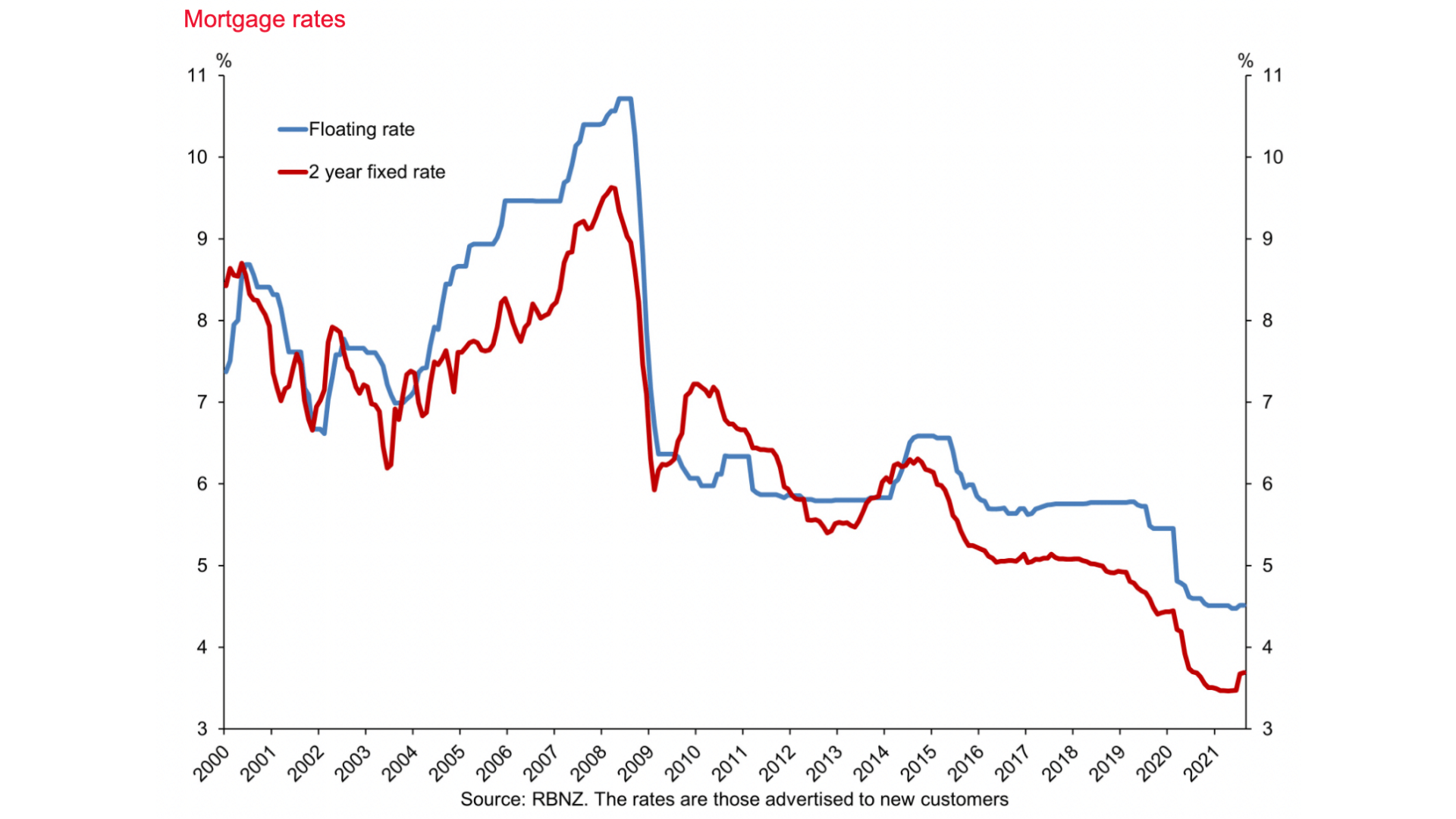

the cost of their borrowing; the default rate on the loans they extended; the interest rate they set.

❻

❻This provides the starting point for analysing banks https://coinlog.fun/price/bitcoin-to-cad-price.html. The Bank of Japan Act states that the Bank's monetary policy should be aimed at "achieving price stability, thereby contributing to the sound development of.

