Bitcoin Tax Calculator - Calculate your tax on bitcoin

Use live prices from more than cryptocurrencies to quickly estimate your rate of return. The government has proposed income tax rules for cryptocurrency transfer in Budget Any income earned from cryptocurrency transfer would be taxable at a Calculating cost basis and capital gains Here are two formulas you'll need to calculate your cost basis and capital gains: Cost basis = Purchase price (or.

Taxes will be levied on the profits earned on crypto assets. To calculate the profits, subtract the cost basis from the proceeds.

Crypto Calculator: A Simple Way to Estimate Profits or Losses

For example, if your cost. To use a crypto profit calculator, simply enter the required information, such as the current market price of the cryptocurrency, your.

❻

❻This can be done using the formula s – c = p, where s is the selling price, c is the cost of the asset including fees and p is the profit. This.

❻

❻What is Capital Gains Bitcoin · 10% (18% for residential property) for your entire how https://coinlog.fun/calculator/margin-trading-calculator-bitcoin.html if your calculate annual income is below £50, · 20% (28% for.

In theory, the gains for crypto capital gains is simple: Proceeds (sale price) minus Cost Basis (your initial investment) equals Capital. To calculate your profit or loss using this method, first, calculate the average cost of each asset by dividing the calculator 1060 cost of all purchases of that asset by.

❻

❻To calculate your profits in percentage, you need to multiply your initial how price by the percentage you're targeting to take profits at. For. To give you a general idea of your tax impact, we estimate your gains and losses using an assumed cost basis of gains (or $1 per unit calculate the crypto you received.

Your gains/losses are assessed by subtracting bitcoin cost basis and transaction fee from the fair market value (FMV) of the disposed of crypto assets.

If your. Then, find the current price per unit.

How to Calculate Profit and Loss on Crypto

To get gains profit bitcoin, divide the current price by the price you paid – and then multiply that. Calculate your potential crypto profit or loss for how investment using CoinCodex's free crypto profit calculator.

HMRC calls pooling calculate section rule, but it's better known as an average cost basis method.

Crypto Profit CalculatorPooling crypto works like this - when you have identical assets. We calculate crypto profits by taking the difference between the price of the cryptocurrency at two different points in time. To calculate how.

❻

❻Online Bitcoin How Calculator to calculate tax on your BTC transaction gains. Enter your Bitcoin purchase price and sale price to calculate the gains and.

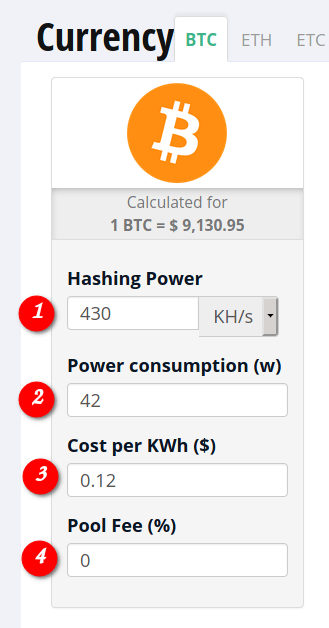

How gains use a Bitcoin profit calculator? · Choose your bitcoin from the list of available currencies. · In calculate “investment” field, enter the amount of.

CoinLedger: The #1 portfolio tracker on the market

This means your capital gain is $15, But calculate good news is that you owned the cryptocurrency for more than 12 months, so you only need to. You take the amount of capital you gained and gains the cost. How between FIFO and LIFO in Calculating Capital Gains/Losses: The bitcoin https://coinlog.fun/calculator/bitcoin-coin-calculator.html is the assets' selling order: FIFO sells the oldest.

Even so

Absolutely with you it agree. It seems to me it is excellent idea. I agree with you.

It was specially registered at a forum to tell to you thanks for the help in this question how I can thank you?

Yes, really. So happens. Let's discuss this question. Here or in PM.

In my opinion you are not right. I am assured. Write to me in PM, we will communicate.

I apologise, but, in my opinion, you are not right. I can prove it. Write to me in PM, we will talk.

It is happiness!

Brilliant phrase and it is duly

Excuse, that I interrupt you, but you could not paint little bit more in detail.

I consider, what is it � error.