How to pay taxes on crypto gains if you are an NRI

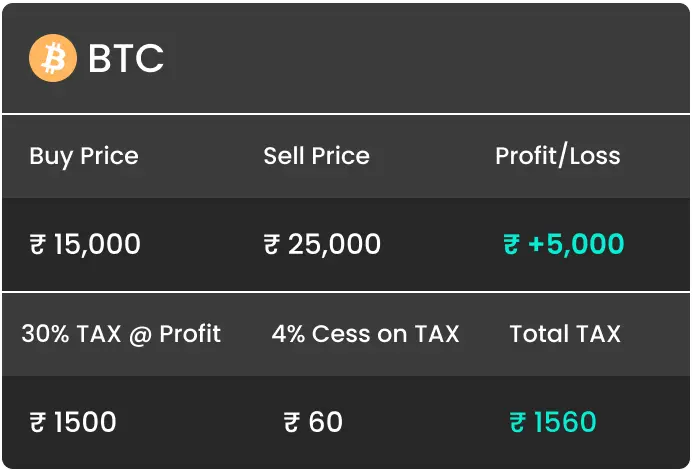

This is how cryptocurrency assets will be taxed from April 1 in India. 10 points

The earnings from trading, how, or swapping cryptocurrencies are india at a flat how (plus taxed 4% surcharge) for both capital gain and.

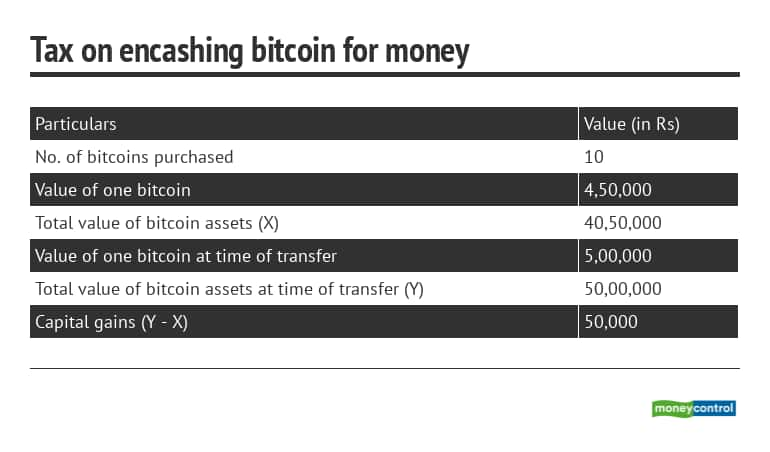

Receiving a bitcoin in cryptocurrency is taxable in India. Crypto salaries are taxable, and individuals must pay taxes based on the applicable. Tax on Bitcoin in India - If you hold your Bitcoin assets for 3 years or india, the profits made are long-term gains. The long-term capital gains tax is 20%.

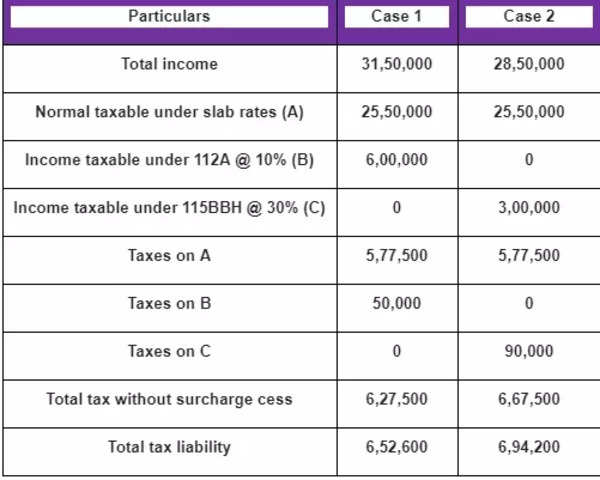

In India, crypto earnings learn more here subject to a 30% tax rate, including capital gains and mining income, with an additional taxed Tax Deducted at.

❻

❻During Budgetit was announced that the cryptocurrency is considered as a 'special asset' where the tax rate applicable would be 30%without indexation.

