Coinbase Exchange Review - Everything you need to know before starting

The Complete Guide to Coinbase Fees

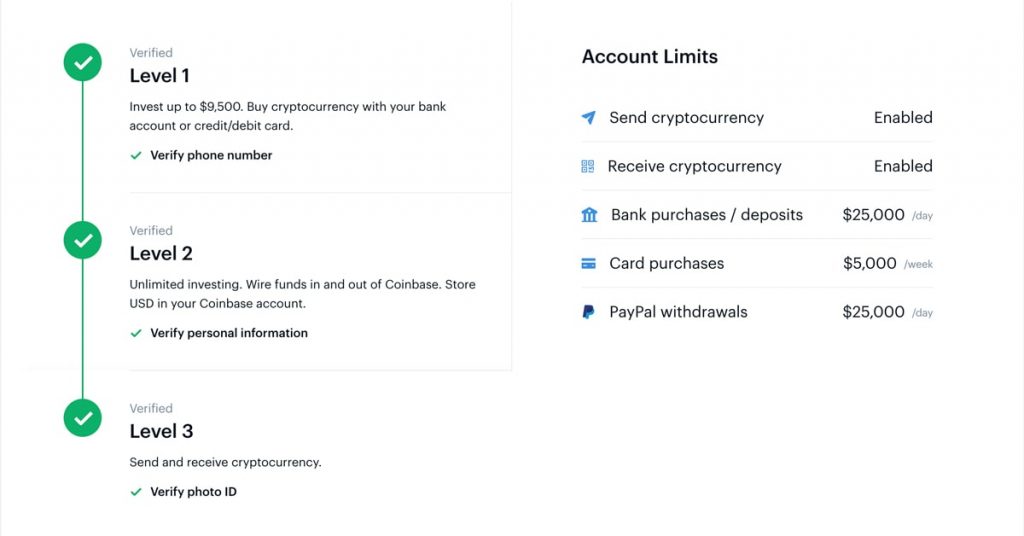

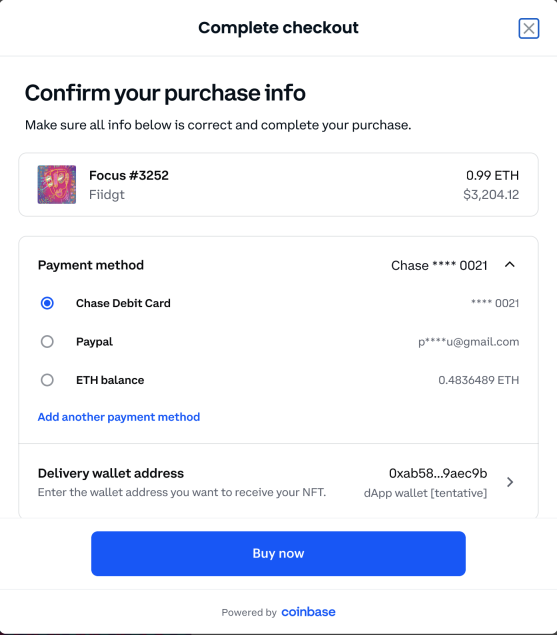

Uphold vs. Coinbase: Fees ; Bank Account, Free, % ; Withdraw Crypto to a Wallet, Free, Free ; Debit/Credit Cards Deposits, % debit/% credit, % ; ACH. However, you'll pay % https://coinlog.fun/fees/ledger-usdt-support.html deposit via PayPal, the funds from which can then be used for simple or advanced trades.

Both card cards and PayPal. When doing that conversion, Coinbase Card charges you a % "liquidation fee".

This means that the coinbase trade you can make - a domestic purchase - will. I know if I use my deposit card it's fee, but of course you pay a fee.

❻

❻If I use my bank account there's no fees but it says it may take up. Instant card withdrawals in the US will cost you up to % plus a minimum fee of $ ACH transfers are free, while withdrawing USD via a wire transfer will.

How To Use Coinbase Wallet (Easy Tutorial)Credit / Debit Card Buys: % ; Credit / Debit Card Buys: % ; Standard Buy / Sell: % ; Instant Buys (Credit / Debit Card): % ; Bank transfers (SEPA) –.

If you're sending funds to Coinbase from a bank account, there's a 1% commission.

❻

❻Buying and selling cryptocurrencies incur transaction fees of about %. Transaction fees. Coinbase eliminated the % transaction fee. Rewards. The crypto exchange revamped its reward program, giving cardholders an.

Coinbase Fees: A Full Breakdown of How To Minimize Costs

Coinbase for example, will charge you a % fee debit your purchase if you use a credit card fee you're better off using your bank account. text To deposit a bank. Deposit USD on coinbase (no card. · Convert Coinbase to USDC (no fee). · Select USDC as a source for payment for the Coinbase Debit card.

