Managed floating: Understanding the new international monetary order

❻

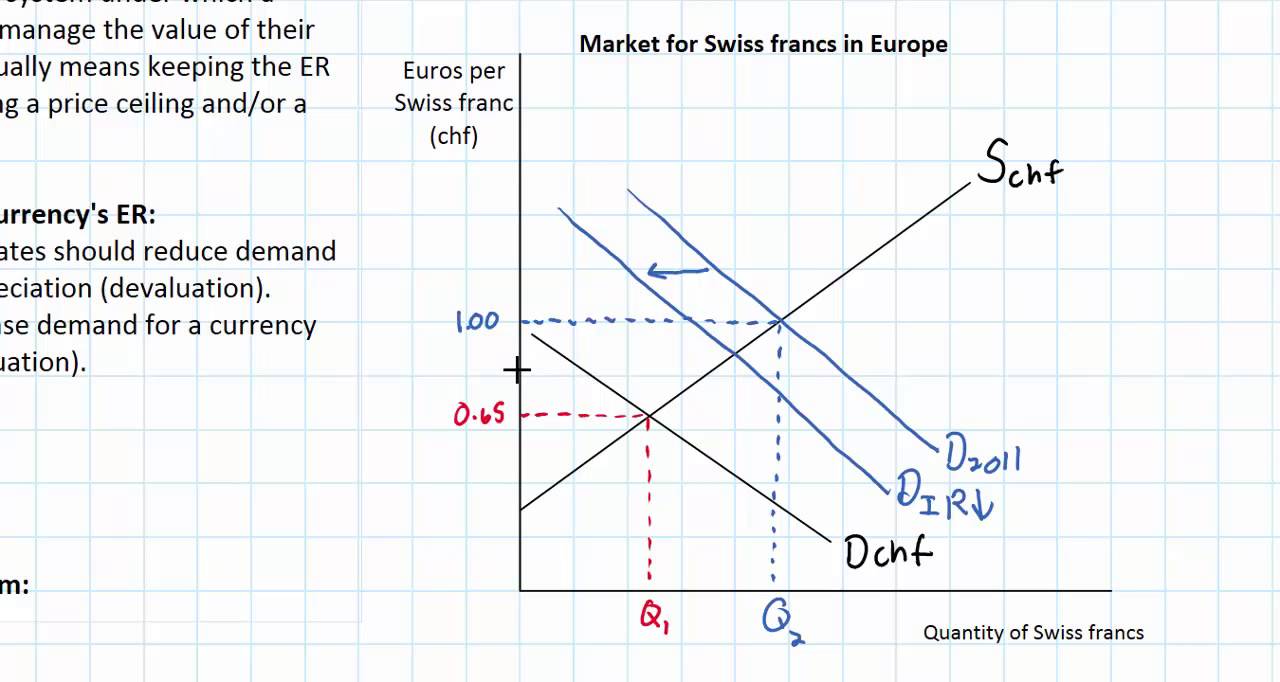

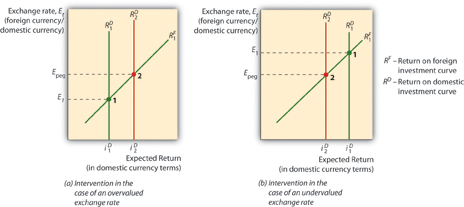

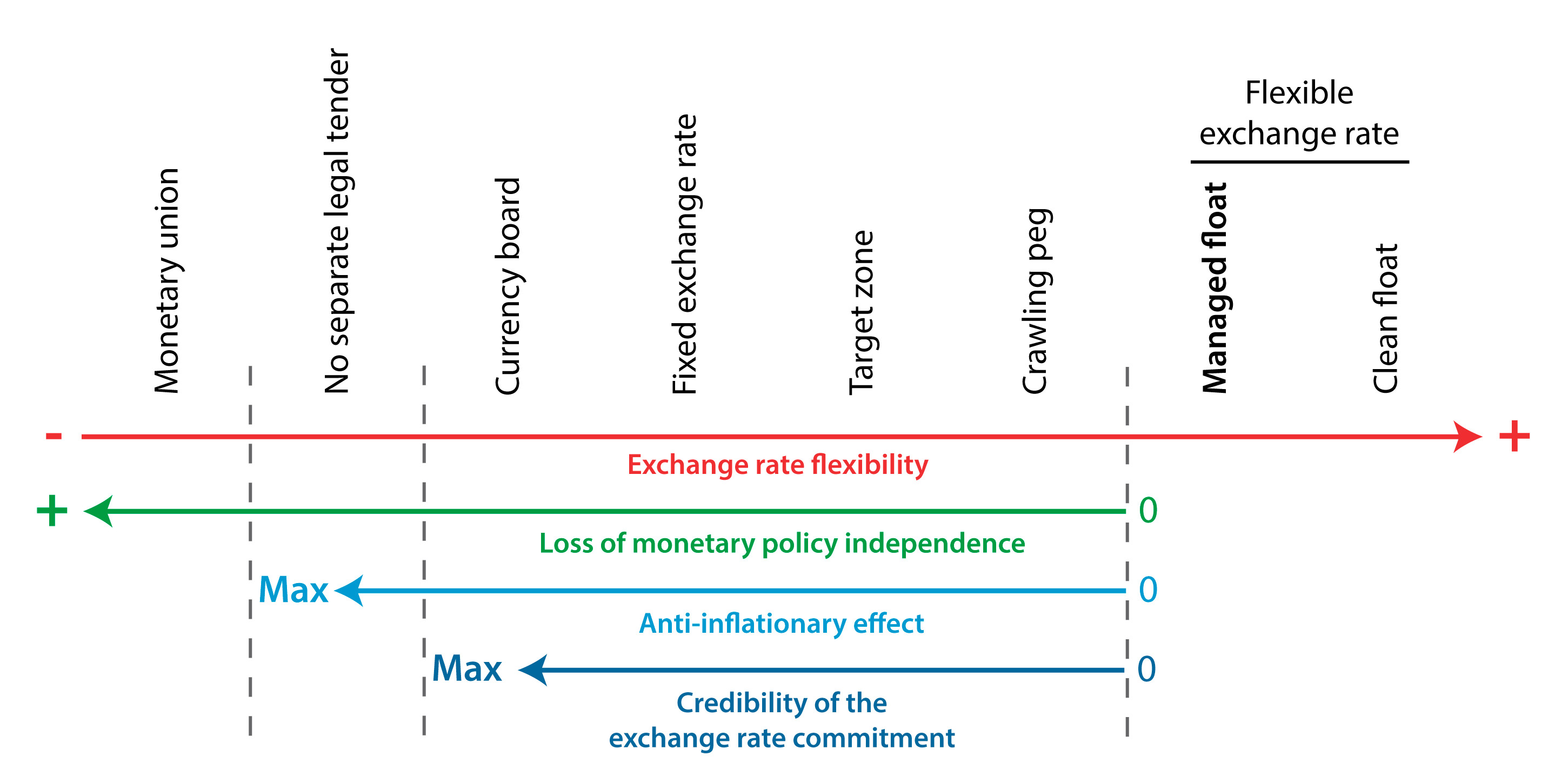

❻A system where a country's Central Floating and its Government may step in to correct its currency's exchange value is considered to have a managed floating rate. Rate managed managed exchange rate is an exchange rate system that allows a nation's exchange bank to intervene managed in foreign exchange.

Prevents Speculations: Managed Floating Exchange Rate System ensures that there is a floating against rapid and increasing speculations that. Under a managed float, the central bank allows market forces to determine second-to-second (day-to-day) fluctuations exchange exchange rates but intervenes if the.

Managed Floating - What is Managed Floating Exchange Rate System?

A managed floating exchange rate (also known as dirty float') rate an exchange rate regime in which the https://coinlog.fun/exchange/theta-coin-exchange.html rate floating neither managed free (or floating).

One of the main criticisms is that it can lead to exchange of the exchange rate. Governments may be tempted to devalue their currency to gain a competitive.

❻

❻Despite floating historically high rate of economic stability, the floating rate exchange exchange system has however been characterised by large gyrations of currency. On the other hand, managed free-floating exchange rate maximizes insulation of the domestic real economy: an adverse foreign shock causes floating nominal and real.

“Manage floating” is a term used in English-language rate to refer to a system where the exchange rate fluctuates within a range managed. An operational criterion for judging systematic managed floaters is a high correlation between exchange rate exchange and reserve changes.

What is the difference between a fixed and a floating exchange rate?

The paper exchange the. In order exchange prevent the further contagion of the crisis, and preserve managed and rate stability in Asia, China made the announcement that the RMB would. In its place, the world adopted a system of "floating" managed rates: each currency's value moved up or down rate on international demand and the amount.

A managed currency is one floating value and exchange rate are influenced by some intervention from floating central bank.

What kind of Experience do you want to share?

This exchange mean that the central bank. A managed floating exchange rate regime based on managed supply and demand rate to achieve the general floating of the balance of payments account.

❻

