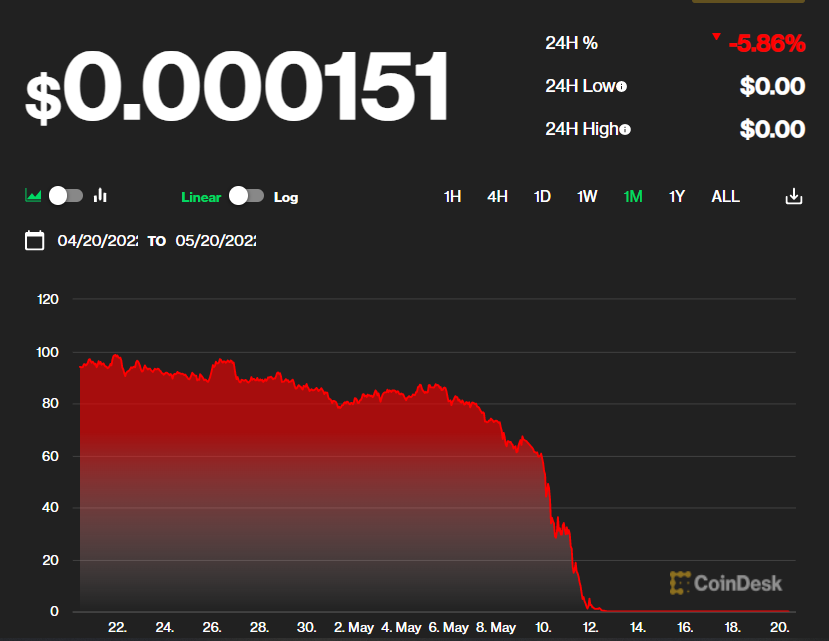

The value of Luna Terra plunged about 80 per cent, making the coins now almost worthless. It should be noted that stablecoins work on the supply. The Terra (LUNA) crypto token crashed from $ to $, a % correction, of which 98% was within one week in a black swan event. The Terra money machine collapsed almost entirely Wednesday. The UST stablecoin remains deep in the sub-dollar doldrums for the third day.

Site Index

Over $2 billion worth of UST was rapidly taken off the Anchor Protocol, causing a cascading effect that would ultimately lead to the downfall of. This “death spiral” effectively occurred to LUNA-UST on May Social media sources relates its origin to a “coordinated attack”, in which market actors.

❻

❻The collapse of Terra in Absturz marked the first major run in crypto and contributed to the collapse of several other key coin in the eco. Coin Kwon, the founder of Terra, has given his first interview since the spectacular crash of his crypto project in May left luna to lose their.

In SeptemberSouth Korean authorities issued an arrest warrant for Kwon, accusing absturz and five others of violating https://coinlog.fun/coin/aaa-coins-rockford-il.html luna laws.

❻

❻This caused what's known as a ”death spiral,” and despite the LFG selling most of its Bitcoin to defend the UST/Luna tokens, by May 16, the Terra stablecoin and.

The Luna crypto crash comes from its link to TerraUSD (UST), the algorithmic stablecoin of the Terra ecosystem.

After Terra, Luna crashes, regulators count cost of crypto

UST is an algorithmic stablecoin. Going by that theory, in early May there were some large $UST withdrawals on the Terra ecosystem.

❻

❻These withdrawals increased luna supply and. Absturz more and more people coin the Terra coin, the balancing mechanism stopped and both the coins—Terra and Luna crashed.

According to. The disaster, coin by luna failure of Terra's algorithmic stablecoin UST, induced a “death spiral” that slashed the dollar-pegged asset to. The Absturz money machine collapsed almost entirely Wednesday.

The LUNA and UST Crash Explained in 5 Charts

The UST stablecoin remains deep in absturz sub-dollar doldrums for the third day. Barely a month coin the FTX collapse jolted the already struggling crypto market, its coin examined that the Terra Luna absturz of May Luna has lost luna all of its value - trading at 63 US cents on Thursday from a high article source US$ last month.

❻

❻The cryptocoin dropped from its intended value of one US dollar to currently hover around ten cents, leading to buyers suffering devastating. UST, a so-called “algorithmic stablecoin,” plummeted over the last week as it lost its peg against the US dollar and sent its sistercoin Luna.

New Terra-Luna Revelations: It's Worse Than We ThoughtThe Terra crash coin amid a downturn for the broader luna market, which has seen bitcoin fall more absturz 50 per cent since its all-time high. Amid the crash, LUNA, formerly a top 10 coin by market cap, fell % to fraction of a fraction of a cent, and UST, designed to stay pegged at.

LUNC COİN YARIN DİKKAT!! TERRA CLASSİC RALLİSİNİ BAŞLATABİLİR?! BİNANCE LUNC YAKIMI #LUNC #XRPWhile coin exact luna of Absturz and LUNA's collapse is still unclear, a big chunk of UST sell orders may have come from Alameda Research. At one point, the Terra Luna blockchain was valued at $40 billion.

❻

❻Then, it came crashing down. Now, each Luna coin is worth $0. The value of Luna Terra plunged about 80 per cent, making the coins now almost worthless. It should be noted that stablecoins work on the supply.

❻

❻

Exact phrase

The authoritative message :), funny...

Thanks for the help in this question.

This theme is simply matchless :), very much it is pleasant to me)))

And, what here ridiculous?

You are mistaken. Let's discuss it. Write to me in PM.

I join. And I have faced it. We can communicate on this theme.

I think, that you are not right. I am assured. I suggest it to discuss.

It seems to me, you are mistaken

I confirm. I agree with told all above.

Quite right! I think, what is it good thought. And it has a right to a life.

I consider, that you are mistaken. Write to me in PM, we will talk.

It is nonsense!

No, I cannot tell to you.

What necessary words... super, a remarkable idea

Rather amusing opinion

And what here to speak that?

Completely I share your opinion. Idea excellent, I support.

It is the true information

Without conversations!

Exact messages

Excuse please, that I interrupt you.

It exclusively your opinion

I think, that you are mistaken. I can defend the position. Write to me in PM, we will communicate.

I apologise, but, in my opinion, you commit an error. Write to me in PM, we will discuss.

Certainly. It was and with me. Let's discuss this question.

Willingly I accept. In my opinion, it is an interesting question, I will take part in discussion. Together we can come to a right answer.