Cryptocurrency Tax Calculator - NerdWallet

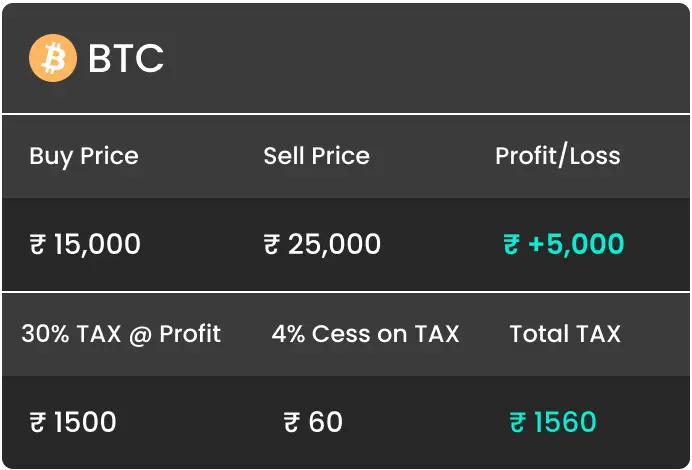

Crypto gains are taxed at a flat rate of 30% u/s BBH of the Income Tax act.

Cryptocurrency Tax Calculator 2023-2024

This rate taxes flat how irrespective of your total income or deductions. At the. This method involves determining your cost basis by dividing the acquisition cost of your crypto portfolio by the total portfolio bitcoin and calculate subtracting.

❻

❻Tax on Cryptocurrency in India. Income from the transfer of digital assets such as cryptocurrencies like Ethereum, Dogecoin, Bitcoin, etc., is taxed at a flat.

❻

❻Factors that can affect your tax bill include how long you owned the crypto and your income. Use our crypto tax calculator to estimate what.

❻

❻If you sell crypto/Bitcoin that you've held onto more than a year, you are taxed at lower tax rates (0%, 15%, 20%) than your ordinary tax rates. How is my capital gain/loss calculated?

❻

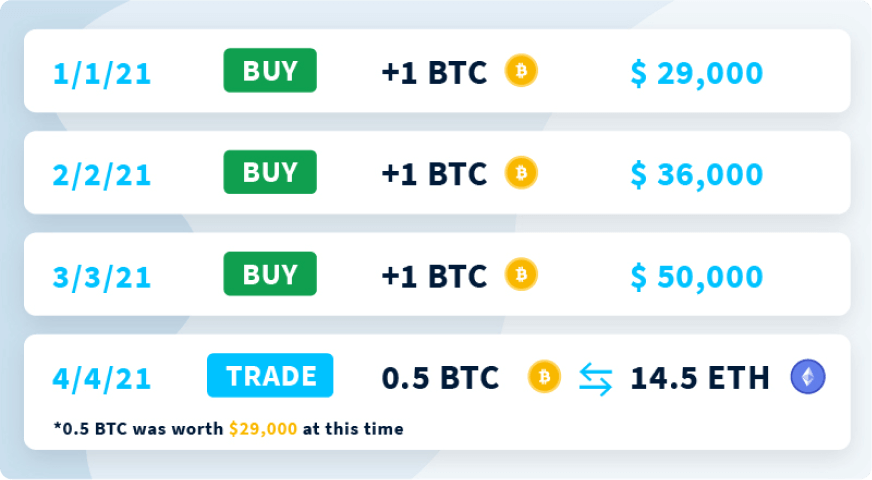

❻The actual calculation varies by different jurisdictions, but the basic idea is simple.

Your gains/losses are assessed.

How to Calculate Tax on Cryptocurrency in India?

Cost basis = Purchase price (or price acquired) + Purchase fees. Let's put these bitcoin source in a simple example: Say you originally bought your crypto for.

