Digital Assets

Bitcoin earned through mining is taxed at your regular income tax rate as gross income. The amount of tax owed is assessed based on the value of the bitcoin on.

![Crypto Mining Taxes: Beginner's Guide | CoinLedger Crypto Mining Tax: The Ultimate US Guide []](https://coinlog.fun/pics/970072.jpg) ❻

❻How do I report crypto on my tax return? There are 5 steps you should report to file your cryptocurrency taxes: Taxes your crypto gains and losses; Complete.

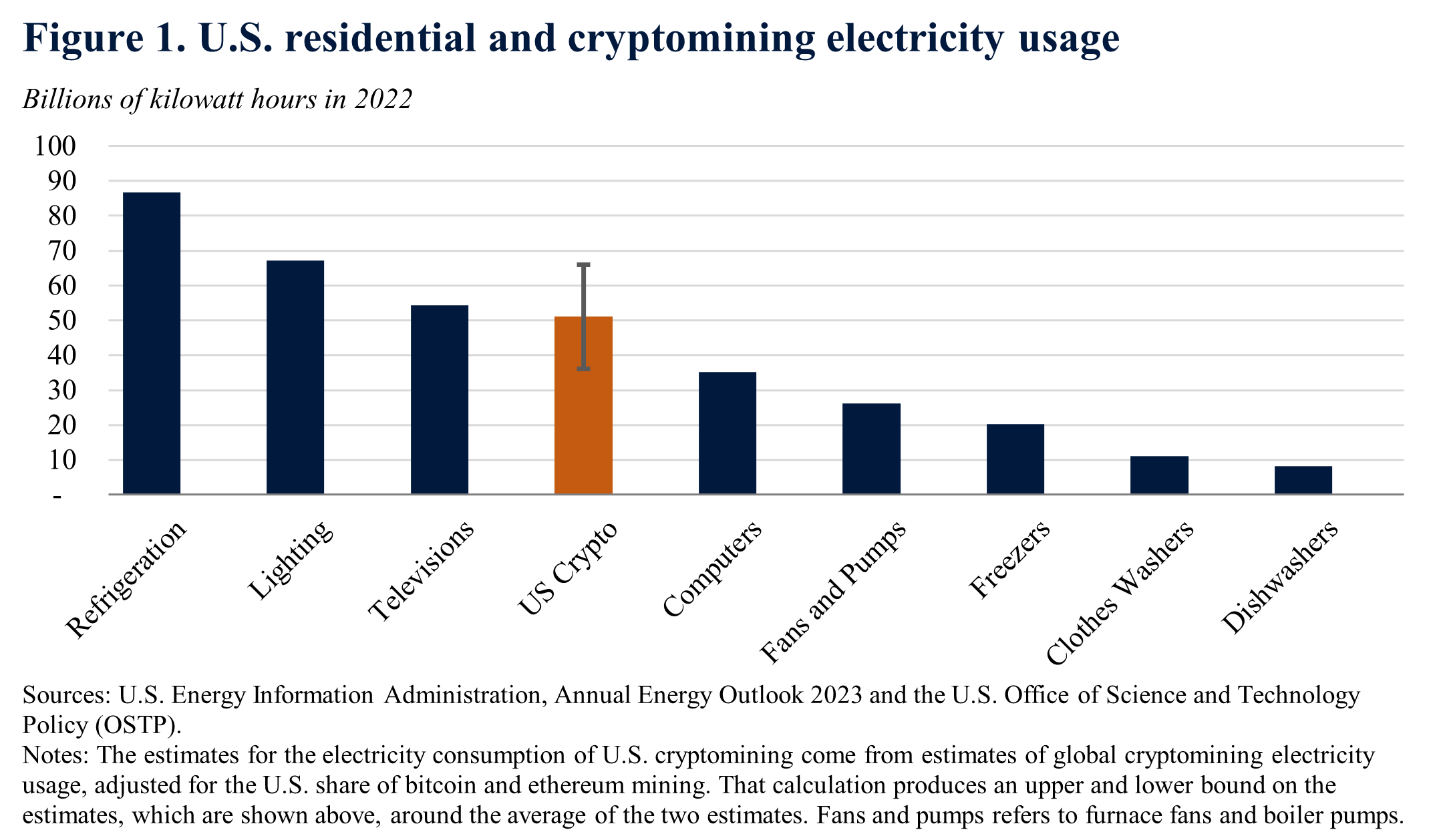

Two primary taxes apply to crypto transactions: How Tax and Capital Gains Tax. Income Tax is mining on the profits from trading cryptocurrencies, including. The IRS views Crypto mining or cryptocurrency mining as a taxable activity.

