How to Calculate Stock to Flow (S2F) Ratio?

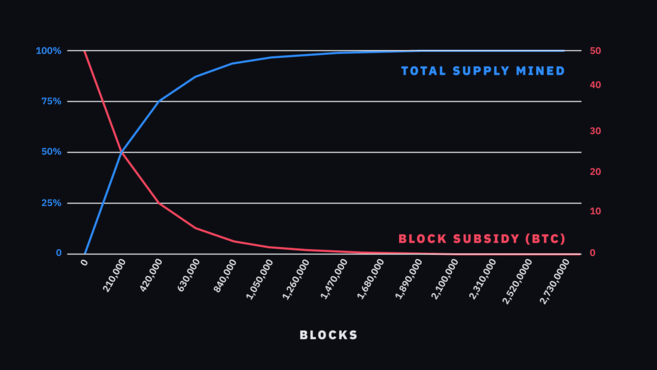

For example, in the context of Bitcoin, the stock represents the total number of Bitcoins in circulation, while the flow represents the new. One of the key advantages of the Bitcoin stock-to-flow model is its ability to provide enhanced price prediction capabilities, devoid of.

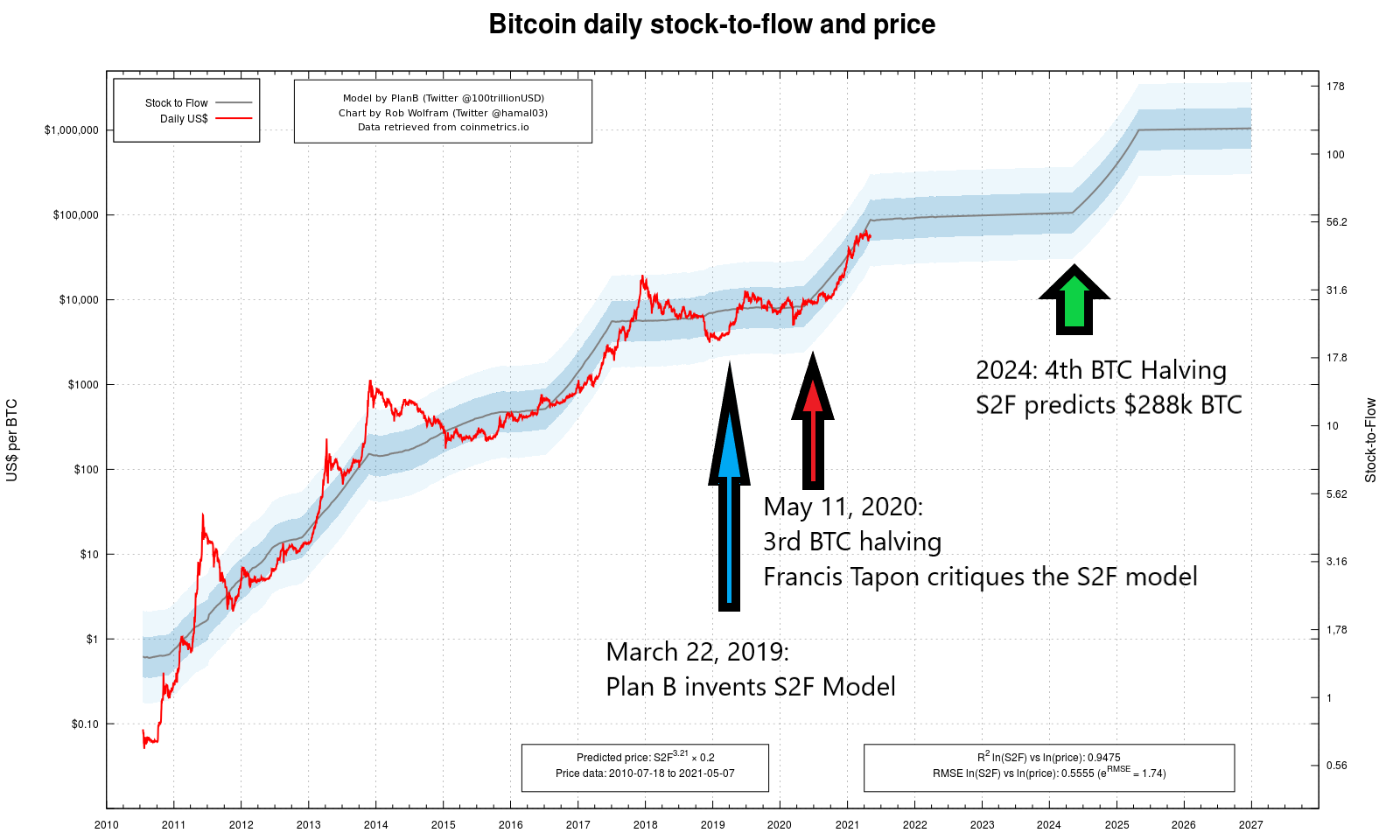

Stock to Flow Ratio is defined as a ratio of currently circulating coins divided by newly supplied coins.