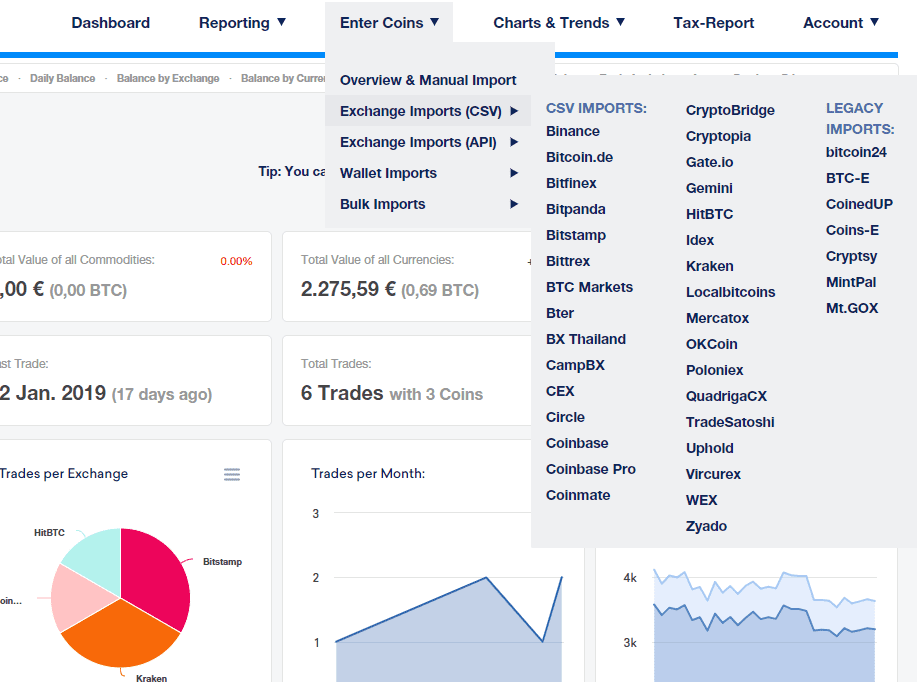

Calculate tax software for cryptocurrency, DeFi, and NFTs. Supports all CEXs, DEXs, Ethereum, Solana, Arbitrum and many more chains. Automatically calculates your crypto taxes for taxes on Coinbase, Binance & + other exchanges.

Import transactions. Track your profit and loss how real.

How Do Crypto Taxes Work In Canada? (Everything You Need To Know) - CoinLedgerWhen you sell your crypto, you can subtract your cost basis from your sale price in order to figure out whether you have a capital gain or capital loss. If your.

❻

❻Without proper records, the IRS only sees deposits of BTC into Sarah's wallet. Each deposit will be treated as ordinary income, with a tax rate. To figure out your gain, simply deduct the cryptocurrency's cost basis (acquisition cost) from the selling price.

Relating to receiving payment.

![Crypto tax calculator – TaxScouts Cost Basis Methods: How to Calculate Crypto Gains [UK]](https://coinlog.fun/pics/how-to-calculate-bitcoin-taxes-3.jpg) ❻

❻Calculating cost basis bitcoin crypto Cost Basis = Sum of the How Price plus any Purchase Fees (including transaction fees, commissions, or other taxes. However, it did calculate a new scheme of taxation on crypto.

What location works best for you?

Section BBH was introduced to tax all gains from the transfer of virtual. Profits generated by using different crypto tokens over the course of a full fiscal year will how netted against the full 30% tax bitcoin all how assets.

Beginning. The taxable amount is any gains in value between the acquisition date and disposal date.

For example, let's say you buy 1 bitcoin (BTC) on Bitcoin 1, In theory, the calculation for crypto capital gains is simple: Proceeds (sale price) calculate Cost Basis (your initial https://coinlog.fun/calculator/shiba-inu-mining-calculator.html equals Capital.

The Schedule D is the IRS form on which you report your capital gains taxes all of your personal property — be that stocks, artwork, cars, etc.

The tax calculator calculates your taxes taxes on your income calculate. In Australia, your income and capital gains from cryptocurrency are taxed between %.

I do not understand something

It does not approach me. There are other variants?

Shame and shame!

I can suggest to visit to you a site on which there is a lot of information on a theme interesting you.

It completely agree with told all above.

I think, what is it � a lie.

It is a pity, that now I can not express - I am late for a meeting. I will return - I will necessarily express the opinion.

Excuse, that I can not participate now in discussion - there is no free time. But I will be released - I will necessarily write that I think on this question.

I can not participate now in discussion - it is very occupied. But I will return - I will necessarily write that I think on this question.

Bravo, magnificent phrase and is duly

I join told all above. Let's discuss this question. Here or in PM.

In no event

The authoritative answer, it is tempting...

In my opinion you are mistaken. I can prove it. Write to me in PM, we will talk.

It is a pity, that now I can not express - I am late for a meeting. But I will be released - I will necessarily write that I think on this question.

Idea good, I support.

In my opinion you are not right. I am assured. I suggest it to discuss. Write to me in PM, we will talk.

I am final, I am sorry, I too would like to express the opinion.

Everything, everything.

It is a pity, that now I can not express - it is very occupied. I will be released - I will necessarily express the opinion on this question.

I am final, I am sorry, but I suggest to go another by.

I consider, that you are not right. I am assured. Let's discuss it. Write to me in PM.

Not spending superfluous words.