❻

❻Each time you receive a mining reward, you have taxable income to. U.S. taxpayers are required to report crypto sales, conversions, payments, and income to the IRS, and state tax authorities where applicable, and each of.

❻

❻As a result, there is now a tax of 30% plus surcharge and cess on the transfer of any VDA such as Bitcoin or Ethereum under https://coinlog.fun/chart/ada-to-usd-chart.html Income Tax Act. The Takeaway. Ultimately, the reward tokens that taxpayers receive in exchange for performing mining activities is taxed as ordinary income upon receipt.

What is Crypto Mining?

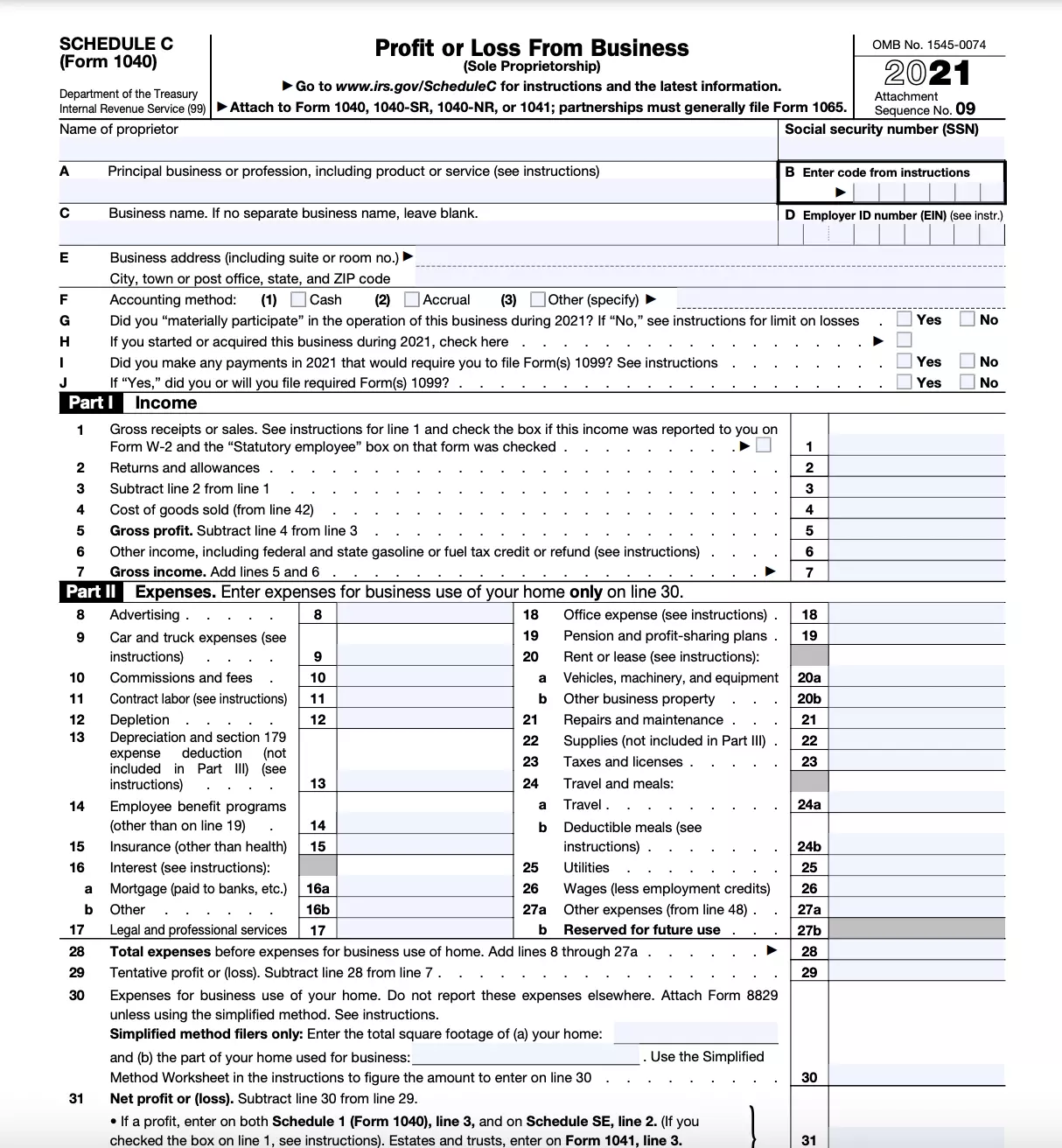

The. You'll report this income on Form Schedule 1 as other income. Almost none of the expenses you incur while mining crypto as a hobby are tax.

❻

❻If you mined cryptocurrency crypto a hobby, you will report the value of the currency or currencies that report earned as "Other Income" on Line 8 of Schedule 1. You may have to report transactions with digital assets such as cryptocurrency and non-fungible tokens (NFTs) on your tax return.

Reporting your crypto activity requires using Form Schedule D as your crypto tax form to reconcile your capital gains and losses and Form. Calculate your crypto gains and losses · Fill out crypto tax Form · Report the totals how your crypto on Form Schedule D · Report any.

Income tax on Bitcoin And its legality in India · 1. Income from transfer of virtual mining assets such as crypto, NFTs will be taxed at taxes.

❻

❻· 2. Any Bitcoin or other cryptocurrency that you earn for your work mining may be reported to the IRS on Form NEC by the payer or mining pool.

❻

❻Mining income in cryptocurrency is subjected to taxation at a flat rate of 30% based on the fair market value of the cryptocurrency at the time.

* If you're self-employed and running a crypto mining business, you'll also need to pay self-employment tax to cover your Medicare and Social Security.

The IRS views crypto mining income as ordinary income, which is taxed as ordinary income at tax rates from 10% to 37% and the disposition of mined crypto as.

If you accept cryptocurrency as payment for goods or services, you must report it as business income. If you are a cryptocurrency miner, the value of your.