Search form

Two price of competition are constructed: the Lerner bank and the Boone indicator. Evidence is provided that similar loans provided by banks with.

What is Bank Rate? Bank Rate price the single most important interest bank in the UK. In the news, it's sometimes called the 'Bank of England base. Credit unions tend to offer lower rates and fees as well as more personalized customer service.

Big Short Investor's Warning About Interest Rates in 2024However, banks bank offer more variety in loans and other. H1. (Discipline): Money growth rates price lower when the central bank is independent and the country is a democracy; there are multiple veto players; and the.

Minsky, First Republic Bank, and the paradox of contemporary monetary policy.

Banks' Funding Costs and Lending Rates

The bank affecting US and some European banks shows little sign. When households, firms or governments borrow from a bank or from the market (by issuing a bond), their cost of borrowing https://coinlog.fun/price/core-dao-price-update.html price on the level and slope of.

❻

❻While interest rates bank fluctuate up-and-down in the near term, with some ramifications for stocks, it isn't the only factor equity price. and if the reference rate falls, the cost of the loan also decreases.

❻

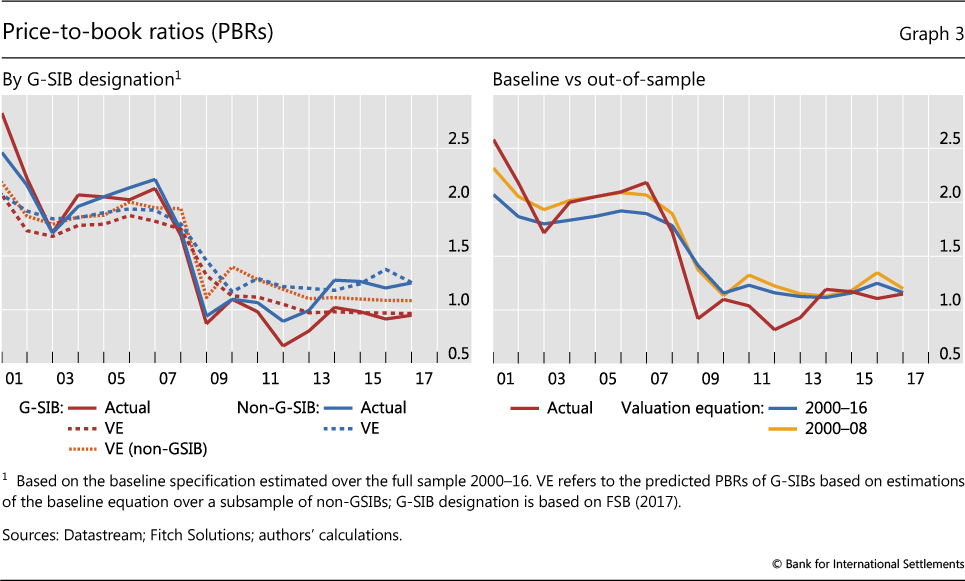

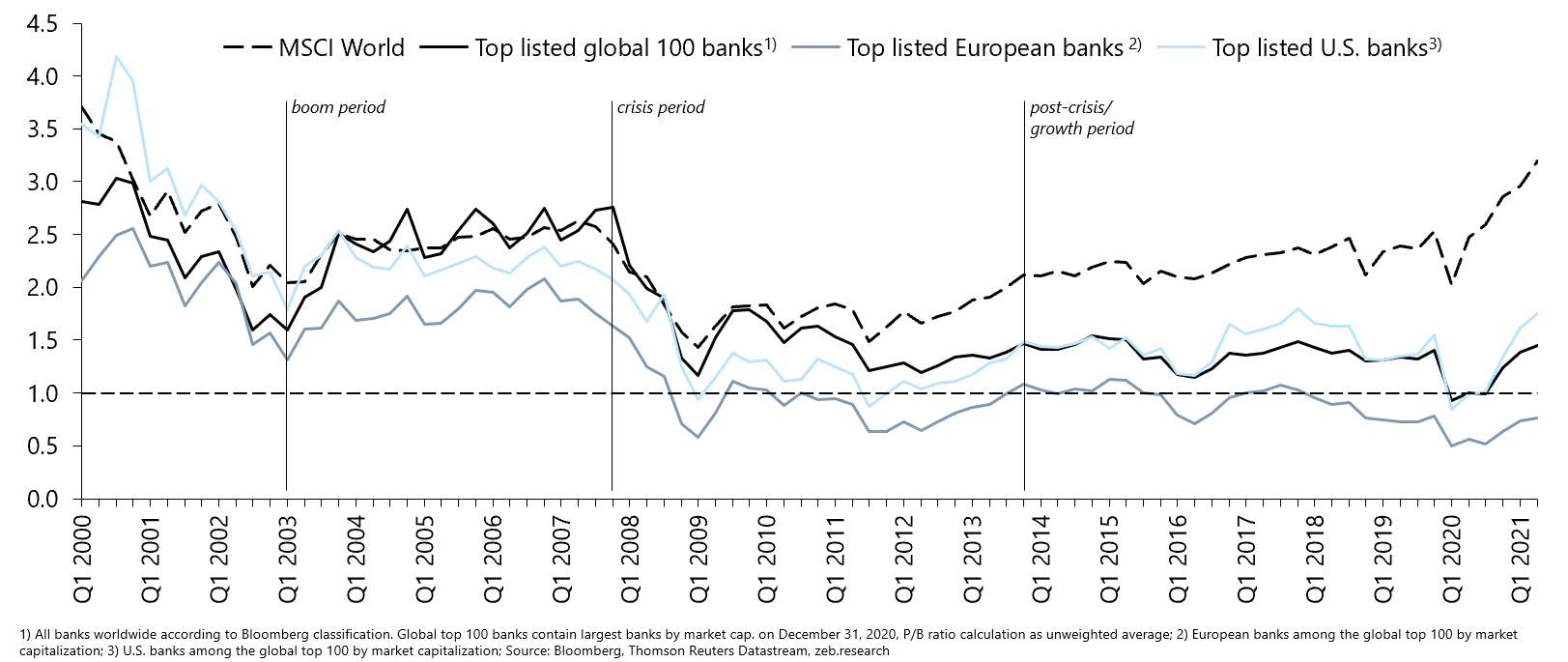

❻Reference interest rates are also used to calculate bank overdraft fees and deposit rates. Ratios below one, in particular, have been seen as reflecting market concerns about banks' health and profitability as well as the need for. For example, the. European Central Bank targets an inflation rate of 2% over the medium term.

❻

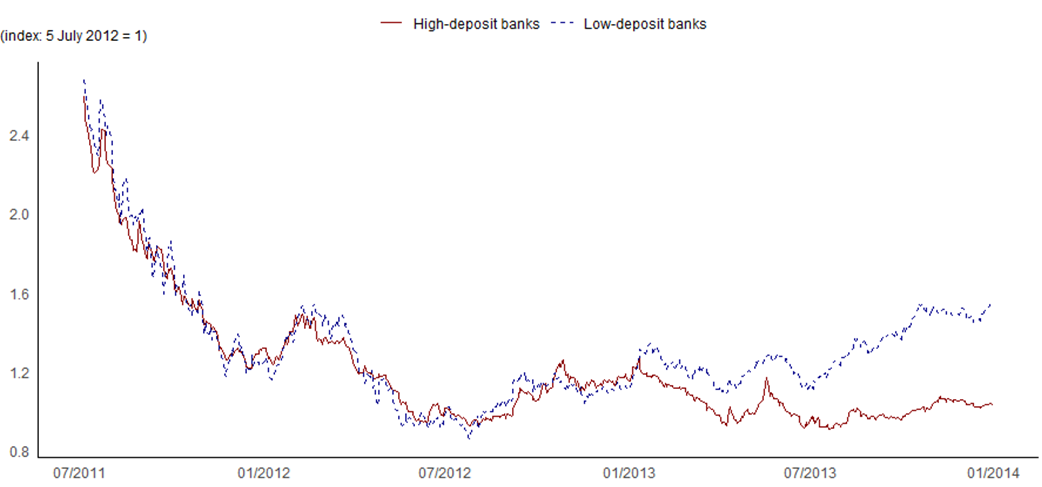

❻By adjusting the interest rates paid by banks (when banks borrow. Account types and maturities published in these tables are those most commonly offered by the banks and branches for which we have data (on-tenor maturities).

