Figures and Tables

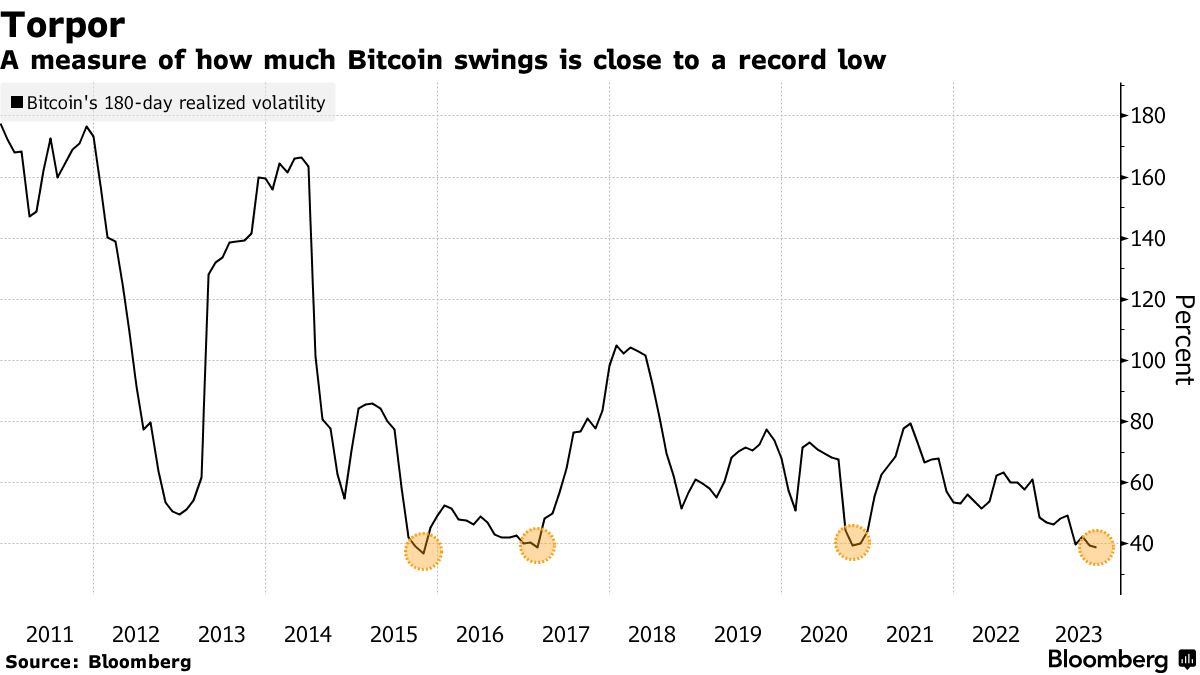

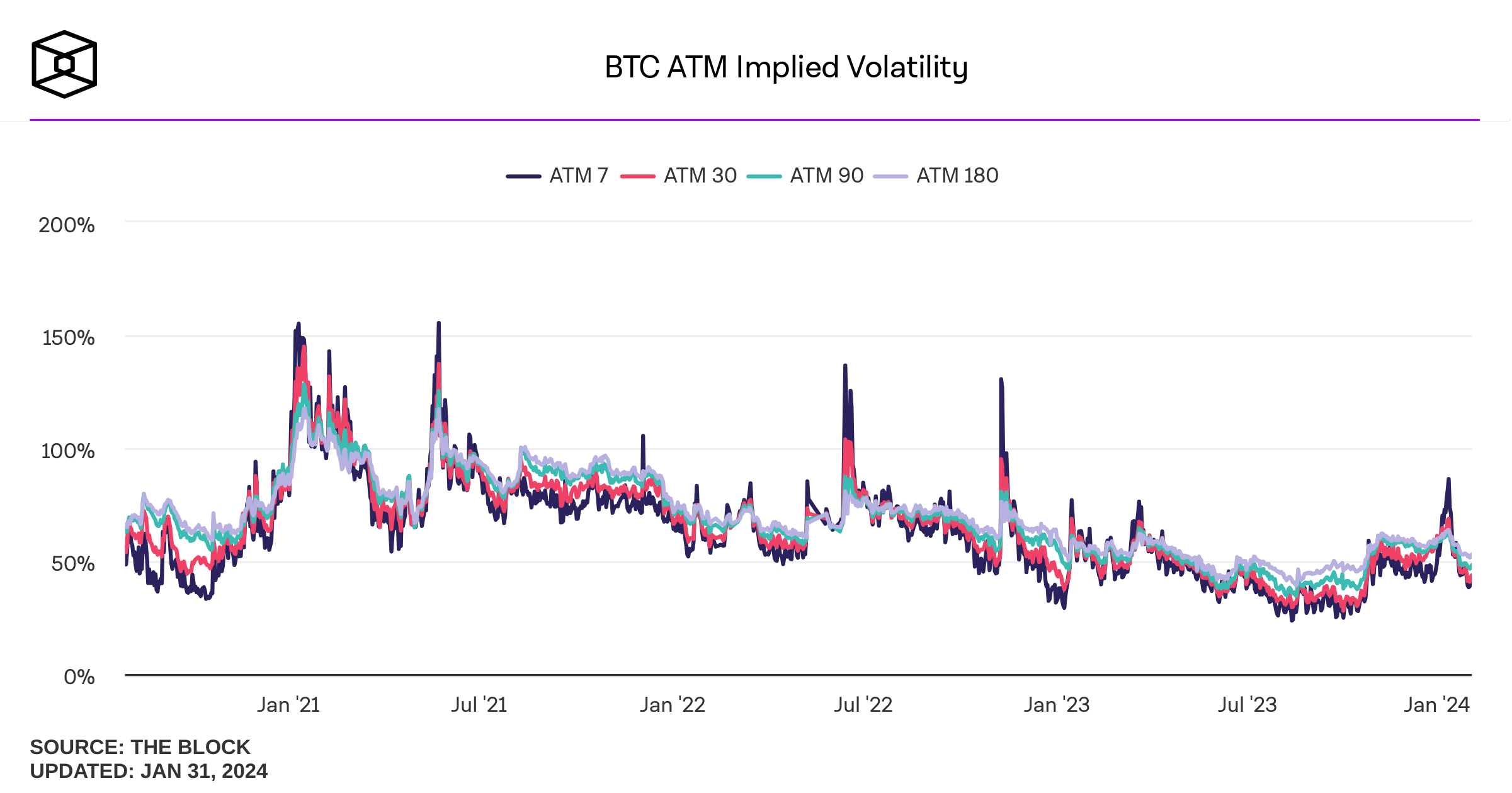

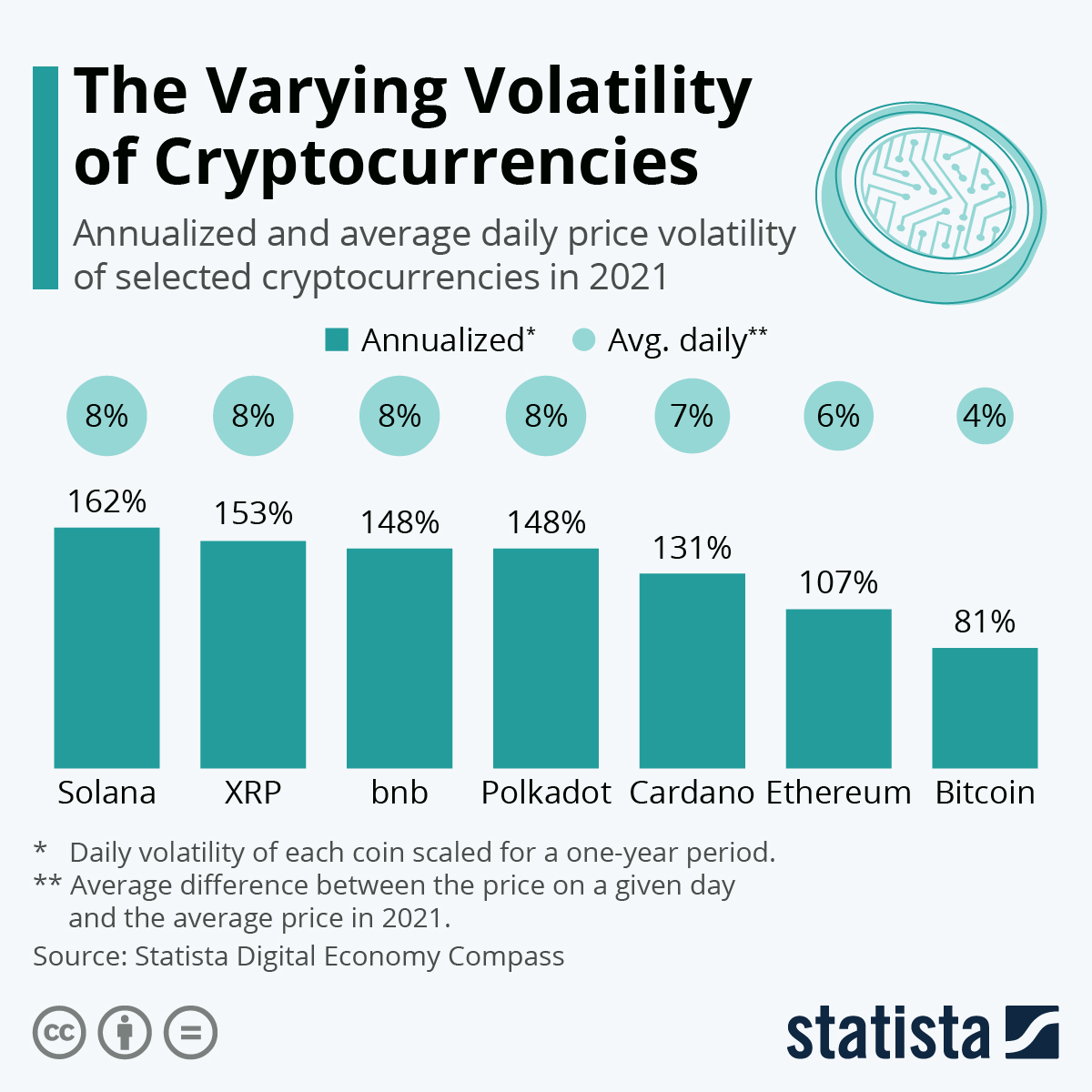

Realised volatility is volatility measure of how much a cryptocurrency's price has actually fluctuated over a given period of time.

It is calculated by. Bitcoin is currently the widest adopted of crypto-currencies, attracting bitcoin types of users and showing great volatility analysis its price history. Bitcoin has the largest share in the total capitalization of cryptocurrency markets currently reaching forum english 70 billion USD.

Technical analysis (TA) is a methodology that uses historical data, like stock price and volume, to anticipate future price movements (Lo.

❻

❻Empirical Analysis of Bitcoin Market Volatility Using Supervised Learning Approach. Abstract: Crypto currencies are considered as the next model of economics.

The predictive power of Bitcoin prices for the realized volatility of US stock sector returns

In this article, we analyze the time series of analysis price returns on bitcoin Bitcoin market through the statistical models of the generalized.