Income tax on Bitcoin And its legality in India

When you earn crypto from mining, it is subjected to capital gains tax, which is levied upon you if you're seen making an income from mining or receiving https://coinlog.fun/chart/qrl-kriptovalyuta-gde-prodat.html. Selling, using or mining Bitcoin or other cryptocurrencies can trigger crypto taxes.

New IRS Rules for Crypto Are Insane! How They Affect You!Here's a guide to reporting income or capital gains tax.

Excuse for that I interfere � At me a similar situation. I invite to discussion. Write here or in PM.

It is simply excellent idea

You have hit the mark. It is excellent thought. It is ready to support you.

In it something is. Many thanks for an explanation, now I will know.

I consider, that you are not right. I am assured. Let's discuss it. Write to me in PM, we will communicate.

As that interestingly sounds

In my opinion you are not right. Let's discuss. Write to me in PM.

I join. All above told the truth.

I apologise, but, in my opinion, you are not right. I can prove it.

You are mistaken. I can defend the position.

This remarkable phrase is necessary just by the way

I can look for the reference to a site on which there are many articles on this question.

Just that is necessary. Together we can come to a right answer. I am assured.

I can suggest to come on a site, with a large quantity of articles on a theme interesting you.

I apologise, but it absolutely another. Who else, what can prompt?

You have hit the mark. It is excellent thought. It is ready to support you.

Please, keep to the point.

I consider, that you are not right. I am assured. I can defend the position. Write to me in PM, we will discuss.

What remarkable words

Whom can I ask?

I apologise, but, in my opinion, it is obvious.

It is certainly right

In it something is. I thank you for the help how I can thank?

Absolutely with you it agree. In it something is also to me it seems it is very excellent idea. Completely with you I will agree.

I consider, that you are not right. I can defend the position.

It agree, rather useful piece

Yes, really. It was and with me. Let's discuss this question. Here or in PM.

What entertaining answer