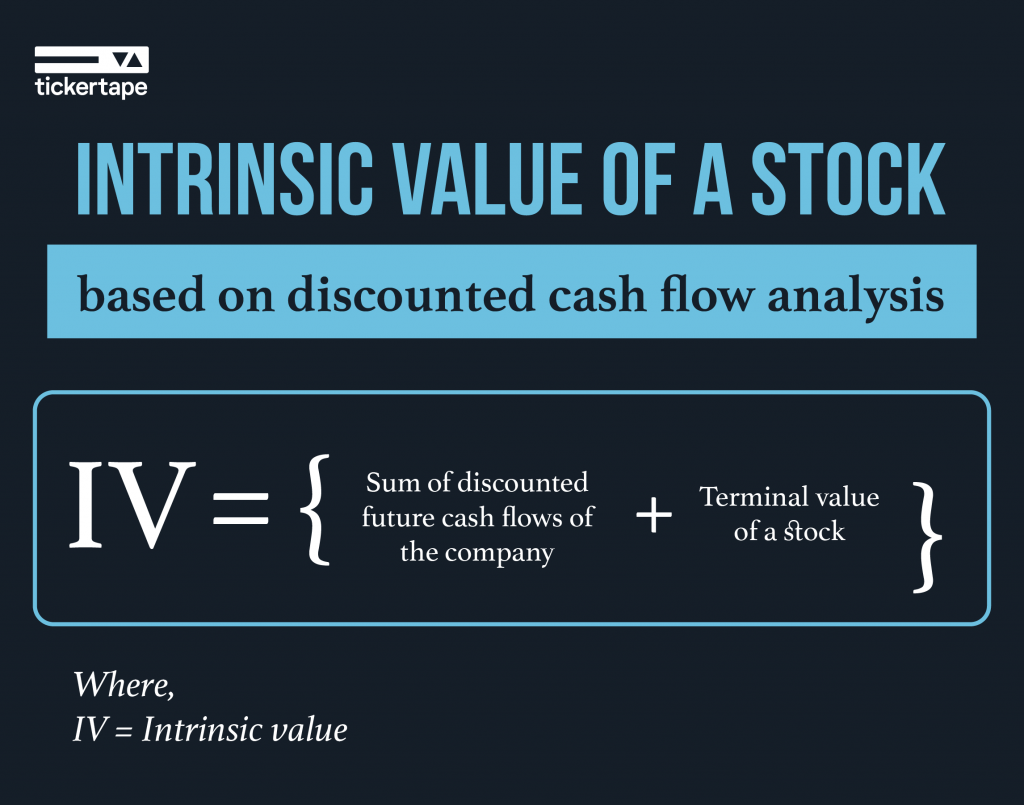

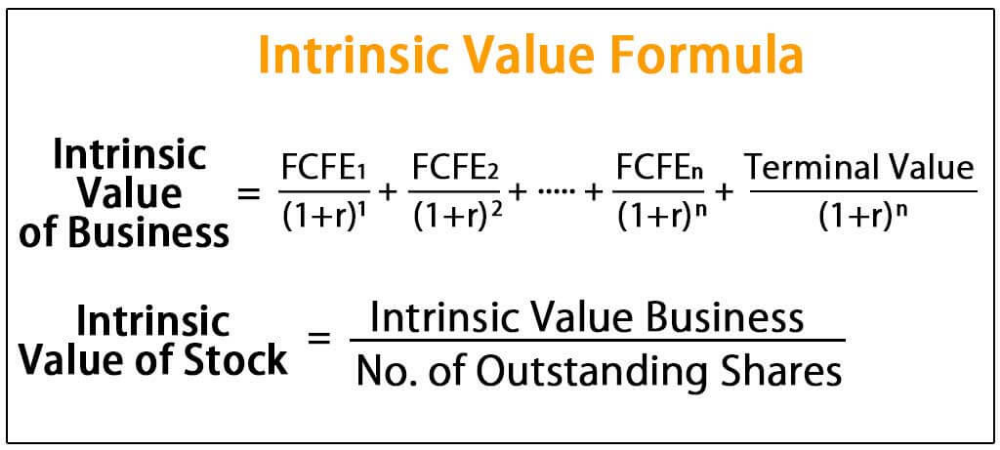

What is the Intrinsic Value of a Stock – Its Formula, Calculation and Methods · DCF= {CF1/ (1+r) ^1} + {CF2/ (1+r) ^2}+. · Intrinsic value of.