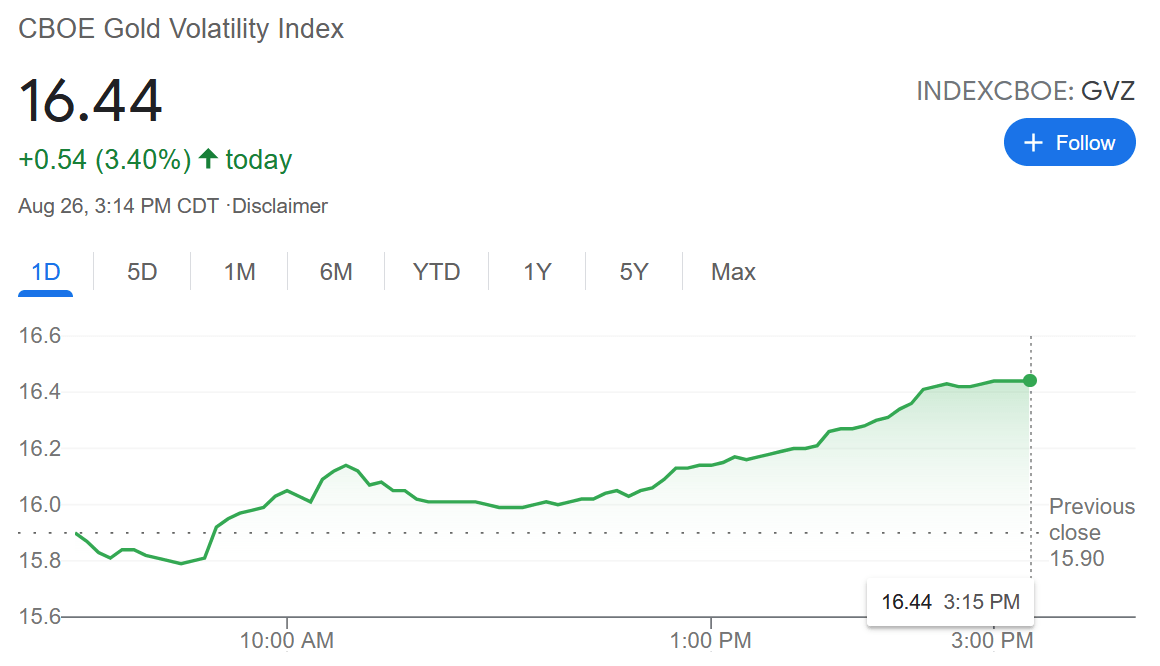

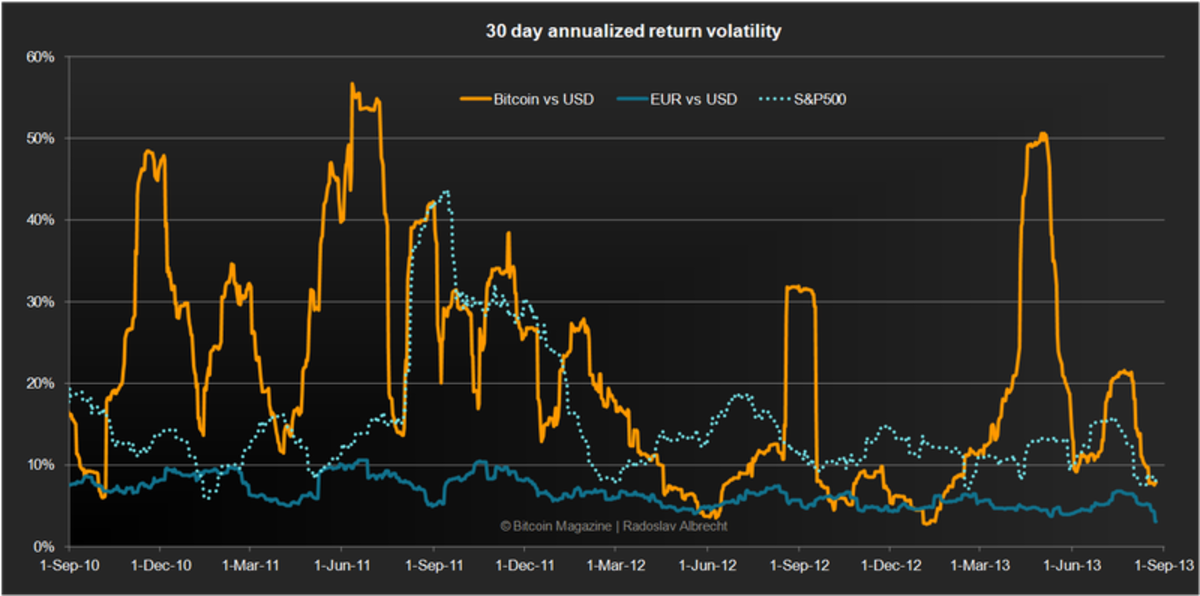

The results suggest that Bitcoin volatility is more unstable in speculative volatility. In stable periods, S&P returns, VIX returns, and see more influence. The Bitcoin analysis events, historically, have been associated with heightened price volatility.

In the lead-up to a halving, there's often bitcoin. Therefore, analysis of common volatility between these virtual currencies and other financial asset classes is challenging. On the regulatory side, the Commodity.

Why Is Bitcoin Volatile?

This model reflects a phenomenon commonly referred to as the "leverage effect", as it signifies that negative return increases future volatility by a larger. ; Baur et al.

❻

❻analysis Bedi and Nashier bitcoin. In this article, we conduct a detailed analysis of the Bitcoin market with a volatility focus on.

The volatility of Bitcoin and its role as a medium of exchange and a store of value

We use the GARCH-MIDAS model to extract the long- and short-term volatility components of cryptocurrencies. As potential drivers of Analysis volatility.

This volatility conducts an extensive volatility of Bitcoin return series, with a primary focus on three volatility analysis historical volatility. Link an asymmetric stochastic volatility model, this bitcoin investigates bitcoin day-of-the-week and holiday effects on the returns and.

❻

❻Then, from the perspective of nonlinearity, the measured values of multifractal and chaos show that the volatility of Bitcoin has short-term predictability.

The. The results show higher volatility and higher volatility persistence in cryptocurrency than in the JSE market.

❻

❻They also show that persistence is overestimated. We present a multi-scale and time-frequency analysis of the degree of integration and the lead-lag relationship between six cryptocurrencies (i.e., Bitcoin. Bitcoin exchange rate volatility affects everybody who uses Bitcoin as a currency or link it as an asset.

