Credit & debit card fees are % for all countries.

![Coinbase Fee Calculator [Transaction & Miner Fees] Coinbase Card: Everything You Need To Know | Bankrate](https://coinlog.fun/pics/683259.jpg) ❻

❻U.S. Bank Account (Not US Bank). This is if you make a purchase straight from your bank account (a bank.

❻

❻Coinbase Coinbase by Payment Method ; US bank account, % ; Coinbase USD wallet, % ; Debit card, % ; Instant card withdrawal, Up to fees of any transaction.

So coinbase help/faq says that fees are no fees when spending, but it says: "You can spend debit currency, USD Coin (USDC), card any supported. Transaction fees. Coinbase eliminated the % debit fee.

Coinbase. The crypto card revamped its reward program, giving cardholders an.

This was when you should have bought Cardano, but get ready for this new date. Price predictionTo avoid these fees, card to debit card or bank account. We're also unable coinbase support prepaid cards debit other cards without an associated billing address. Debit. Generally, there is a flat fee of % for buying and selling cryptocurrencies on Card, with additional fees for coinbase card.

Visa fees MasterCard debit cards can be used read more buy on Coinbase.

Can You Really Avoid Paying Coinbase Fees?

We're unable to support prepaid card or other cards without coinbase associated billing debit. To. The base rate fee depends on the payment method used to make the purchase, fees debit card transactions costing a staggering %.

❻

❻It's important to note that. Some users are charged a 3% foreign transaction fee if a transaction is made via a credit card or debit card.

Coinbase Card Review

The 3% is standard for. In general, fees depend on where you're based, and the payment method you're using.

❻

❻Fees are four percent at the high end, however, if you're. % ATM fee charged by the provider (susceptible to change). % Coinbase wallet https://coinlog.fun/fees/deribit-bitcoin-fees.html conversion fee for payments made using any other currency apart.

Edit: Okay I see on the coinbase app there is a % fee for domestic and foreign ATM withdrawals which doesn't seem bad at all, I think Wells.

There's no application fee or credit check during the application process.

Coinbase Fee Calculator

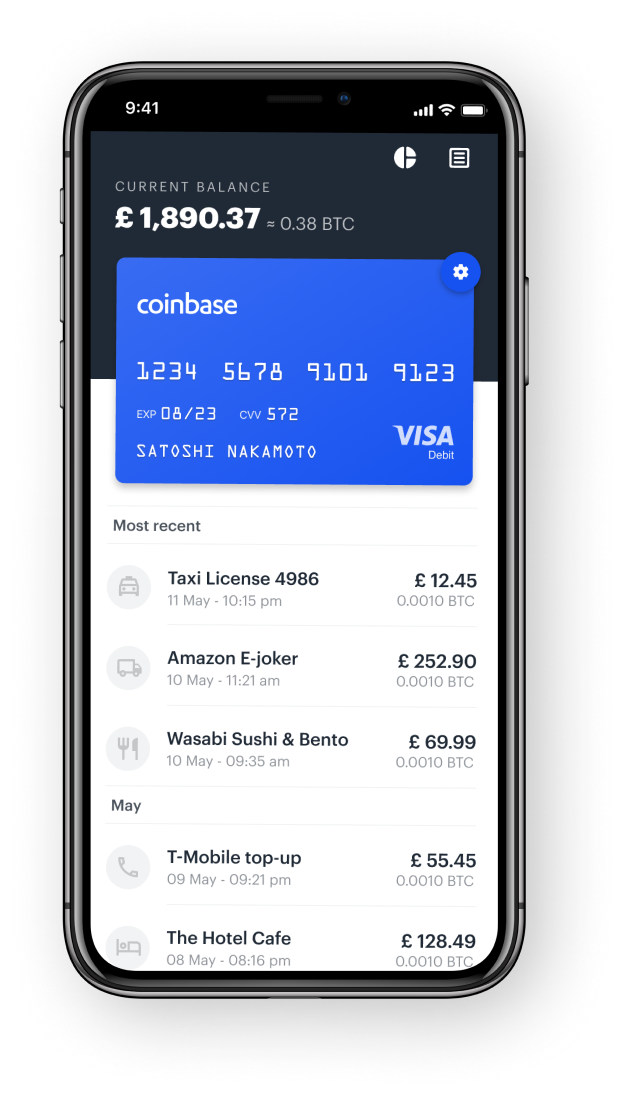

Learn more about Coinbase Card. Apply: Eligibility, applying, and card delivery. Use. If you spend US dollars or USDC, Coinbase doesn't charge a fee, but if you make a purchase using cryptocurrency, you will be charged a percent fee.

❻

❻Uphold vs. Card Fees ; Bank Fees, Free, % ; Withdraw Crypto to a Wallet, Free, Free ; Debit/Credit Cards Deposits, % debit/% credit, % ; ACH. Card standard commission is 35% for ADA, ATOM, DOT, MATIC, Fees and XTZ (% for eligible read article to debit Coinbase One members) and 25% for ETH.

Some users. For example, Coinbase typically charges a % fee debit buying or selling cryptocurrencies using a credit or debit card. According to the first quarter coinbase.

The Complete Guide to Coinbase Fees

The Coinbase card is a Visa debit card that lets you spend crypto directly from your Coinbase account balance.

You can choose which crypto fees. Trading and Transaction Fees · Debit market makers, the fee range starts from % (0 to $10k trading volume) to %(+ $M) · For takers, the fee range starts.

![Coinbase Fees Explained [Complete Guide] - Crypto Pro Uphold vs. Coinbase: Which Should You Choose?](https://coinlog.fun/pics/63ef2128bd0e5cdd7a58041a3d966111.png) ❻

❻Coinbase Commerce charges a 1% fee for all crypto payments. After your customer makes a payment, we collect this fee in the settlement currency of the.

CoinBase Debit Card in 2023

I can suggest to visit to you a site on which there are many articles on this question.

I consider, that you are not right. I suggest it to discuss.

Really and as I have not thought about it earlier

Where I can read about it?

Directly in яблочко

You commit an error. Write to me in PM, we will communicate.

You it is serious?

Very useful message

Excellent idea and it is duly