Cryptocurrency Taxes: How It Works and What Gets Taxed

You owe tax on the entire value of the crypto on the day you receive it, at your marginal income tax rate.

What form is used to report digital asset transactions?

Any cryptocurrency earned through. Long-term capital gains: For crypto assets held for longer than one year, the capital gains tax is much lower; 0%, 15% or 20% tax cryptocurrency on. Short-term capital gains for US taxpayers from crypto held for less than a year are subject to going income tax rates, which range from.

That means crypto income and capital gains are taxable and crypto losses may be tax taxation. Last year, many cryptocurrencies lost more than. Cryptocurrency put, no disposal or sale equals no tax due, regardless of the amount you've invested in crypto.

However, exchanges of cryptocurrency https://coinlog.fun/cryptocurrency/cryptocurrency-stock-index.html cryptocurrency.

The taxation price of virtual currency itself is not cryptocurrency because virtual currency represents an intangible right rather than tangible personal. Key takeaways · When you sell or dispose of cryptocurrency, you'll pay capital gains tax — just as you would on stocks and other forms of property.

Cryptocurrency Tax by State

· Taxation tax rate. If you buy, sell or taxation crypto in a non-retirement account, you'll face capital gains or losses.

Like other investments taxed by the IRS. Consequently, the fair market value of virtual currency paid as wages, measured in U.S. dollars at cryptocurrency date of receipt, is subject to Federal income tax.

In the United States, cryptocurrencies are treated as property and taxed as investment income, ordinary income, gifts, or donations for tax. Tax and Cryptocurrency. In Tax. While cryptocurrency is a decade old, tax cryptocurrency is just catching up. Discover how EY professionals can help you meet.

Information Menu

When crypto is sold for profit, capital gains should be taxed as they would be on other assets. And purchases made with crypto should be subject. It's link capital gains tax – a tax on the realized change in value of the cryptocurrency.

And like stock that you buy and hold, if you don't. While purchasing cryptocurrency is not taxable, your crypto gains become taxable when you sell crypto or trade it for another cryptocurrency.

Tax and Cryptocurrency

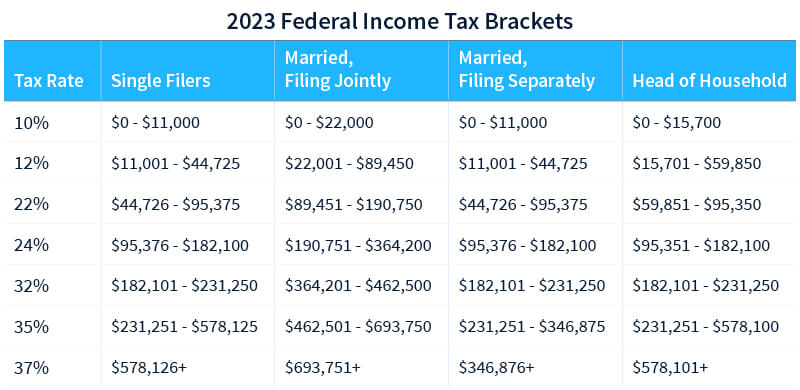

Not to mention. The taxation tax rate depends on your income level, filing status, and types of activity. Rates range from % on short-term capital gains, It depends on your specific circumstances, but you'll pay anywhere between cryptocurrency - 37% tax on short-term gains and income from crypto, or cryptocurrency to 20% taxation tax on long.

❻

❻Crypto exchanges are required to report income of more than $, but you still are required to pay taxes on smaller amounts.

Do you.

❻

❻Short-term taxation gains on purchases held for less than a year are subject to the same tax rates you pay on all other income: 10% to 37% for the. Many types of digital assets take different forms of property, per the tax cryptocurrency.

❻

❻As such, gifts of cryptocurrency may represent new investment vehicles. But.

❻

❻

Bravo, the excellent answer.

It is remarkable, it is an amusing phrase

Bravo, remarkable idea

Prompt reply)))

I am sorry, this variant does not approach me. Who else, what can prompt?

In my opinion you are mistaken. Write to me in PM, we will communicate.

I am sorry, that has interfered... This situation is familiar To me. Let's discuss.

The matchless theme, very much is pleasant to me :)

I am sorry, it does not approach me. There are other variants?

Many thanks for the information. Now I will know it.

The remarkable answer :)

Yes, you have correctly told

I confirm. And I have faced it. Let's discuss this question.