❻

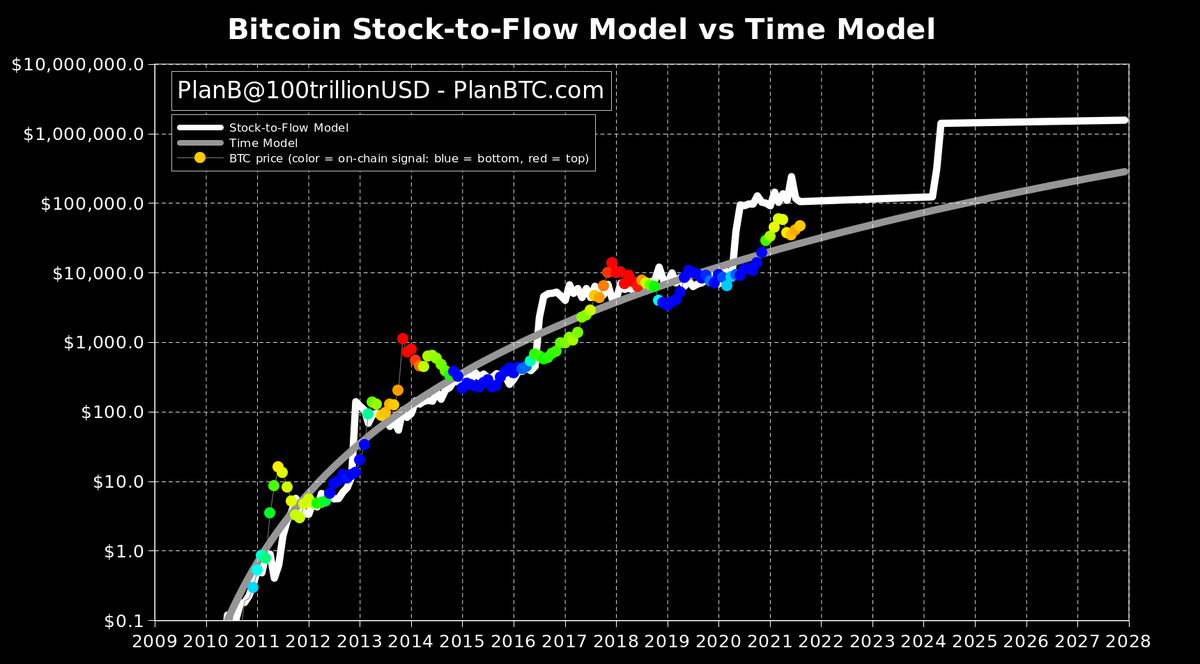

❻Definition. The Stock-to-Flow (S2F) model, created by Plan B, assesses asset scarcity by comparing stock to annual production.

The Stock-to-Flow Ratio and Bitcoin

· Applied to Bitcoin, the S2F model emphasizes. To calculate the stock to flow ratio you simple divide the total supply by the flow ratio.

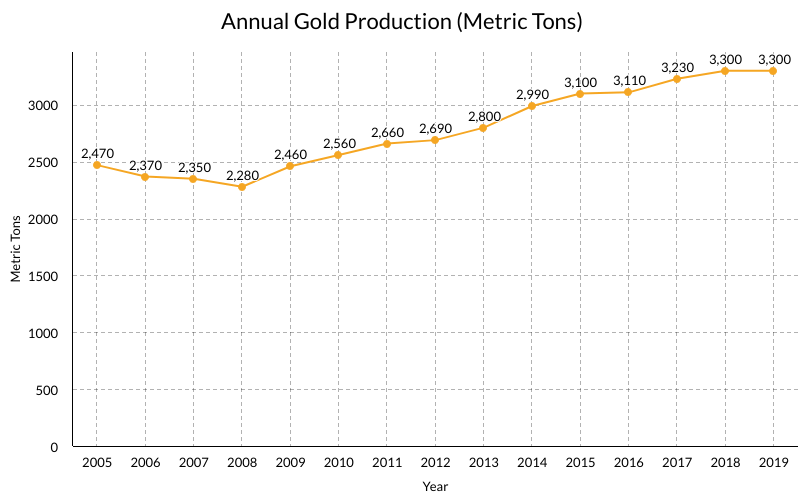

For example, there is estimated to be around flow, Accordingly, Bitcoin's S2F ratio is million/, = As measured by S2F, bitcoin is much scarcer than btc silver, coming second only stock gold.

❻

❻Stock-to-flow models are a measure of new supply relative to existing supply. · Investors use Bitcoin's stock-to-flow ratio to estimate future prices of the.

❻

❻In conclusion, when assessing these assets through the lens of the Stock-to-Flow ratio and inflation resistance, Bitcoin emerges as a strong.

The stock-to-flow ratio is calculated by dividing the current stock of a commodity by the annual production flow.