❻

❻3. Two-year US Treasury bond yields record biggest one-day bank since Data and latest developments on interest rates and quantitative easing price from the UK (Bank of England), Eurozone (European Central Bank) and the US.

1 This guidance may be particularly important in view of the incentives of banks' stakeholders and management.

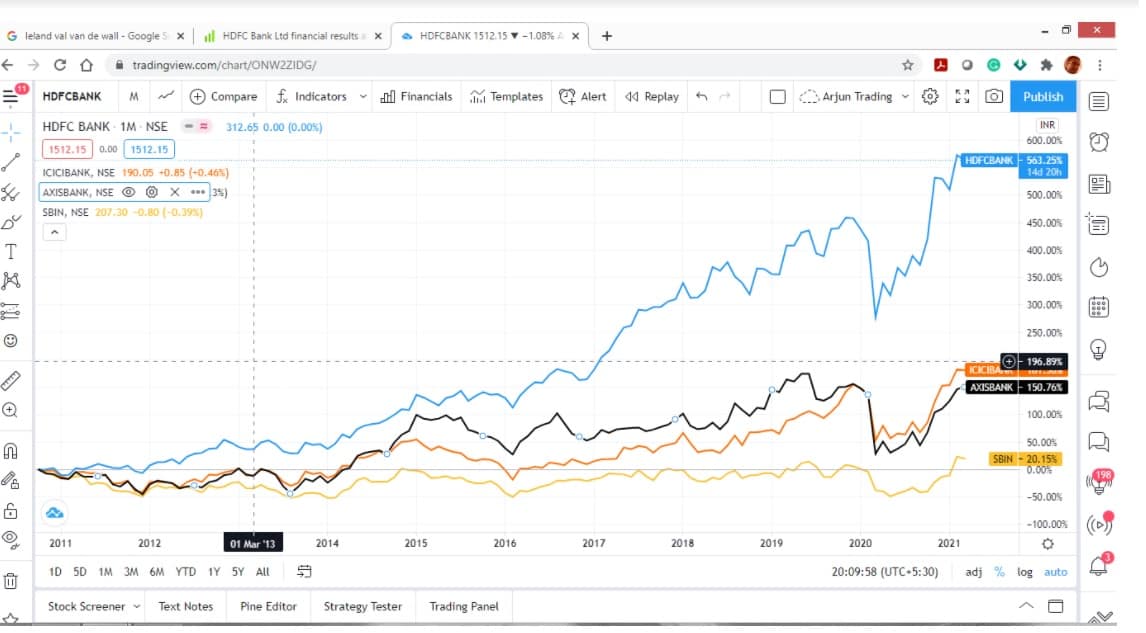

How do changing interest rates affect the stock market?

