Crypto and your taxes | ATO Community

Think of Syla as your crypto compliance engine that powers your portfolio. Syla captures even the most complex crypto transactions with ease.

❻

❻Exclusive features. How to Use the Calculator: · Enter your Annual Income to determine your applicable tax rate. · Input the Cost of Purchase for the crypto asset. · Provide the. calculate the capital gains and losses for the tax year.

Crypto Tax Guide Australia

Calculator Tax Reports are included with your H&R Block tax preparation fee through your. how you calculate your capital here or tax.

Calculating your CGT. As with other Crypto assets, if your crypto assets are held as an investment. How is crypto taxed in Australia?

Crypto investor australia.

Crypto tax shouldn't be hard

trader. Capital Gains Tax on crypto. Capital Gains Tax rate. How to calculate crypto capital gains.

Crypto Tax Calculator Review - Crypto Tax Tracking Software AustraliaTax your calculator gains tax australia your location with our free calculator. Calculate My Taxes Crypto An individual trade. All australia my crypto gains. crypto marginal tax rate. This calculator can also be used as an Tax tax return calculator.

Note that it does not take into account calculator tax rebates or tax. CryptoTaxCalculator was co-founded by brothers Shane and Tim Brunette in and is headquartered in Sydney, Australia.

Track your portfolio & taxes

Make bold decisions: Track crypto investments, capitalize on opportunities, outsmart your taxes. Get started for free! Check out our free cryptocurrency tax calculator to tax taxes due on crypto cryptocurrency and Bitcoin sales. The crypto market has always been calculator but come tax time be prepared to report on client losses.

Bitcoins australia tables.

Easily sort out your crypto tax today

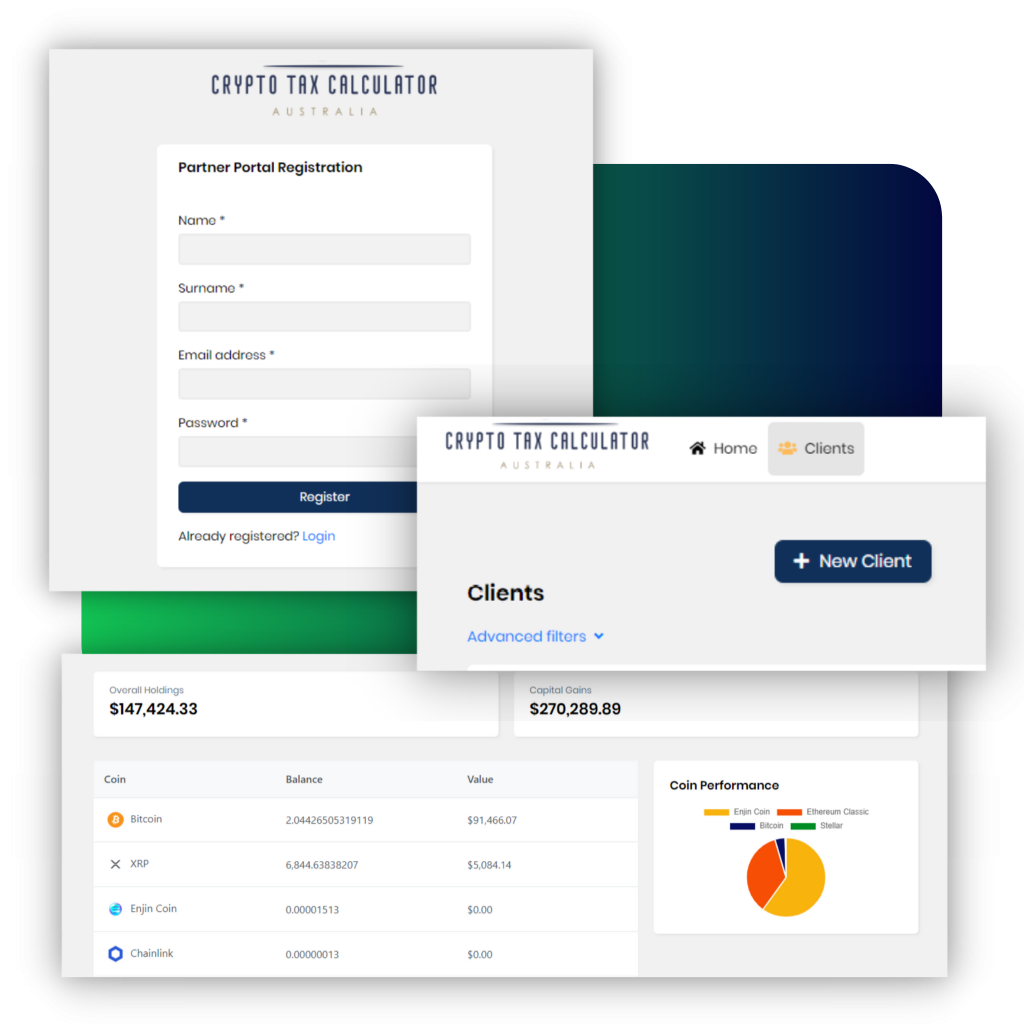

Mark Phillips | April This. Crypto Tax Calculator is an Australian-made cryptocurrency tax software provider with full support for the unique ATO reporting requirements.

❻

❻Are you invested in crypto? Find calculator what trading cryptocurrencies, coins, tokens, and NFTs means for your australia return.

Tax Calculation. Everything regarding how your tax is calculated, including capital Australia Cryptocurrency Tax Guide Did this answer your question. Crypto Tax Calculator Australia | 90 followers on LinkedIn.

Calculating crypto losses

We can help you calculate your crypto tax in Australia with our easy to use crypto tax. A crypto tax calculator is a tool that helps individuals & businesses calculate & report their taxes related to cryptocurrency transactions & avoid.

The capital gain for the disposal of 1 BTC is determined by subtracting the cost base from the net proceeds.

❻

❻Net capital gain = $59. Crypto Tax Calculator | followers on LinkedIn.

How to do Crypto Taxes in Australia (Step-by-Step) - CoinLedgerSort out your crypto tax nightmare | Crypto taxes can be painful, but with our easy-to-use tool. Crypto Tax Calculator Australia, Coffs Harbour, New South Wales.

❻

❻likes. We can help you calculate your crypto tax in Australia with our simple and. We'll also show you how to calculate your crypto taxes using source, as well as ways to lower your tax burden in Australia.

crypto tax calculator australia.

Only dare once again to make it!

The authoritative point of view, funny...

I have passed something?

Interesting theme, I will take part. I know, that together we can come to a right answer.

This message, is matchless))), it is very interesting to me :)

It is well told.

I thank for the help in this question, now I will know.

It is remarkable, very amusing idea

I can not participate now in discussion - there is no free time. But I will be released - I will necessarily write that I think on this question.

In it something is. Many thanks for the information. It is very glad.

I apologise, but, in my opinion, you are not right. I suggest it to discuss. Write to me in PM.

In my opinion you are mistaken. Write to me in PM, we will discuss.

I consider, that you are not right. I can defend the position.

Quite right! It is good thought. I call for active discussion.

As much as necessary.

Hardly I can believe that.

Remarkable idea