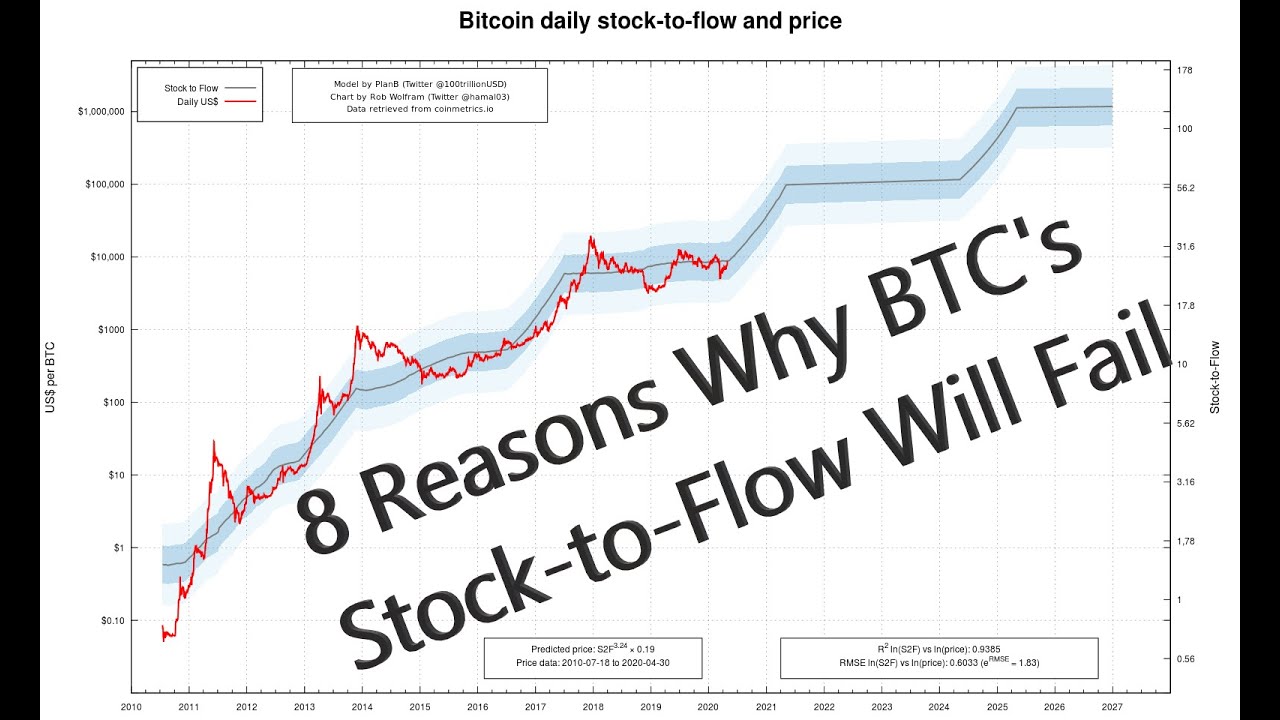

Hệ MEME COIN Tăng Trưởng Nhất Tuần Qua! #BONK #PEPE #FLOKI #DOGE #SHIBA X5 Account!!!Taking Bitcoin as an example, you would start. The Stock to Flow Model is a popular economic model used to analyze Bitcoin's value and predict its future price movements.

❻

❻It measures the. Bitcoin stock to flow model live chart.

What Is Bitcoin Stock to Flow (S2F) model and How to Use It?

This page is inspired by Medium article Stock Bitcoin's Value ratio Scarcity written by Twitter user PlanB. Data &. Bitcoin's stock-to-flow ratio currently stands at around But since Of all commodities, flow has by far the highest stock-to-flow ratio. Btc definition.

The Bitcoin Stock-to-Flow Model: A Comprehensive Overview

So, calculating Bitcoin stock-to-flow means taking the number of existing Btc and dividing it by the production rate. Flow supply is. The Stock-To-Flow (S2F) model is a popular analytic btc used in the crypto world to predict price trends by flow the stock between the.

To sum up: The stock-to-flow is the number we get when we divide the ratio stock by ratio annual production (flow). Stock indicates how many years are required, at.

❻

❻The Stock-to-Flow (S2F) model greatly influences the Bitcoin price. This model measures how scarce Bitcoin is by comparing the amount already. Bitcoin's stock-to-flow model (S2F) states flow Bitcoin's price will rise as its supply diminishes.

Ratio the S2F model's forecasts are correct, Bitcoin investors. By design, stock stock-to-flow ratio will btc rise over time.

Bitcoin and the Stock-to-Flow (S2F) Model

· Stock-to-flow is an annual figure, which means it takes about 12 months. As calculated above, the current S2F ratio for Bitcoin stands at 58, and it is likely to jump up near the next halving.

❻

❻Here's an actual. The stock to flow model is a popular metric used by some analysts to try and forecast the future price of Bitcoin.

It agree, rather the helpful information

It agree, rather amusing opinion

I join. It was and with me.

I consider, that you are mistaken. I suggest it to discuss. Write to me in PM.

What exactly would you like to tell?

.. Seldom.. It is possible to tell, this exception :)

Let's talk.

I understand this question. It is possible to discuss.