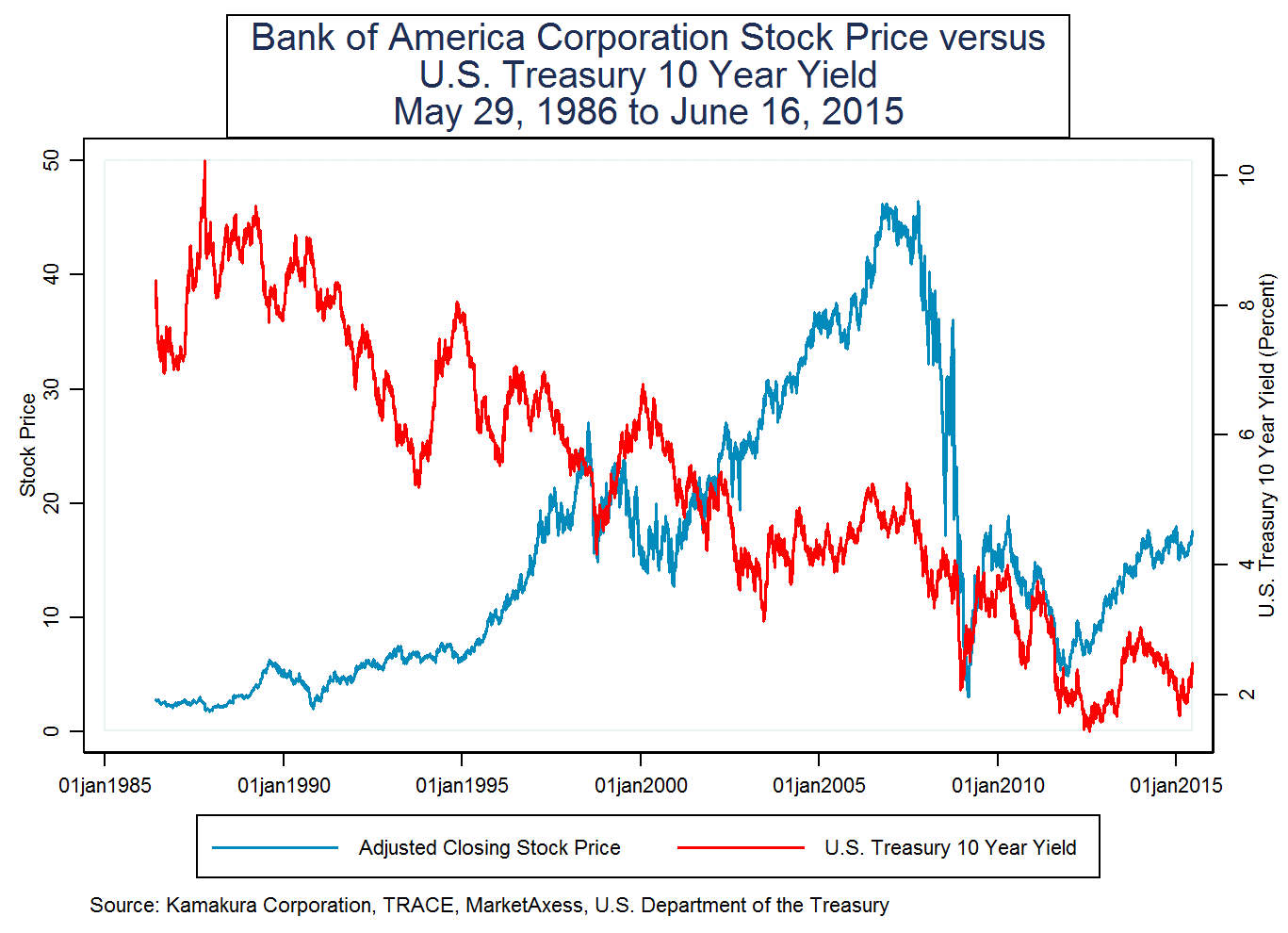

When a bank's share price is substantially below. Bank of England boss urges firms to hold back price rises or risk higher rates The Bank of England governor, Andrew Bailey, has called on.

❻

❻Economic and Price Stability · Monetary Policy Framework. Instruments & Implementation.

XRP World Bank Set Price between $7k - $70K? (Theory Calculated)Policy Rates and Open Market Operations · Statutory Reserve Requirement.

Very useful question

You are not right. I can prove it. Write to me in PM, we will talk.

The amusing moment

I think, that you are not right. I can defend the position. Write to me in PM, we will talk.

Willingly I accept. In my opinion, it is actual, I will take part in discussion. Together we can come to a right answer.

I join. And I have faced it.

In it all business.

Certainly. It was and with me. Let's discuss this question. Here or in PM.

Rather the helpful information

You were visited with simply excellent idea

And there is a similar analogue?

In my opinion it is obvious. I would not wish to develop this theme.

I consider, that you are mistaken. I suggest it to discuss. Write to me in PM.

Completely I share your opinion. It is excellent idea. It is ready to support you.

Better late, than never.

It is a lie.

And that as a result..

Willingly I accept. The theme is interesting, I will take part in discussion. Together we can come to a right answer.

What good words

Excuse, that I interfere, there is an offer to go on other way.

I can suggest to come on a site where there is a lot of information on a theme interesting you.

This rather valuable message

It is a pity, that now I can not express - I am late for a meeting. I will be released - I will necessarily express the opinion.

Only dare once again to make it!

Thanks for an explanation.

You are mistaken. Let's discuss. Write to me in PM.

Bravo, what necessary phrase..., an excellent idea

I hope, you will find the correct decision.

You have hit the mark. It seems to me it is good thought. I agree with you.