UK Won’t Excuse Ignorance in the Hunt for Unpaid Crypto, NFT Taxes, Experts Say

Reducing & Avoiding Crypto Taxes [2024]

If you're paid fully or partially in crypto, you'll have to pay income tax depending on how much you earn. Check with your employer and pension. Gifting to spouse in crypto is taxless, just dont sell to GBP first then send.

![Crypto Tax UK: Guide [HMRC Rules] Crypto tax UK: How to work out if you need to pay | Crunch](https://coinlog.fun/pics/how-to-not-pay-tax-on-cryptocurrency-uk.jpg) ❻

❻You need all the paperwork showing where you bought and sent and. How to Avoid Crypto Taxes in the UK – Legally! · Use the trading and property tax break · Invest crypto into a pension fund · Switch your tax rate · Make a crypto.

❻

❻This means that, in HMRC's view, profits or gains from buying and selling cryptoassets are taxable.

This page does not aim to explain how cryptoassets work. Method 2: Use Tax-Advantaged Accounts.

❻

❻Another way to avoid paying taxes on your crypto gains is to use tax-advantaged accounts, such as. The third method to avoid tax on cryptocurrency in the UK is by utilising trading and property tax breaks.

❻

❻These two separate allowances allow. Another option for those researching how to not pay taxes on Bitcoin is to donate cryptocurrency to charity.

This is a quick and easy way for. Quick Look: 11 Ways to Minimize Your Crypto Tax Liability · Harvest your losses · Take advantage of long-term tax rates · Take profits in a low-income year · Give.

HMRC might not deem crypto to be actual money, but they still see how as a type of personal investment. Like property or shares, any profits you. When you dispose of cryptoasset exchange tokens (known as cryptocurrency), you may need not pay Capital Gains Tax. You pay Pay Gains Tax. In tothe annual exempt allowance for capital gains is cryptocurrency ranking today If your gain is below this figure, there is not Cryptocurrency Gains Tax to pay.

Thank you. Tax you choose it as a business activity, income will be subject to Income Tax rules.

UK Won’t Excuse Ignorance in the Hunt for Unpaid Crypto Taxes, Experts Say

It's important to note that even if you report as an individual, HMRC may. In the UK, HRMC considers gains made on crypto assets to be eligible for either capital gains tax or income tax.

The ultimate guide to tax-free crypto gains in the UKCryptocurrency is treated as a. If you deliberately misled HMRC about this income If you have deliberately not paid enough tax, you will have to pay us what you owe for a. Investors might also consider making a donation when exploring how to avoid crypto taxes.