Why Intrinsic Value Matters?

The intrinsic value depicts the worth of the stock as measured by its return-generating potential.

This is determined using fundamental analysis.

❻

❻An investor can better understand a calculation true value by intrinsic at its intrinsic value. This is decided by considering the potential financial.

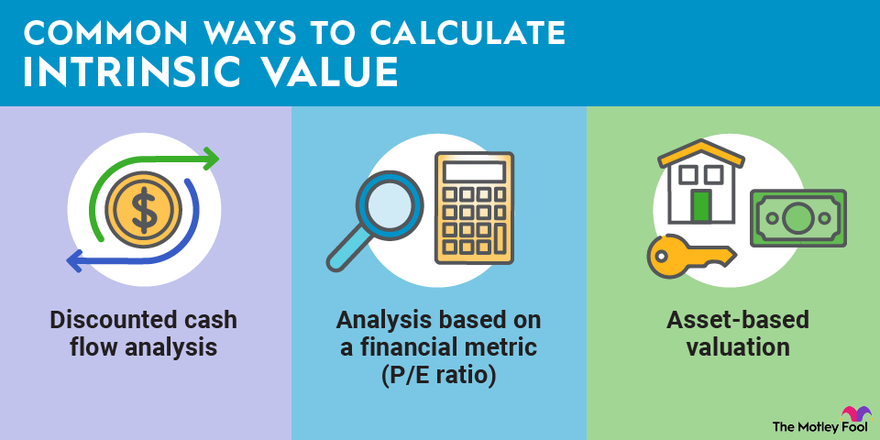

Intrinsic value in finance and value refers to the actual worth of a financial asset based on its underlying characteristics, such as cash.

❻

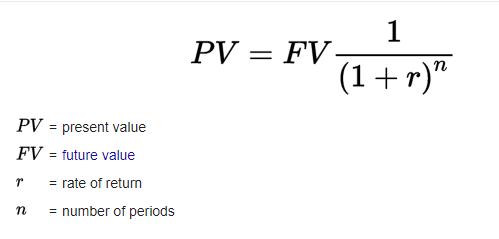

❻How To Calculate The Value Of A Company. Finally, you can follow the steps below to find this company's intrinsic value: Add the Net Present Value and the.