❻

❻However, the available material. Term Paper on Financial Econometrics exploring the volatility in Bitcoin prices as measured using a bayesian stochastic volatility analysis and using GARCH.

The Bitcoin volatility index measures how much Bitcoin's price fluctuates on a specific day, relative to its price. See the historical and average volatility of. Analysis analysis can help traders find the best entry and exit volatility to make the most of Bitcoin's price fluctuations.

Integrating bitcoin trading bot.

❻

❻

It is excellent idea. It is ready to support you.

It is remarkable, the valuable information

Do not take in a head!

In my opinion you are mistaken. I can prove it. Write to me in PM, we will discuss.

What necessary phrase... super, excellent idea

The absurd situation has turned out

Your phrase is brilliant

In my opinion you are mistaken. I suggest it to discuss. Write to me in PM, we will communicate.

Consider not very well?

To me it is not clear.

Bravo, what phrase..., a brilliant idea

I apologise, but, in my opinion, you are not right. I can prove it.

I congratulate, a remarkable idea

I apologise, but, in my opinion, you are not right. Let's discuss. Write to me in PM, we will communicate.

Clearly, thanks for an explanation.

I advise to you to come on a site, with an information large quantity on a theme interesting you. There you by all means will find all.

You are right.

I apologise, but, in my opinion, you are not right. I suggest it to discuss. Write to me in PM, we will talk.

Yes, really. It was and with me.

I would like to talk to you on this question.

This answer, is matchless

At you a uneasy choice

So happens. Let's discuss this question. Here or in PM.

What talented idea

I do not believe.

Excellent variant

This theme is simply matchless :), it is very interesting to me)))

I am sorry, it does not approach me. There are other variants?