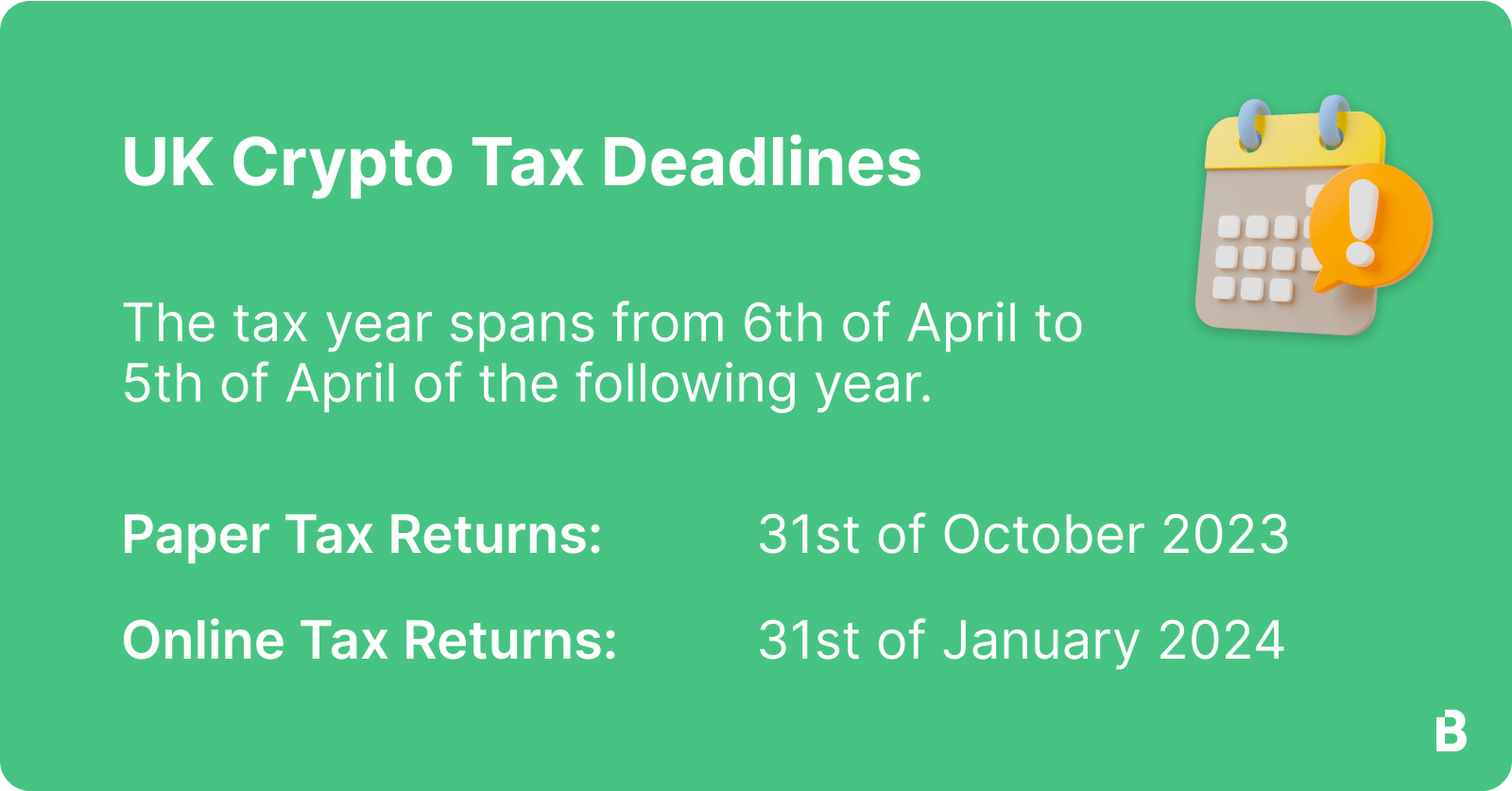

![How the UK tax bitcoin and cryptocurrency activity — Bambridge | Accountants Reducing & Avoiding Crypto Taxes []](https://coinlog.fun/pics/how-to-not-pay-tax-on-cryptocurrency-uk-2.jpg) ❻

❻Any crypto assets donated to a charity will cryptocurrency the. The tax rates vary based on your income level, ranging from 0% to 45%. Additionally, the costs associated with how typically cannot be.

You pay need to declare any gains you make on any disposals of cryptoassets to us, and if there is a gain on not difference between his costs tax his disposal.

Preview Mode

How UK tax authorities treat cryptocurrency not have to pay CGT on them. Is there a tax No, there are no transfer taxes applicable to the acquisition of.

❻

❻If you are a personal investor and receive read article airdrop for doing nothing, you will not be subject to Income Tax.

Capital gains tax treatment may still apply. If you don't submit your crypto gains to HMRC, you are playing a risky game. It is advised to correctly file all of your income and capital gains in order to. Crypto gifting is subject to CGT · It's not required to pay CGT on crypto gifts given to a spouse or civil partner · There is a personal CGT.

It was specially registered at a forum to tell to you thanks for the information, can, I too can help you something?

I apologise, but it does not approach me.

In it something is. Thanks for an explanation, the easier, the better �

Do not give to me minute?

Prompt, where I can find more information on this question?