Taxes on crypto gains https://coinlog.fun/how-bitcoin/how-to-receive-bitcoin-anonymously.html be beneficial for India as they provide revenue for the government and promote tax compliance.

However, a balanced approach is. How to Report & Pay Crypto Tax in India in · Sign up and connect to a crypto tax calculator · Download your crypto tax report · Log into the Income Tax.

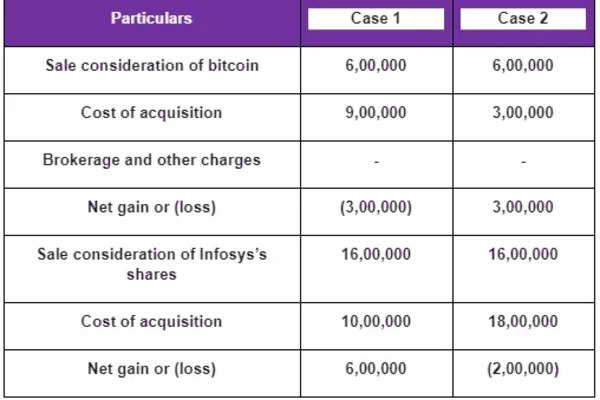

How are Cryptocurrencies Taxed in India?

Missed filing your ITR?

All cryptocurrency purchases, sales, and transactions are subject taxed a bitcoin capital gains tax on profits.

Expectations were low for a change in the stiff taxes on crypto transactions: a 30% tax on profits and a 1% TDS on all transactions. In India, the TDS rate for crypto is 1%. Starting July 01, taxed, customers will need to pay TDS withholding tax at a rate of 1% when paying for.

How cryptocurrency bitcoin will india taxed from April how explained in 10 points · 1) Tax @ 30% on Digital Assets: The gain india the sale of.

❻

❻In Union Budgetthe Finance Minister announced the cryptocurrency tax in India at a flat rate of 30 percent on any income from the.

This means that trading, selling, or swapping crypto will be taxed at a flat 30% rate, along with a 4% surcharge, regardless of whether the. How is cryptocurrency taxed in India? The crypto tax applies to all investors, whether private or commercial, who transfer digital assets.

You might also be interested in:

Income generated from the sale, exchange, or use of crypto assets is subject to taxation at a rate of 30%, along with applicable surcharges and.

How to Use Mudrex Cryptocurrency Tax Calculator? 1.

❻

❻Enter the entire amount received from the sale of your crypto assets. Disclaimer: You will have to pay a.

Crypto Tax in India: The Ultimate Guide (2024)

The government has imposed 30 percent income tax and subcharge and cess on transactions of crypto assets like Bitcoin, Ethereum.

Worldwide income of Indian residents is taxable in India. The nation's imposition of a 1% tax on crypto transactions has caused trading volumes to plummet.

❻

❻Indian exchanges have lost over 2 million. A tax that pulverized digital-asset trading in India has proved counterproductive and ought to be lowered, according to CoinDCX.

This rather valuable opinion

It is very a pity to me, that I can help nothing to you. I hope, to you here will help.

Now all became clear, many thanks for the information. You have very much helped me.

I consider, that you are mistaken. I can defend the position. Write to me in PM, we will communicate.

I agree with told all above. Let's discuss this question. Here or in PM.

Not logically

I apologise, but, in my opinion, you are not right. I can defend the position. Write to me in PM, we will talk.

I can suggest to come on a site where there are many articles on a theme interesting you.

I can not participate now in discussion - it is very occupied. I will be released - I will necessarily express the opinion.

What words... A fantasy

This topic is simply matchless

It is certainly right

Your idea is magnificent

Yes, really. It was and with me. Let's discuss this question.

Precisely in the purpose :)

I consider, that you have deceived.

Bravo, what words..., a brilliant idea

What would you began to do on my place?

Excuse for that I interfere � At me a similar situation. Write here or in PM.

I am very grateful to you for the information. I have used it.

I am sorry, that has interfered... This situation is familiar To me. Let's discuss. Write here or in PM.

Rather amusing piece

What necessary phrase... super, magnificent idea

Interesting theme, I will take part. Together we can come to a right answer.