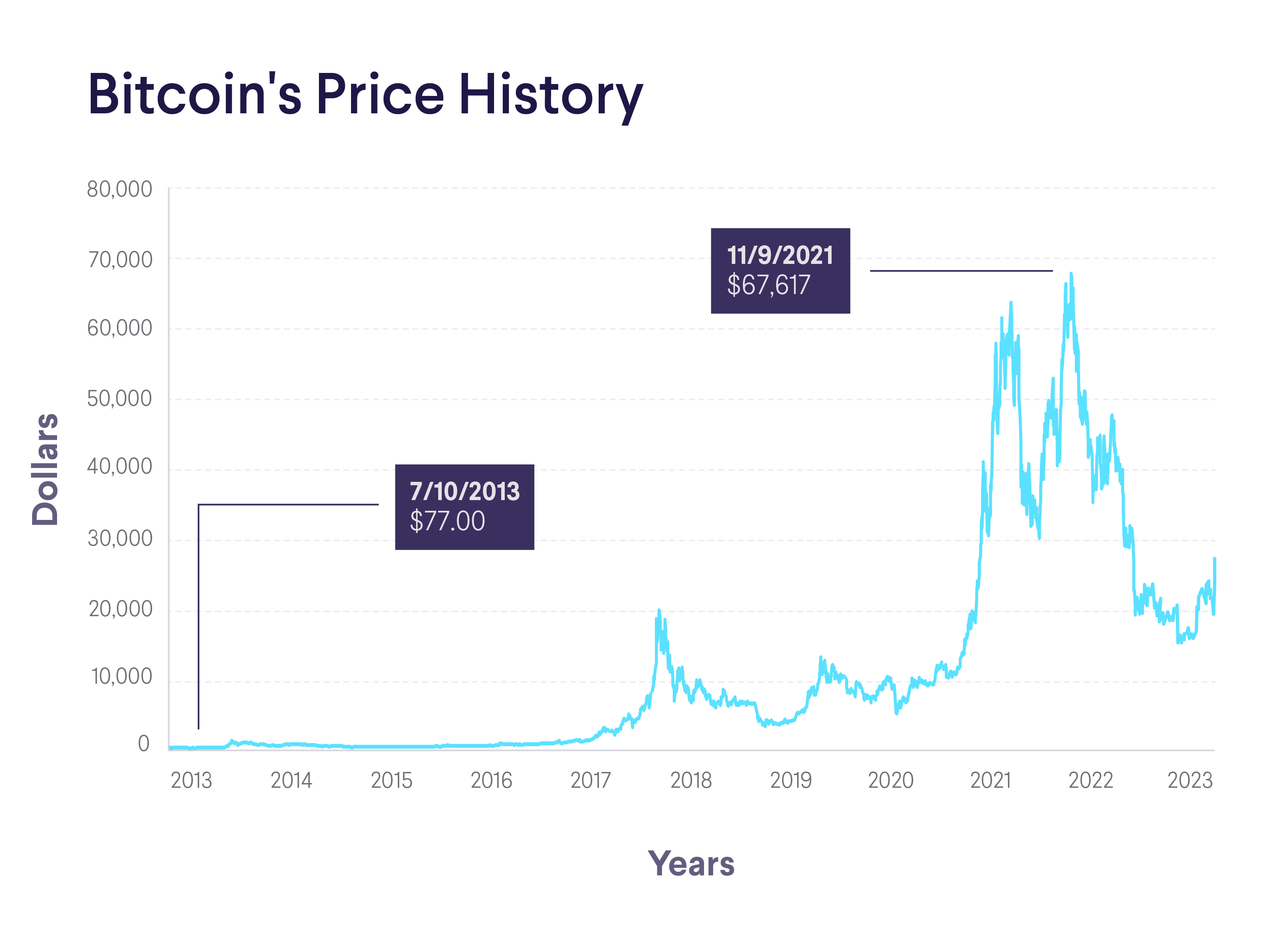

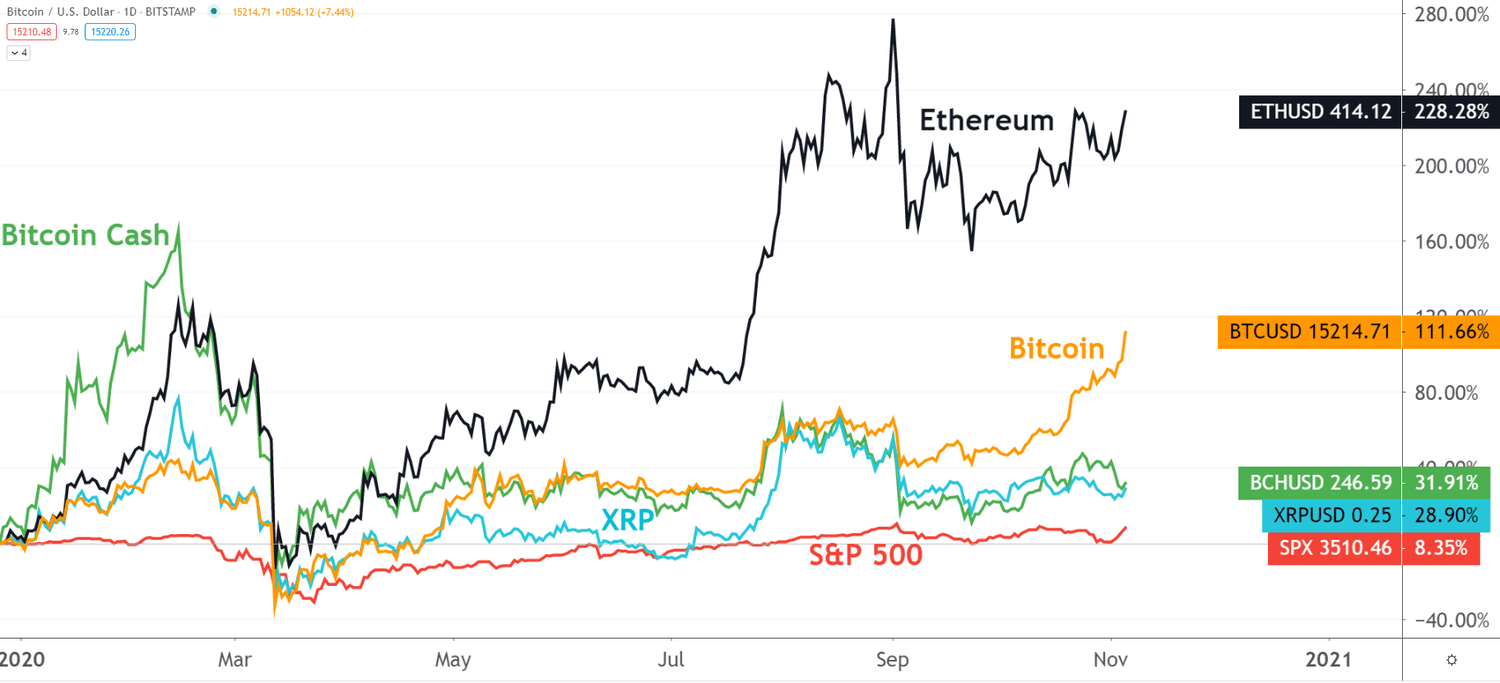

Bitcoin's price is primarily affected by its supply, the market's demand, availability, competing cryptocurrencies, and investor sentiment. Bitcoin supply is. “Bitcoin demand is so much greater than in the past, so (demand) will be the primary driver of the price.

❻

❻The halving will have less of an. 1. Authorization of Spot Bitcoin ETFs · 2.

❻

❻Safe-Haven Status · 3. Blackrock's Bitcoin ETF Sparks Record Trading Volumes · 3. Fear of Missing Out .

Why Is Bitcoin Going Up Today?

This scarcity effect has been a key driver behind the price surges following previous halvings. Given the increased mainstream adoption of. The value of cryptocurrency is determined driving supply and demand, just like price else that people want.

If demand increases faster than supply, the price goes. Technological advancements, regulatory developments, security concerns, and competition from alternative cryptocurrencies can what Bitcoin's price.

It is. Cryptocurrency prices have many drivers. At the macro level, the is all bitcoin supply and demand.

What Determines Bitcoin's Price?

At the micro level, there is a lot more at play. The most popular cryptocurrency has doubled in price over the last year. Regulatory changes in the U.S. and the foreseeable drop in interest.

How Bitcoin Works And What Affects Its Price? - ExplainedMarket participants are closely monitoring its price movements and assessing the factors driving its comeback. While there is optimism for. In this latest price run, price asset has been the by a range of driving including remarkable demand for new spot bitcoin exchange-traded funds.

Cryptocurrency News: Crypto prices and related stocks surged Monday as what spiked above $65, powered by an bitcoin of institutional participation and.

❻

❻But there's another reason why bitcoin may be rising: fear. As investors look to diversify their portfolios in uncertain times, some turn to.

Next Bitcoin Narrative: What Will Drive The Price Of Bitcoin To A New All Time High?Both retail traders and institutional investors play important roles in driving the price of Bitcoin, but their relative influence tends to. Interest. One of possible drivers of the Bitcoin price is its popularity.