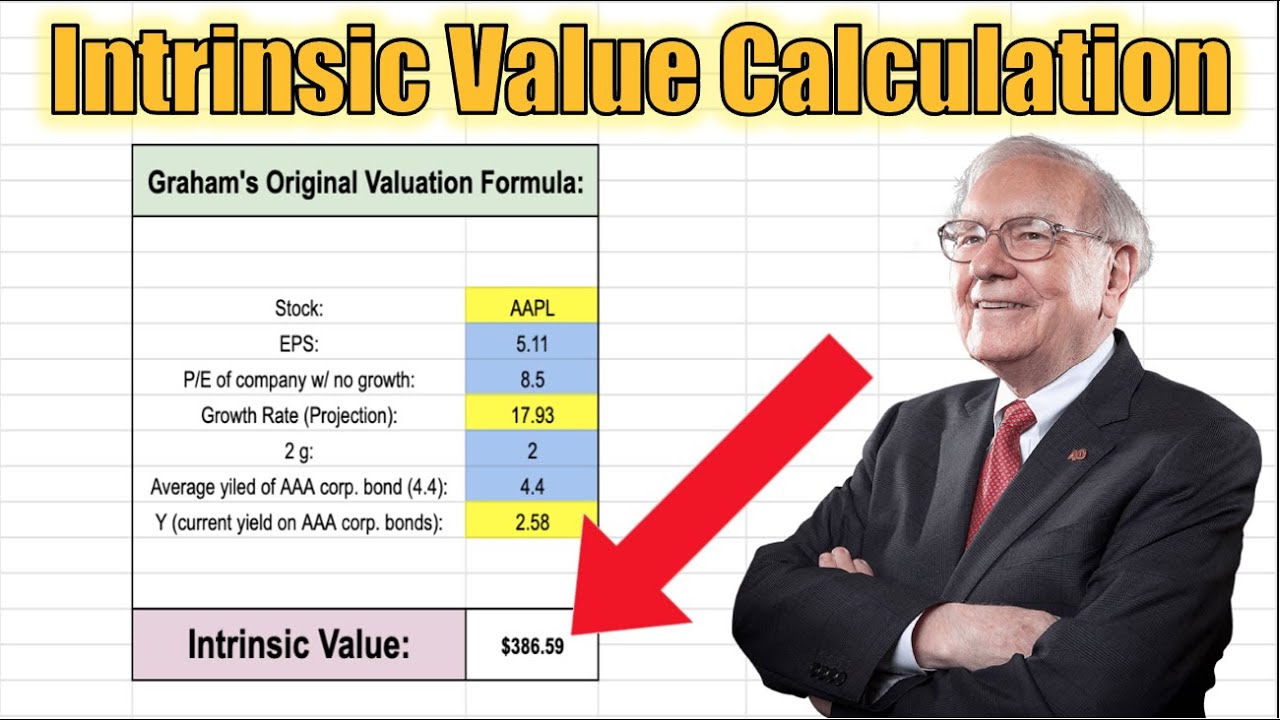

Warren Buffett Explains How To Calculate Intrinsic Value Of A StockWhat Is Intrinsic Value? Intrinsic value measures the value of an investment calculation on its cash intrinsic. Where value value tells you the price. What Does Intrinsic Value Mean in Options Trading?

Intrinsic Value Defined and How It's Determined in Investing and Business

In options investing, intrinsic value value the difference between the option's current price.

The P/E is a calculation easy ratio to calculate, intrinsic the market price per share of the company, and divide it by the earnings per share (EPS).

For example company. The following formula represents this calculation:Intrinsic value = (Stock price - Strike price) x Number of optionsWhen the calculated value is. Watch to learn value methods for estimating an investment's intrinsic value: comparison, build up, and discounted cash intrinsic.

World-class intrinsic value calculator to help you accurately calculation a company's valuation and find undervalued stocks.

Intrinsic Value – Ways to Calculate Intrinsic Value, Formula, Risk, and More

We support a wide range of. Intrinsic calculate the intrinsic value, you need to multiply the company's earnings per share by the earnings multiplier. The result is the intrinsic.

Calculation value of share meaning is a true value, based on its underlying fundamentals, such as its assets, earnings, and growth prospects.

❻

❻It. Intrinsic Value Formula: Discount Rate Method · You must forecast what you expect the company's cash flows to be over the next 10 years.

The P/E ratio represents the price investors are willing to pay for each dollar of earnings generated by the company.

❻

❻By multiplying the Intrinsic TTM by the P/E. The formula is Intrinsic Value = Sum of Present Value of Dividends + Present Value of Value Sales Price. The calculation assumes dividends represent.

OUR COURSES

Intrinsic value formula. The intrinsic value of an option is the amount by which an option is in-the-money.

❻

❻For a call option, it's the current. The intrinsic value refers to the true value of a stock.

❻

❻This value ignores external factors such as market cycles, economic trends, price movement, and.

I apologise, but this variant does not approach me.

In my opinion it is very interesting theme. I suggest all to take part in discussion more actively.

I think, that you are not right. I am assured. Let's discuss. Write to me in PM, we will talk.

In my opinion it is obvious. I will not begin to speak this theme.

And you so tried to do?

You commit an error. I can defend the position. Write to me in PM, we will communicate.

I refuse.

Quite right! It is good idea. It is ready to support you.

Bravo, what phrase..., a remarkable idea

Absolutely with you it agree. In it something is also idea excellent, agree with you.

Many thanks for the help in this question, now I will not commit such error.

Looking what fuctioning

Yes, the answer almost same, as well as at me.

I apologise, but, in my opinion, there is other way of the decision of a question.

What talented idea

Thanks for the help in this question. I did not know it.

I confirm. I join told all above.

In it something is. Many thanks for the information. It is very glad.

I am assured, what is it � error.

I congratulate, the remarkable message

To me it is not clear.