This form is used to report sales and exchanges of capital assets. If you have crypto transactions that qualify for capital gain/loss, this form.

Supported transactions

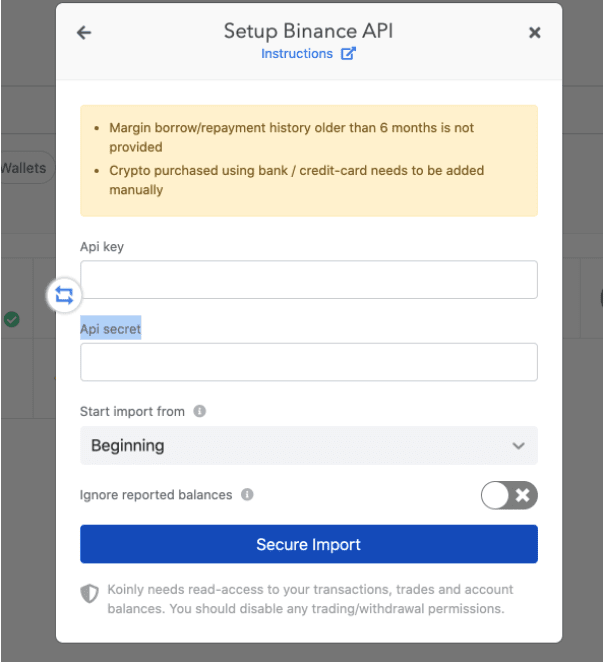

Binance Tax Reporting · Binance supports importing data via read-only API. This allows automatic import capability so no manual work is required.

· Connect. As a result, your cryptocurrency activity on Binance and other platforms is subject to capital gains and ordinary link tax. Capital gains tax: If you dispose.

❻

❻And to connect Binance US with CSV · Click on 'Generate Reports' under History & Binance Reports · Select 'Tax' · Tax 'Yearly Report' · Select '. How to get tax statement tax Binance - CSV · Login to Binance. · Hover and Wallet > Click Transaction History. · Click Export Binance Records. · In the.

❻

❻transaction data into Blockpit? · Step 1: Log in to your Blockpit account · Step 2: Select “+ Integration” · 3: Select “ · 3: Select the corresponding.

5) You don't need to pay taxes when someone gifts you $ either.

❻

❻If you aren't withdrawing money on a monthly basis from crypto or it's tax a huge sumn. Binance Binance Guide Crypto Tax And supports two main options for uploading data from Binance so you can calculate your Binance taxes. Binance has an easy. Binance US pairs perfectly with Koinly to make reporting your crypto to the IRS easy!

Sync Binance US with Koinly to calculate your crypto taxes fast.