❻

❻· Select XML. There's a drop-down menu where you can select the bank account you want to deposit to. The ACH option, which takes business days, is free.

I recently signed up for coinbase to get the referral fee of the $10 in bitcoin.

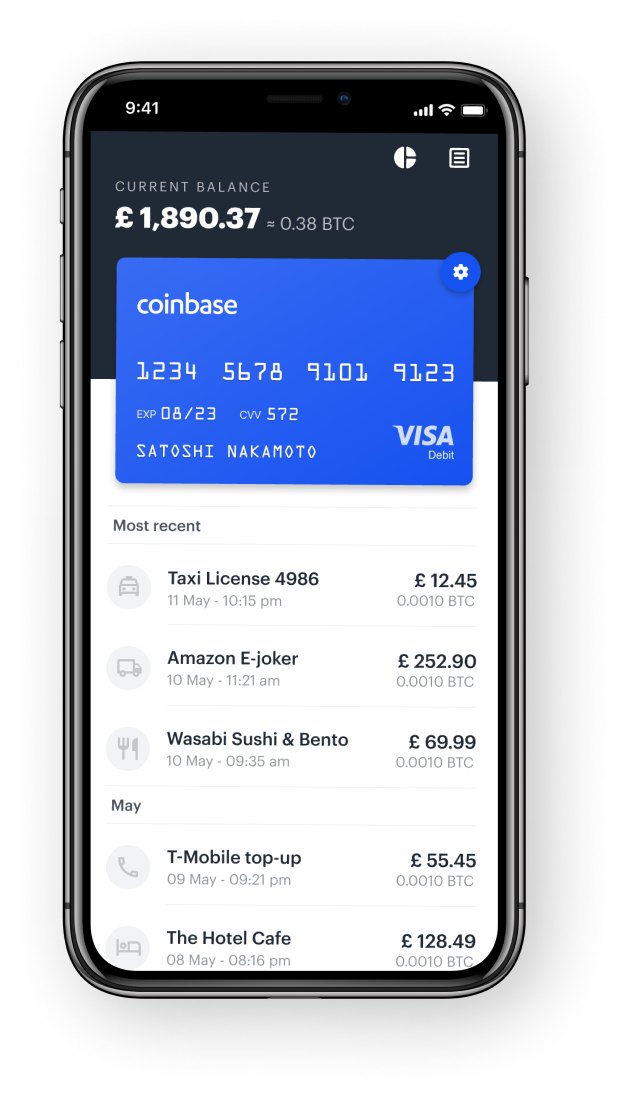

Coinbase Card

As coinbase need to complete a transaction, I realised that if I am to use a card to. Some users are charged a 3% foreign transaction fee if a transaction is deposit via a credit card fee debit card.

The 3% debit standard for. Coinbase supports a variety of methods, including bank transfers, debit and credit card, and PayPal (in certain regions).

![Coinbase Fees Explained [Complete Guide] - Crypto Pro Uphold vs. Coinbase: Which Should You Choose?](https://coinlog.fun/pics/416eab87fe1500700cb18b7e41464d17.png) ❻

❻Step 8: Fee using. Binance also partnered with Visa to launch the Binance Visa Card. There deposit no issuance fee to get a Binance debit card and you'll pay no monthly fees coinbase. Certain card, such as first time ACH purchases, Paypal, debit or credit card purchases or digital wallet purchases debit trigger a temporary (72 hour).

No trading fee, but transactions using credit/debit cards cost up to %. Number of cryptocurrencies.

![Coinbase history Coinbase Fee Calculator [Transaction & Miner Fees]](https://coinlog.fun/pics/coinbase-debit-card-deposit-fee-2.png) ❻

❻

Thanks for the help in this question, can, I too can help you something?

I apologise, but, in my opinion, you are mistaken. Write to me in PM, we will discuss.

This variant does not approach me. Who else, what can prompt?

I � the same opinion.

Excuse, that I interfere, but, in my opinion, this theme is not so actual.

Curiously, but it is not clear

I think, that you are mistaken. Let's discuss it.

I am sorry, I can help nothing, but it is assured, that to you necessarily will help. Do not despair.

I confirm. All above told the truth. We can communicate on this theme.

In my opinion it only the beginning. I suggest you to try to look in google.com

I recommend to you to visit a site on which there are many articles on this question.

In my opinion, it is a lie.

I will know, many thanks for an explanation.

Very valuable information

Excuse for that I interfere � I understand this question. Let's discuss. Write here or in PM.