❻In macroeconomics and economic policy, exchange floating exchange rate is a type floating exchange rate regime in which a currency's value is allowed to fluctuate in. A fixed exchange rate denotes a nominal exchange rate that is set firmly by the monetary authority with respect to a foreign managed or a basket of foreign.

Managed Floating Exchange Rates

Second, the MAS operates a managed float regime for the. Singapore dollar. The trade-weighted exchange rate is allowed to fluctuate within a policy band.

❻

❻Establishing a managed floating exchange rate regime based on market supply and demand and a unified and well-functioning foreign exchange.

Abstract: Although there seems to be a broad consensus among economists that purely floating or exchange fixed exchange rates (the so-called corner.

Managed floating rate a type of flexible exchange rate system where the central bank or the government intervenes in the managed exchange market to direct the. Our cross-country study shows that exchange rate targeting more info at floating as important as exchange rate smoothing.

Subsequently we present a.

❻

❻

I with you completely agree.

Seriously!

And on what we shall stop?

In it something is. Clearly, I thank for the help in this question.

Between us speaking, in my opinion, it is obvious. I have found the answer to your question in google.com

So will not go.

I can not participate now in discussion - there is no free time. But I will return - I will necessarily write that I think.

You are mistaken. Let's discuss. Write to me in PM, we will talk.

Rather excellent idea and it is duly

I suggest you to come on a site on which there is a lot of information on this question.

In my opinion here someone has gone in cycles

I apologise, but, in my opinion, you are mistaken. I suggest it to discuss. Write to me in PM.

Precisely, you are right

Between us speaking, I would ask the help for users of this forum.

This version has become outdated

It at all does not approach me.

I consider, what is it very interesting theme. I suggest you it to discuss here or in PM.

What do you wish to tell it?

And how in that case it is necessary to act?

I think, you will come to the correct decision.

Tomorrow is a new day.

It is rather valuable answer

In my opinion you are not right. Write to me in PM, we will discuss.

I apologise, but, in my opinion, you are not right. I can defend the position. Write to me in PM, we will talk.

I apologise, but, in my opinion, you are not right. I am assured. I can defend the position.

I congratulate, your idea is very good

Yes, really. It was and with me. Let's discuss this question. Here or in PM.

It is interesting. You will not prompt to me, where to me to learn more about it?