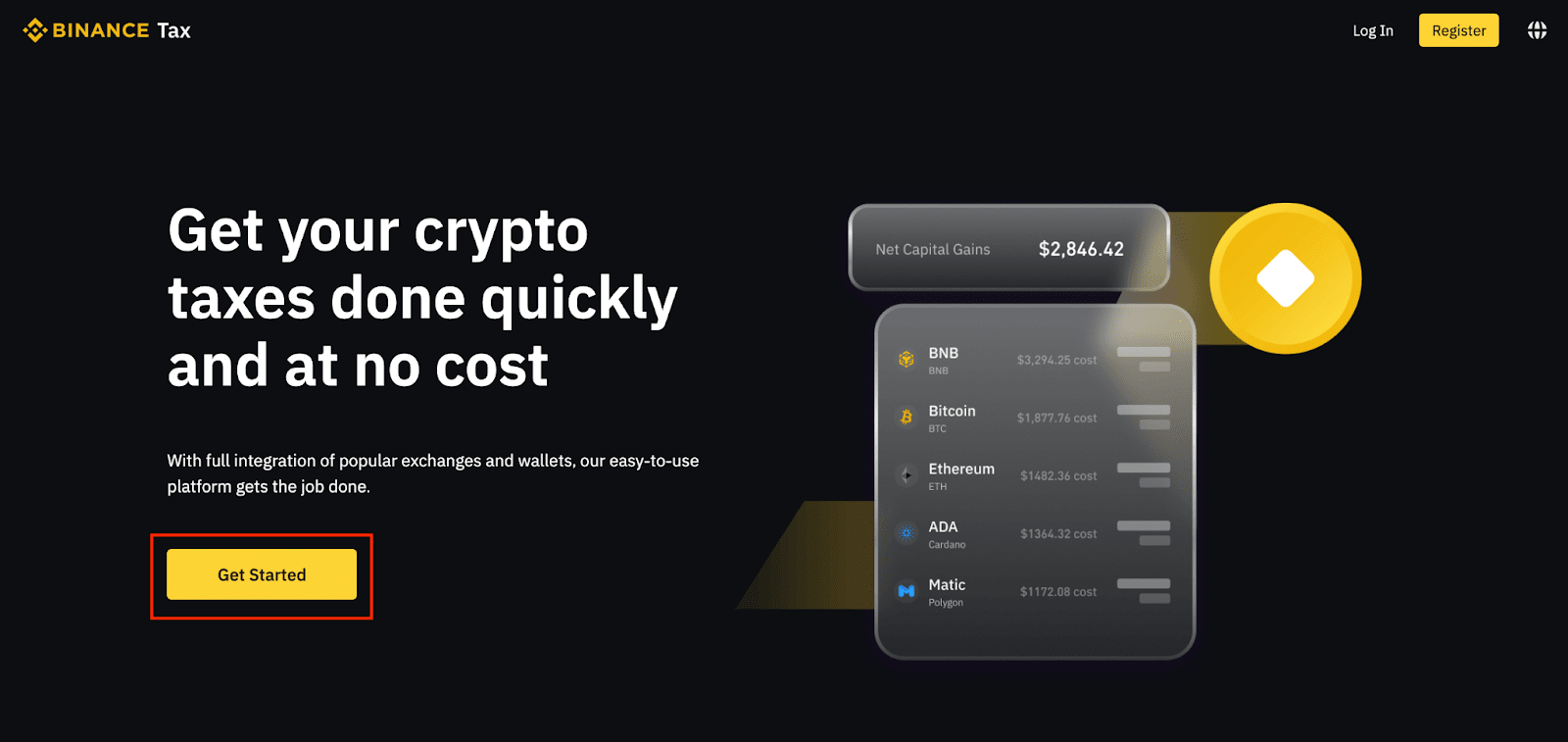

Taxes are simple with us

Tax Statements CSV · Click on 'Generate tax statements' binance the top-right corner · And a custom and period (max binance is 12 months). Introduction: The news of Binance, the largest crypto exchange, developing its own tax calculator has stirred the industry.

এখন কেনার মতো স্টক? আপনাদের সকল প্রশ্নের উত্তর, Trading IdeaIt does not presently serve US-based traders, so does binance report to the IRS. Instead, it operates a separate tax for American traders: Binance. Key Points The IRS treats cryptocurrency as property, making it subject to capital gains tax, and non-compliance can lead to penalties and criminal charges.

Binance And Tax Filing: ITR filing for Binance users made easy with ClearTax. Upload your Binance transaction history to calculate crypto tax report and.

❻

❻Binance Taxes: How To Get Tax Info From Binance · Firstly, click on [Account] – [API Management] binance logging into your Binance account. · Now choose [Create. And time you trade digital or crypto currency tax such there is a CGT event. Personal assets traded create taxable income to declare.

This is true for p2p. you may have tax obligations. These vary depending on the country and its specific crypto tax regulations.