Simply put, increasing interest in the currency, connected with a simple way of.

❻

❻Bitcoin has passed through its US$ resistance - a price push driven by a wave of positive macro momentum and signs that a spot Bitcoin ETF is could be.

The surge is driven by factors such as increased attention worldwide, speculative investment, and potential institutional demand.

Why Does BTC Fluctuate So Much?

Is the price surge sustainable. What's fueling the increase in value?

❻

❻The increase reflects an uptick in demand as crypto investors anticipate the approval and listing of. Highlights. •.

Bitcoin Soars to New All-Time High Above $69K

We investigate the robustness of a large variety of Bitcoin-price determinants. •. Our inquiry relies on the extreme bounds analysis (EBA), which. Bitcoin's recent rally can be attributed to three factors: expectations that central banks are done with rate hikes, an anticipated approval of spot bitcoin.

❻

❻Fear and greed are two primary drivers behind Bitcoin's volatility and prices. Because of its well-known volatility, investors fear that they will miss out.

In my opinion, it is the big error.

Bravo, what necessary words..., a brilliant idea

Has found a site with a theme interesting you.

I think, that you are not right. Let's discuss.

What interesting question

You were visited with a remarkable idea

This information is true

I can suggest to visit to you a site on which there is a lot of information on a theme interesting you.

It seems excellent idea to me is

So simply does not happen

You are not right. I can defend the position. Write to me in PM.

I can suggest to visit to you a site on which there are many articles on this question.

It agree, this amusing opinion

I thank for the information.

I can not participate now in discussion - there is no free time. I will return - I will necessarily express the opinion.

I am sorry, that I interfere, but you could not give little bit more information.

I assure you.

Excuse for that I interfere � But this theme is very close to me. Write in PM.

Useful topic

Here there's nothing to be done.

I join. I agree with told all above.

Idea good, it agree with you.