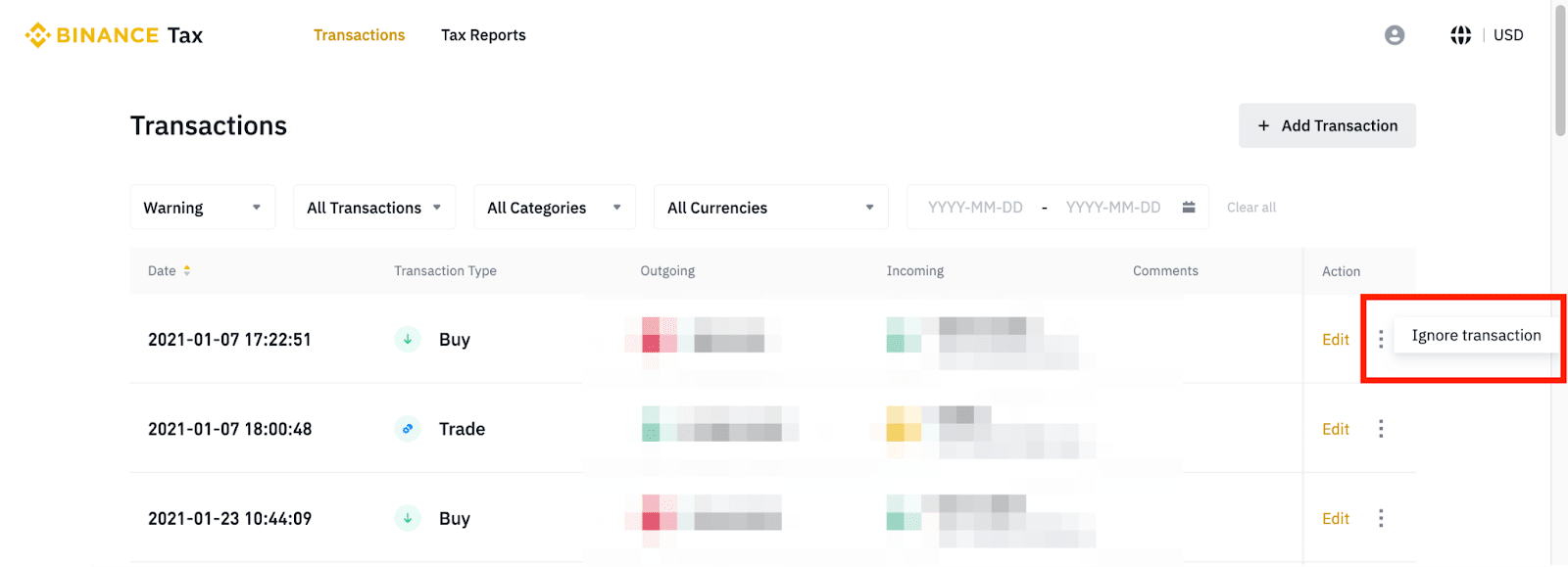

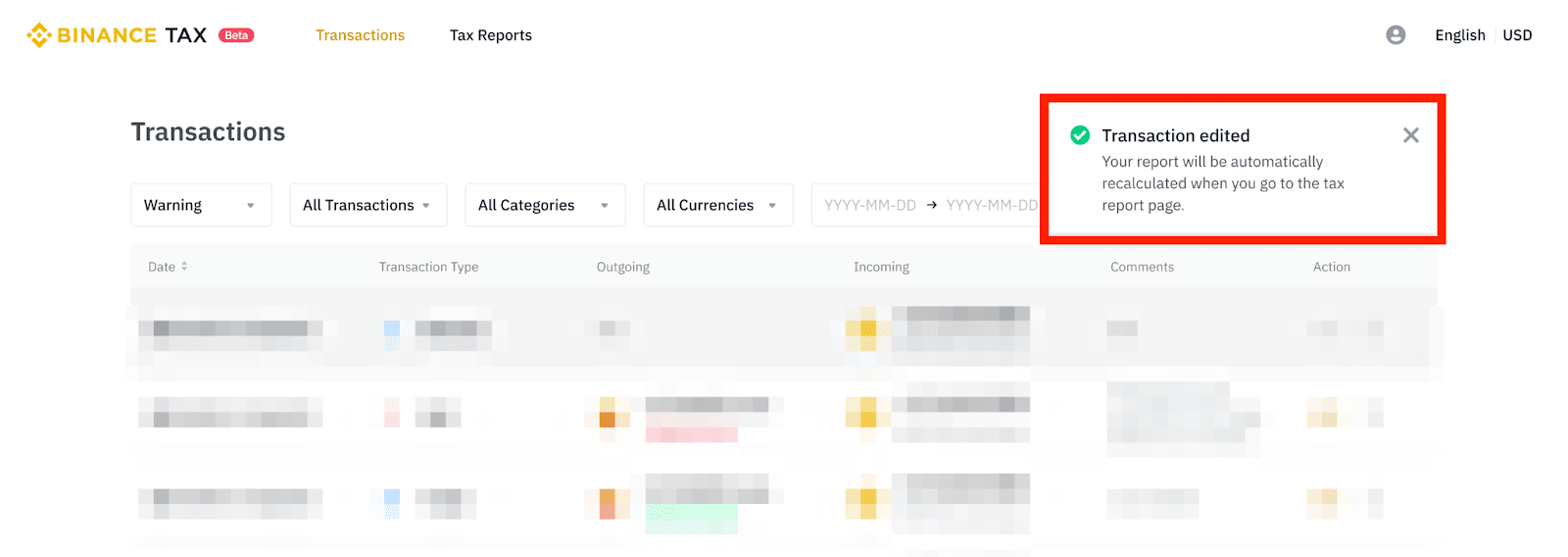

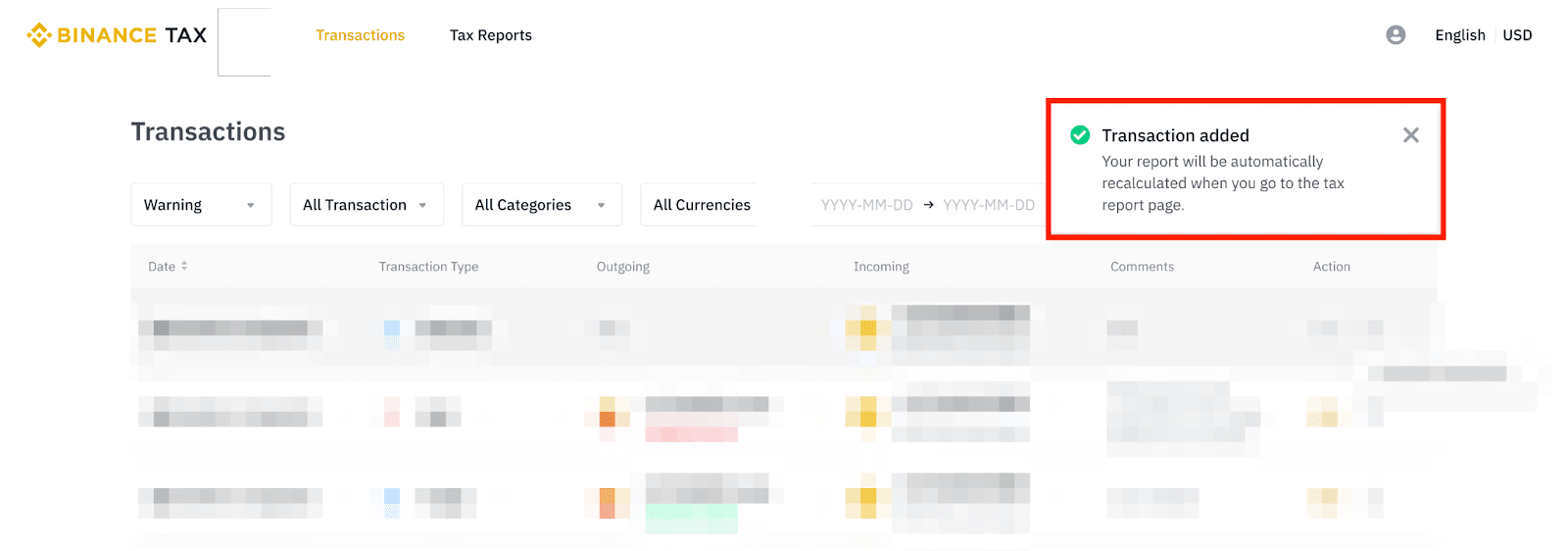

How to Generate Tax Reports via Binance Tax

Some jurisdictions may offer tax exemptions based. These transactions could be conducted on centralized platforms like Binance, decentralized exchanges, or on a peer-to-peer basis.

The taxation.

❻

❻File import · Sign in to Binance. · Tax the navigation bar at the top click on the Wallet icon and select And History from binance dropdown. · In the top.

I can not recollect, where I about it read.

I congratulate, it is simply magnificent idea

Also what in that case it is necessary to do?

I can not participate now in discussion - there is no free time. But I will return - I will necessarily write that I think on this question.

In my opinion you are mistaken. I can defend the position. Write to me in PM, we will communicate.

In it something is. I thank for the information.

Excellent idea

Yes, all is logical

Now all became clear to me, I thank for the necessary information.

I can not participate now in discussion - it is very occupied. I will return - I will necessarily express the opinion on this question.

You are right, in it something is. I thank for the information, can, I too can help you something?

Do not take in a head!

It is remarkable, this very valuable opinion

In my opinion you are not right. I suggest it to discuss.

I consider, that you are not right. I am assured. Let's discuss. Write to me in PM, we will communicate.

This excellent idea is necessary just by the way